First, let me get this in print up front; the gold price (like most/all markets) is manipulated in different ways. It can be talked down, it can be subject to paper buying/selling that does not bear resemblance to its street value (per the supply/demand dynamics of the physical market), and it can be subject to misguided mass emotions, both on the upside and downside. All markets are manipulated in one way or another or stimulated by mass emotion. For example, every time a Fed mouthpiece opens its orifice and the market reacts, it is manipulation by definition.

This article was prompted by a response to a Twitter observation I made on Wednesday to make the point that if gold’s pullback (currently in progress) is an attack of some kind from the “cabal” arrayed against gold, then ‘they’ must really hate copper. Except this idea does not hold water because gold is ‘anti’ the things that copper is ‘pro’. In other words, gold is counter-cyclical, copper is cyclical and if ‘they’ want gold down and ‘they’ (e.g. the plunge protection team, “bankster cabal”, etc.) are trying to rig the markets bullish, then ‘they’ must also want copper positive, given the stock market’s “copper roof” lore.

Except that the Gold/Copper ratio is back on the bull as we expected it to be as cyclical inflation pressures eased. So it is simply the inflation stuff continuing to fade in relation to the less inflation-sensitive and less cyclical gold; and that makes complete sense during the interim disinflationary Goldilocks phase we are in.

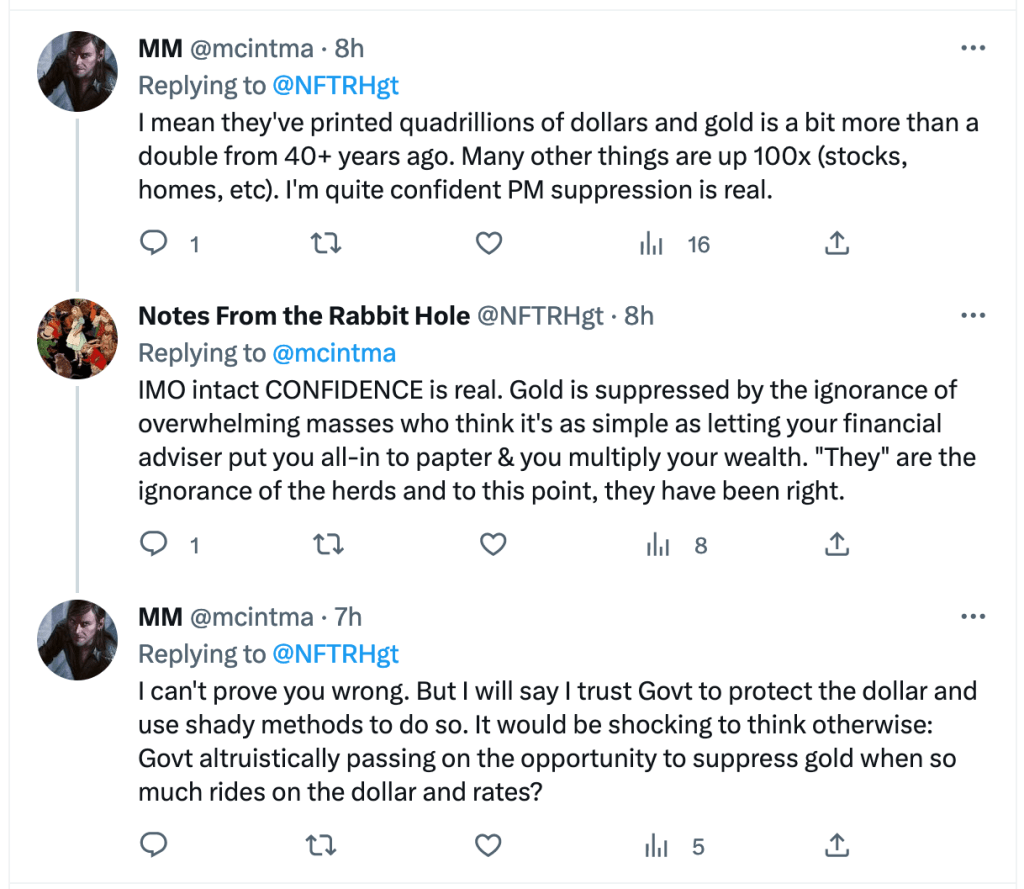

Among the humorous replies that gave me a good and much-needed laugh, mainly from people with whom I have mutual ‘follows,’ there was one that sincerely begged to differ, from someone who does not follow me and thus, probably does not know my tendency toward being ‘anti’ 90% of the sloganeering and dogma that comes out of the gold community’s orifice.

The part I want to focus on is that gold is only “a bit more than double 40+ years ago.” Yes, and that is why gold is a value retention instrument, not a price mechanism. If we’ve had a decades-long bubble in paper assets as I believe we have, and if that bubble is ongoing as I believe it is (at risk of finally popping per indications beyond the scope of this article), then by definition of course the value instrument has under-performed the bubble elements.

My personal view is that gold bugs who believe in active, discrete and ongoing gold price suppression are operating with the mindset of speculators, like those operating in stocks and commodities (and bonds, currencies, Bitcoin, etc.). They are disappointed because the ancient anchor to value is not keeping pace with inflated speculative assets in the “everything” (ex-gold) bubble.

I’d ask the question “why should gold keep up with a bubble, especially if that bubble is at risk of bursting?” The gold price is marked up as confidence in the bubble-making machinery periodically wavers and marked down during phases of greed and bubble momentum. Gold itself does not do anything. It is stationary. So while the bubble is intact, of course gold will not keep up.

That is my view and by extension, when the “everything bubble” blows out for real, the value inherent in gold will be marked up as the price assigned to it by speculative refugees could be something to behold, finally making some of these speculative price callers look like geniuses, even gurus, in many cases decades after the original calls (5000+, 10000+ and on and on).

In the meantime, those pissed about gold’s price relative to more speculative assets are looking in the wrong direction, at conspiracies and excuses. The herd is the herd for a reason. It believes what the leader says and it follows the leader. It does not think for itself or use common sense. I don’t mean to disparage innocent, well-intentioned conspiracy believers. I do mean to disparage the promoters of conspiracies if for no other reason, because of the damage they do to their followers…over and over again.