Fed dot plots reaffirm three cuts, sending gold to an all-time high

Gold bullion reached a new intraday high of US$2,220/oz at 22.15 UK time on 20 March 2024, just after the Federal Reserve (Fed) Open Market Committee Meeting1. The Fed reaffirmed their expectations of three 25 basis point rate cuts this year, despite increasing their economic growth projections and marginally increasing their core inflation forecast. Bond yields also pulled back from 4.32% (just before the Fed announcement) to 4.27% at the end of the day. The US Dollar basket depreciated from 104.1 to 103.3 over the same time frame. All of these factors were positive for gold. If the Fed is making a policy error by sticking to the three-cut plan, despite a rosier economy, gold should also be a beneficiary as a hedge against adverse outcomes.

Investor sentiment towards gold healing, fuelling gold gains

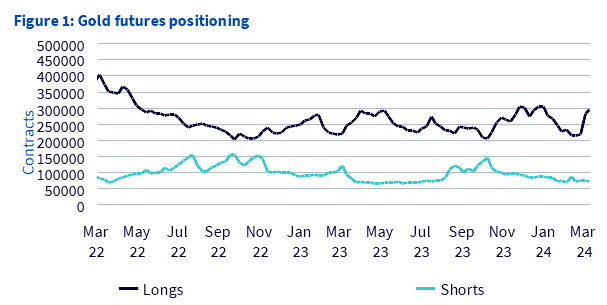

The prior all-time high, reached on 8 March 2024, of US$2,195/oz, seemed to have been driven by a sharp rise in speculative long positioning in gold futures markets. Although, in absolute terms, the longs are still lower than they were back in January 2024, it's clear that there has been a notable reversal in institutional investors’ sentiment towards gold, at least in the futures market.

We have not yet seen a notable pickup in global exchange-traded products (ETP) flows into gold. However, according to the World Gold Council, there have been three consecutive months of inflows into Chinese ETPs, taking total assets under management in such funds to a record high of RMB31bn at the end of February 2024. The increase in speculative length in the futures market and China’s ETP demand could inspire greater global institutional investor demand. With bonds no longer looking as cheap as they were in H2 2023, gold may be back on the radar for investors looking for defensive hedges.

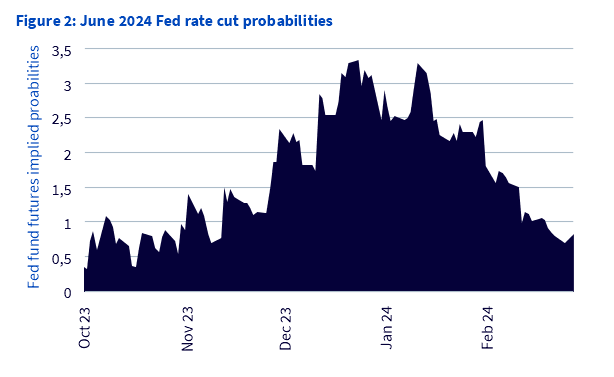

Gold remains highly sensitive to rate cut probabilities…

Between 8 March and 20 March, gold paired back a little as market conviction in the June rate cuts wavered. A stronger-than-expected consumer and producer inflation reading for February had driven the market to reassess whether the Fed will have the support to loosen policy. The probability of a June 2024 rate cut fell to 61% on 19 March, the lowest level since November 2023.

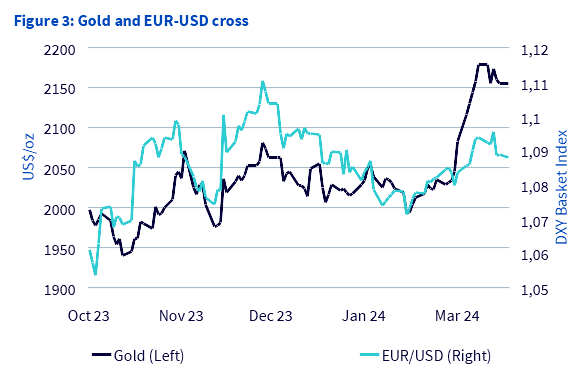

… and the Dollar exchange rate

US Dollar depreciation against the Euro in February and early March had certainly helped gold, but it does not explain the extent of its early March gains. Up until the Fed meeting on 20 March greater market conviction that the European Central Bank will cut rates in June, compared to the Fed, had driven US Dollar appreciation – but that has reversed course once again.

PBoC remains the largest gold buyer

The People’s Bank of China (PBoC) announced the purchase of 12 tonnes of gold in February, marking 16 consecutive months of buying, taking its total holdings to over 2,257 tonnes. Over this 16-month period, China has emerged as the largest central bank gold purchaser (amounting to 309 tonnes). Yet at around 4.3% of total foreign exchange reserves, China has relatively less gold than the US (69.7%), Germany (69.0%), France (66.8%) or Russia (26.2%). If China’s goal is to diversify its FX assets away from G7 currencies, it could keep buying this volume of gold for a considerable length of time and still not hit ratios comparable to the other major central banks.

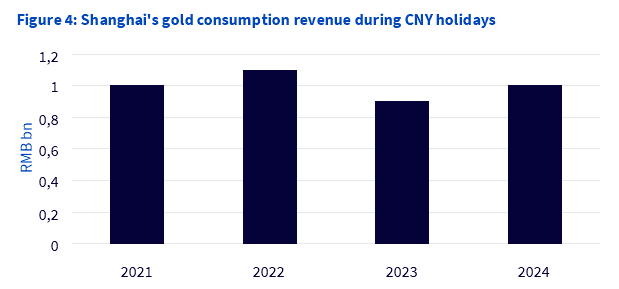

Chinese retail buying displays strength

In addition to the central bank and ETP gold demand mentioned earlier, retail demand for gold in China was especially strong in the opening months of the year. The Lunar New Year period provides a seasonal boost to gold buying in the country. This year was exceptional on account of the ‘Year of the Dragon’ being a very auspicious year and the associated marketing programme that went with it.

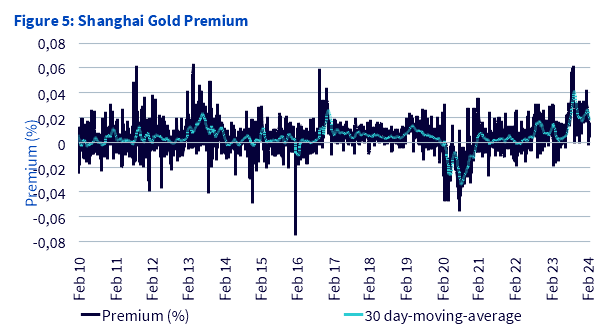

Gold premiums in China were elevated on the back of this high demand. However, these premiums have fallen back as the seasonal period is over and London prices have reached a new high.

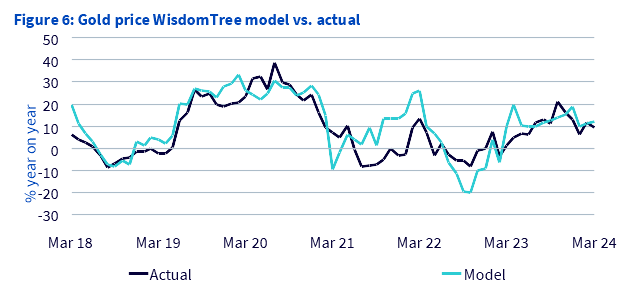

Is gold over-valued?

A key question on many investors' minds is if gold is overvalued. Our model indicates that gold is, in fact, broadly at fair value and, if anything, marginally undervalued, with the model pointing to a 12.8% y-o-y gain vs an actual 12.0% gain (assuming a March CPI inflation number of 3% - which is not yet confirmed).