As we’ve touched on repeatedly, month-end strength in the US dollar has been one of the dominant themes of the month, with big implications for everything from indices to interest rates to commodities.

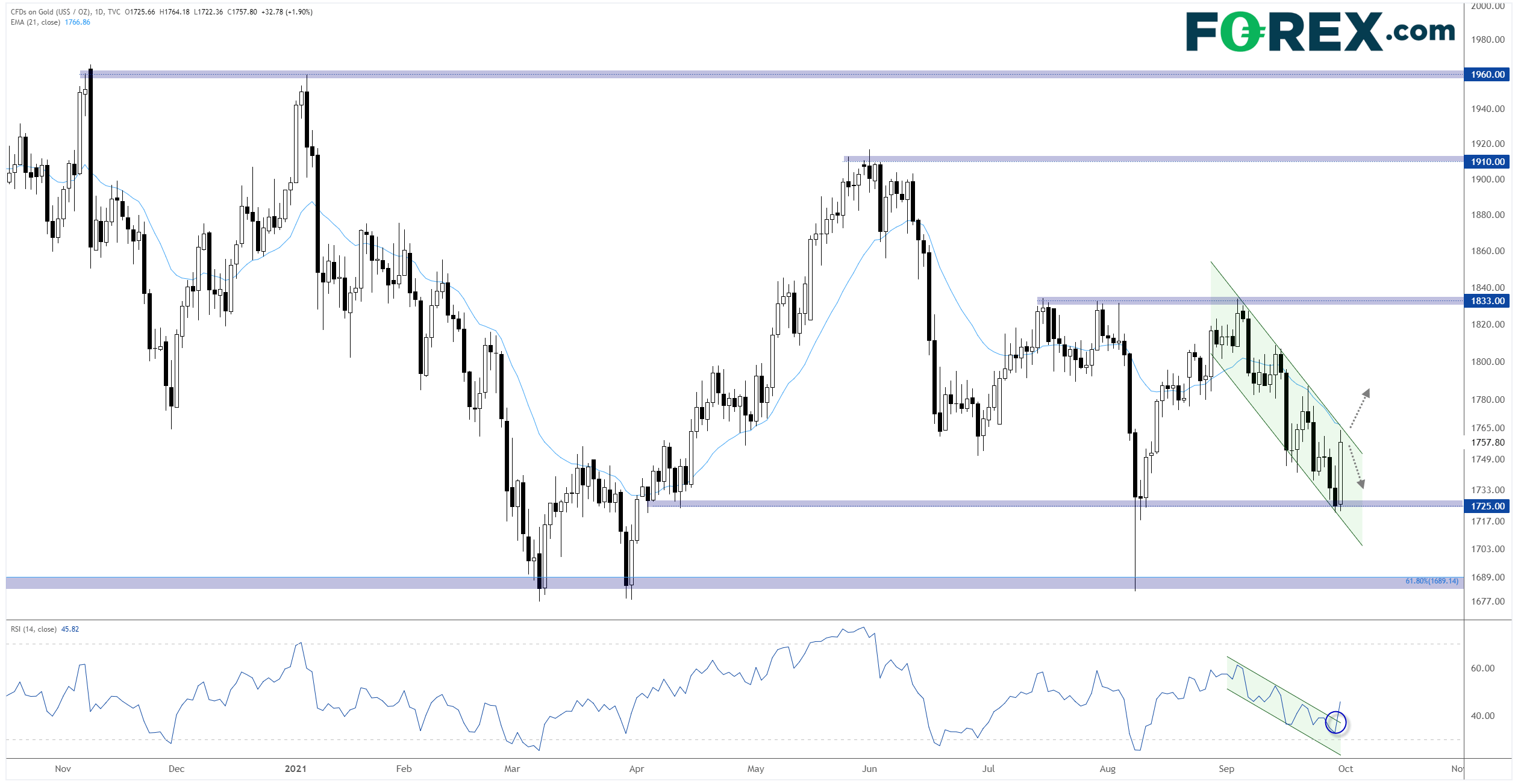

One of the bigger causalities of the greenback’s recent strength has undoubtedly been gold. After testing its 3-month highs at $1833 at the start of the month, the yellow metal has traded consistently lower within a bearish channel over the last four weeks. Adding insult to injury for gold bulls, the precious metal closed at its lowest level in six months yesterday, despite ongoing inflation concerns and low/negative interest rates across the globe:

Source: TradingView, StoneX

So what’s the outlook for gold moving forward?

Well, it remains to be seen, but as of writing the technical picture remains downbeat, with the yellow metal still trending lower within its 1-month descending channel and still below even its short-term 21-day EMA.

That said, there are some nascent signs for optimism among gold bulls: The commodity is bouncing off previous support in the $1730 area, and the RSI indicator is peeking out of its equivalent bearish channel, suggesting that the surge of buying pressure may be enough for a breakout in price itself.

This leaves gold at a potentially attractive trading level for bulls and bears alike. If prices can break conclusively above resistance from the bullish channel and 21-day EMA near $1765, it could signal a new bullish leg toward $1800 or even the previous highs at $1833 next. On the other hand, a failure to break out from the established bearish channel despite today’s strong price action would signal that the bears still have the upper hand and augur for a retest of the $1725 level if not the multi-year lows down around $1680 in the coming days.