What difference a week in gold makes. Just last Friday, I remarked about gold’s sheer resilience in being able to hold to the key $1,800 an ounce level, despite the combined onslaught of rallying US Treasury yields and the dollar

Now, as I write this, the front-month gold contract on New York’s COMEX, is trying to work its way back to that $1,800 perch after spectacularly falling from it over the past two sessions.

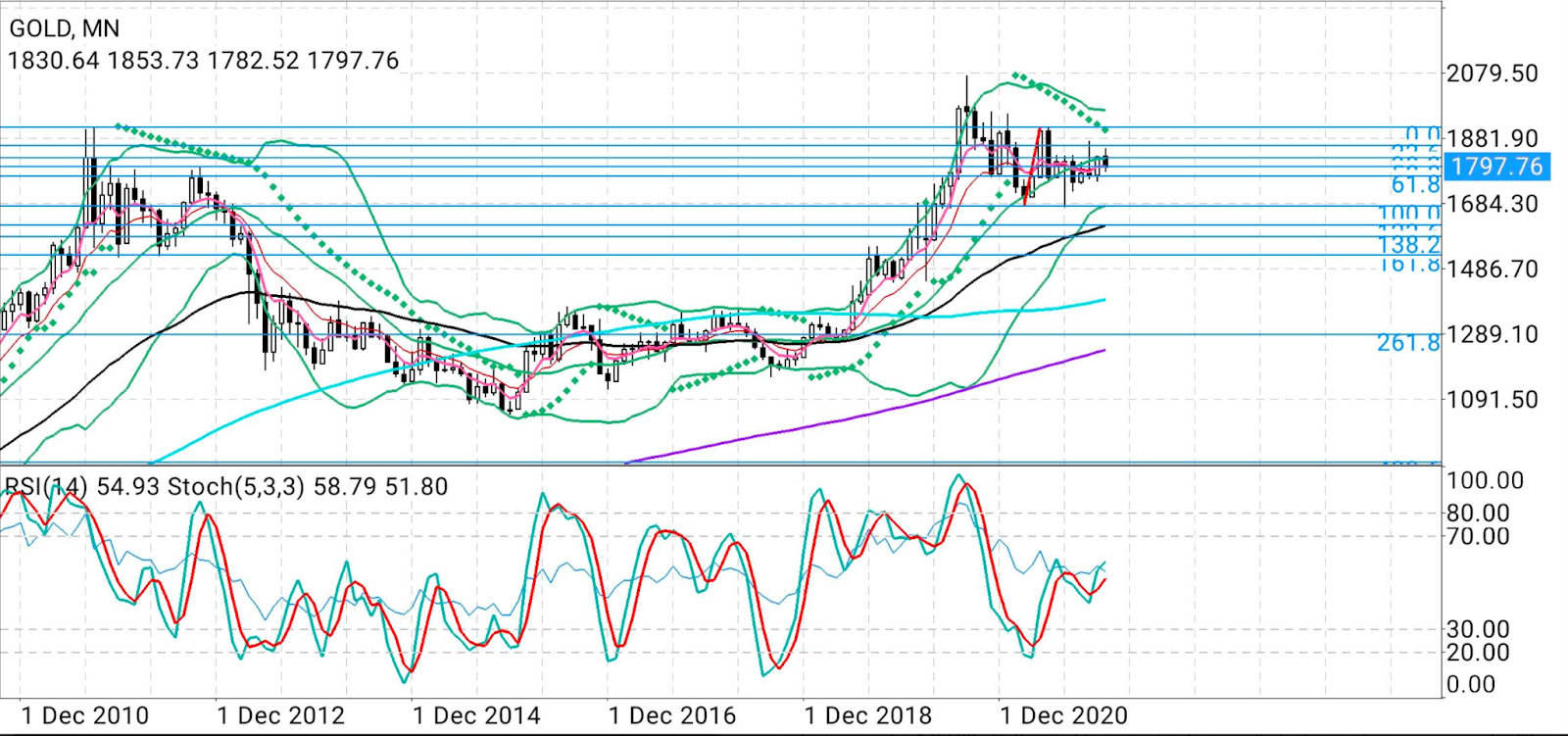

Charts courtesy of skcharting.com

The back-to-back drop between Wednesday and Thursday—after the Federal Reserve unveiled a new hawkish era for US monetary policy that’s conceivably bearish for gold—wiped out almost $60, or 3%, from the COMEX front-month.

It undid two weeks of work by gold longs, who built one of the most intense bids in the short-term to get the yellow metal toward the $1,900 level that would be a bridge to the longer-term $2,000 and record high targets.

While a return to $1,800 itself was within striking range in Friday’s trade—with the COMEX front-month reaching a session high of $1,798.30—the bigger problem for gold will be muscling past the $1,830-$1,835 resistance.

Only on Monday, it broke that impasse, scaling a two-month high of $1,854 as fears of runaway US inflation reinforced the yellow metal’s standing as a hedge against price pressures.

Now, the $1,830-$1,835 resistance is likely to become an even bigger bugbear for gold, after the blow dealt by the Fed.

“Gold has been stuck for months between a rock and hard place made up by the $1,785 support and $1,835 resistance,” said Phillip Streible, precious metals strategist at Blueline Futures in Chicago. Adding:

“When it got above $1,850 this week, gold longs got excited that they had finally broken new path. Well, the Fed has just proven that that’s not the case. It’s back to the drawing board for gold bulls.”

However, Streible said he bought Thursday’s dip in gold “on the belief that we’ll get back to $1,800.”

Fed Chair Jerome Powell, at the conclusion of the central bank’s January policy-making on Wednesday, did not discount the possibility that US interest rates might go up every month this year after the first pandemic-era hike is in, possibly in March.

Gold has always been branded as a hedge against inflation while rate hikes are typically negative for the yellow metal.

The Fed dropped interest rates to virtually zero after the COVID-19 outbreak of March 2020, and kept them for over 20 months. Powell and other central bank officials say a series of rate hikes are needed now to curb price pressures ramping up as a result of the trillions of dollars of pandemic relief spending and supply chain disruptions caused by the crisis.

Prior to its January run, gold had trouble living up to its billing as an inflation hedge as the Dollar Index and US Treasury yields spiked instead on expectations of rate hikes. That appeared to change when the yellow metal broke past the $1,835 resistance more than a week ago and stayed there.

“The breakout above $1,850 was actually a fake-out scripted by the bears in the backdrop of Fed's hawkish tone that turned tables on the bulls, pushing gold down to $1,791,” said Sunil Kumar Dixit, chief technical strategist at skcharting.com and a long-term follower of gold charts.

Dixit said gold’s weekly stochastic reading of 60/69 made a negative crossover below the 70 line, supported by a downward pointing Relative Strength Index that showed domination by bears in the market.

He added:

“It looks like the rout is far from over as the weekly close below $1,797—which is a 50% Fibonacci retracement, measured from the $1,678 low of March 2021 to the $1,916 peak that followed—may extend the bearish bias which will target $1,785, $1,770 and $1,753 initially.”

On the other hand, gold’s daily stochastic reading of 11/32 was approaching oversold territory, said Dixit.

“This may start a short term reversal by mid of next week, causing a bounce back in gold prices to retest the $1,818-$1,825-$1,835 levels.”

Despite the near-term odds stacked against gold, some analysts remain hopeful that the metal will find the vigor required to approach record highs again this year if the US inflation theme remains strong through 2022.

In 2020, gold got to all-time highs above $2,100 on the back of inflation concerns as the US started to build its biggest budget deficit with the onset of COVID-19.

But others opined that the challenges facing gold in the current era of US monetary policy should not be understated.

“Gold is vulnerable to further technical selling now that the $1,800 level has been breached, with $1,760 providing key support,” said Ed Moya, analyst at online trading platform OANDA.

”Risk aversion will eventually lead to some flows back into bullion, but that won’t happen until this selloff is over.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.