January saw the pace of global economic growth wane to a pandemic recovery low as the Omicron wave once again meant COVID-19 disrupted business activity around the world. But the same disruptions contributed to a further near-record uplift in inflationary pressures.

While the outlook for inflation looks to be tilted toward persistent elevated price pressures, as high wage and energy costs collude with ongoing supply shortages in the coming months, the outlook for economic growth is less certain, especially in the face of increased policy tightening among major central banks.

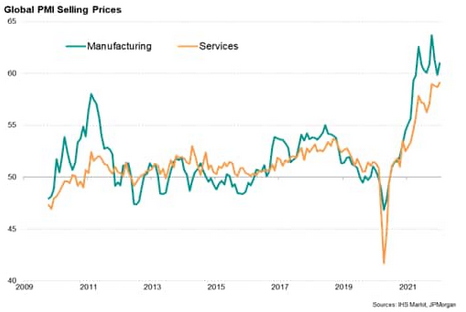

Just as global economic growth slowed to an 18-month low at the start of 2022 amid rising COVID-19 infection rates, price pressures intensified. The JPMorgan (NYSE:JPM) Global PMI™ (compiled by IHS Markit) showed average prices charged for goods and services rising at a rate beaten only once over the comparable PMI survey 12-year history (in October 2021).

Global PMI output and selling prices

Rates of selling price inflation accelerated in both manufacturing and services at a time of output growth faltering to only modest rates in both sectors.

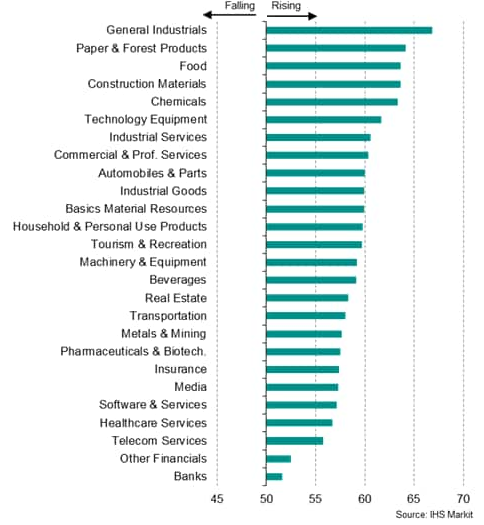

Looking in more detail within the sectors, selling prices rose in all 26 detailed sectors of the global economy covered by the PMI surveys.

Global PMI selling prices by sector

Unprecedented price hikes were recorded by food and drink producers, tech equipment manufacturers and general industrial companies, as well as tourism & travel and media companies. Near-record increases were meanwhile seen for construction materials, industrial services, commercial & professional services and pharmaceutical firms, highlighting the broad-based elevated nature of inflation.

Global PMI selling price inflation rankings, Jan. '22

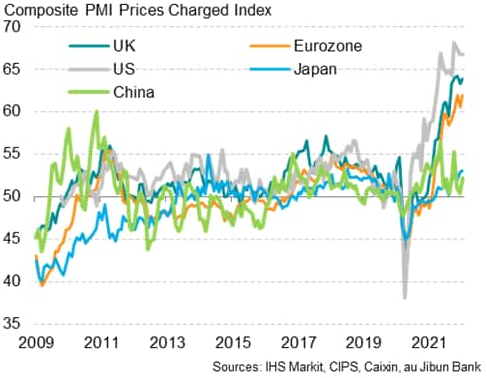

Rising inflation is also broad-based geographically. As has been the case over the last year and a half, the US has reported the strongest price rises in recent months, according to the national PMI data, though new records have also been set in the eurozone and UK. Prices are also rising at multi year highs in many Asian countries, including Japan, though price pressures remained relatively muted in China, thanks in part to government intervention.

Global PMI selling prices by economy

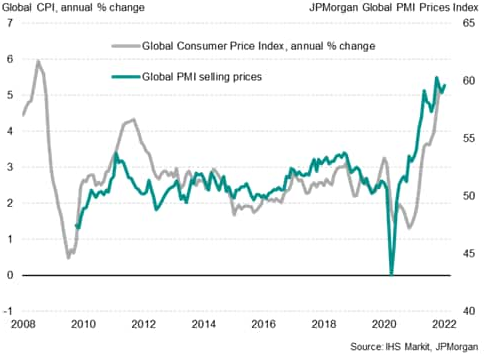

Measured globally, the elevated PMI selling price gauge points to persistent high inflation in coming months. However, it is important to note that the drivers of inflation are showing signs of changing.

Global PMI selling prices and inflation

Materials price inflation shows signs of cooling…

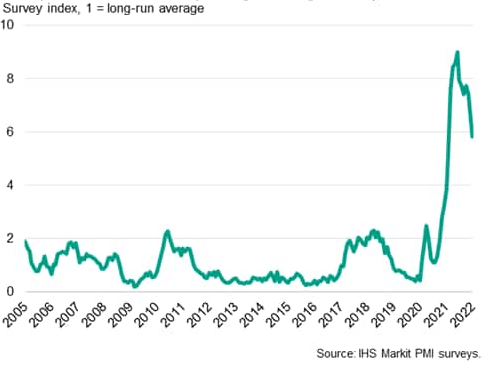

The January PMI survey found a reduction in the number of companies reporting shortages of inputs. Although still running at almost six-times the long-run average number of companies reporting shortages, that's down from a peak of nine-times the long-run average back in June of last year.

Companies worldwide reporting shortages of inputs

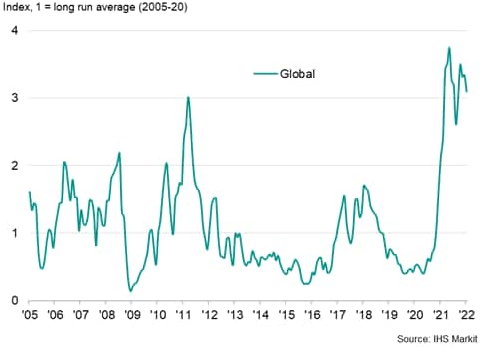

This easing in the number of raw material supply constraints has helped bring manufacturing costs lower. Measured globally, manufacturing input costs rose in January at the slowest rate since last March, albeit still increasing at a rate higher than anything seen previously over the past decade prior to the pandemic, aided by a reduction in the number of companies reporting that costs had risen as a result of rising raw material prices.

Producers reporting higher costs due to rising materials prices

… but wage and energy inflation push costs higher

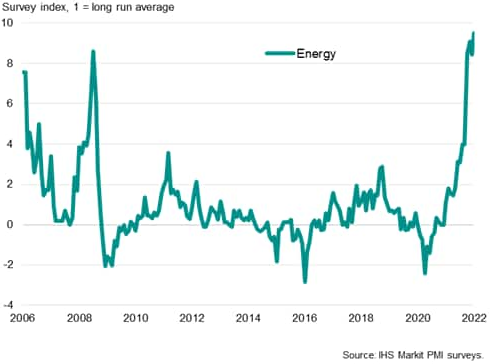

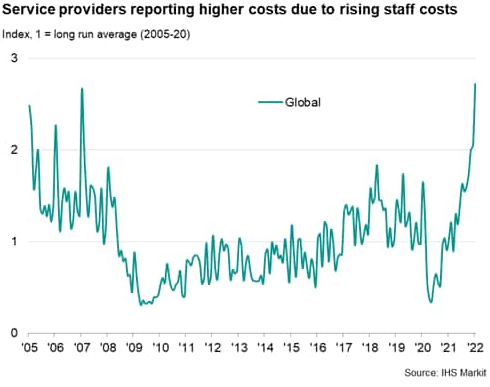

However, while an easing of the supply crunch is helping reduce the cost of some raw materials, firms' costs are being pushed higher by rising energy and staff costs, which is in turn feeding through to higher selling prices for both goods and services.

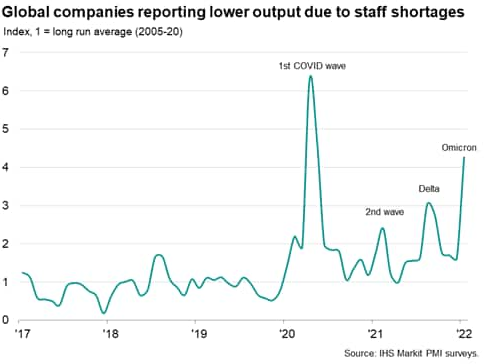

The number of PMI survey contributors reporting that energy prices had increased to an all-time high worldwide in January (comparable data extend back to 2004), matched by a record high in the number of service providers reporting that their expenses had been pushed higher by rising staff costs, in turn linked to deteriorating labour availability, exacerbated in January by the Omicron wave.

Companies worldwide reporting higher energy prices

Outlook

The escalation of energy and wage price pressures in coming months therefore adds to risks that the recent elevated rate of inflation in many countries could persist for longer than previously expected, which will in turn add to pressure on central banks to tighten monetary policy.

However, while the odds are clearly pointing to persistent inflation, risks to the outlook for output (and GDP) are more balanced. Growth will likely accelerate again globally once the worst of the Omicron wave passes, but demand forces have waned in recent months amid various headwinds. These include high inflation, squeezed real incomes, ongoing supply constraints and the withdrawal of pandemic-related fiscal stimuli. By tightening monetary policy, how much do central banks further tilt risks towards growth slowing?

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."