By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

We may be nearing the end of the third quarter but this week will be one of its most important weeks. The Federal Reserve is widely expected to raise interest rates for the first time in 2017, there’s a general election in the Netherlands, G20 Finance Ministers and Central Bankers meet, the House of Commons votes on a key amendment guaranteeing the rights for E.U. citizens that could determine when Prime Minister May triggers Article 50 and there are monetary-policy decisions in the U.K., Japan and Switzerland. On top of that, U.S. inflation and retail sales numbers will be released, Australia and the U.K. have labor data and we will find out how much the New Zealand economy grew in the fourth quarter. So don’t let Monday’s quiet trade make you complacent, as this should just be the calm before the storm. We expect big moves on Wednesday when UK labor data will be released followed by the Dutch Elections, US CPI and retail sales report and then the Federal Reserve’s monetary-policy announcement. The best way to prepare for Wild Wednesday is to understand where expectations lie and the room for surprise. The German ZEW survey and U.S. producer prices are due on Tuesday but these reports are not expected to have a significant impact on the currency.

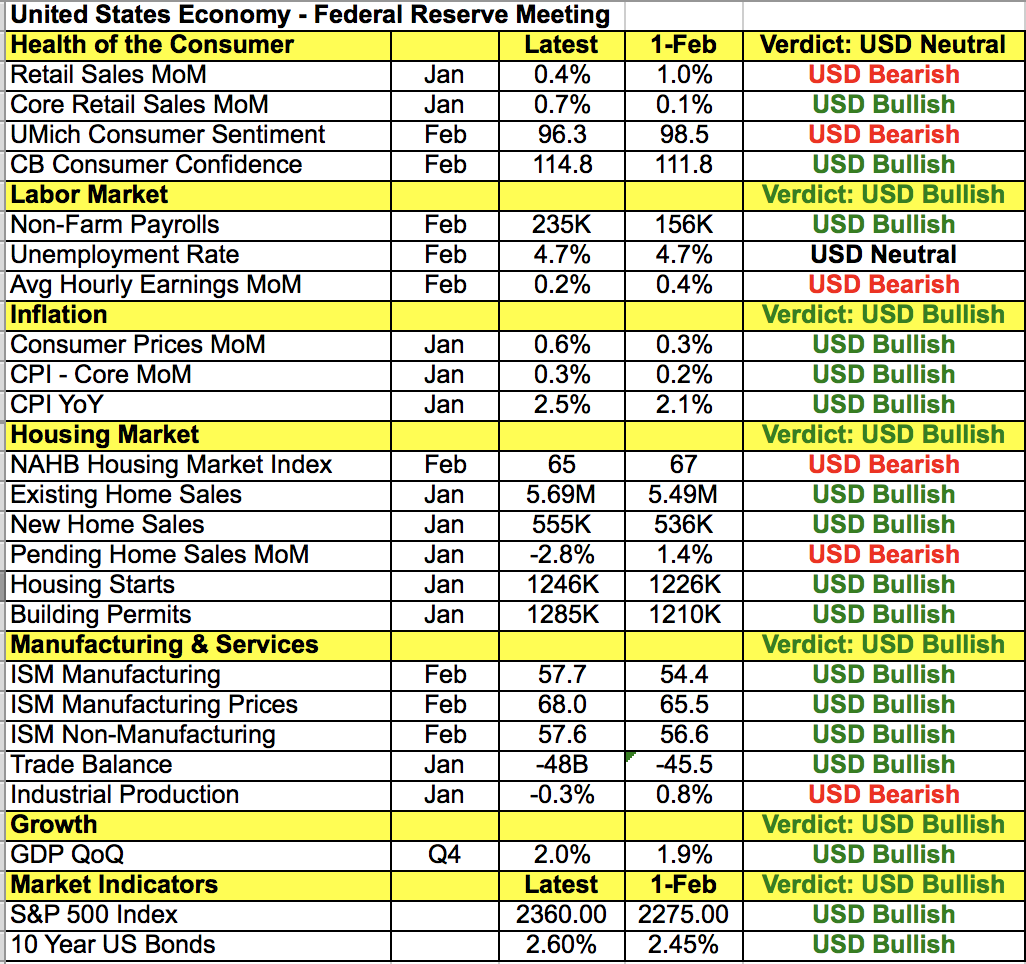

With that in mind, many investors are wondering how to trade some of these upcoming event risks. Starting with the dollar and the Federal Reserve’s monetary-policy announcement, it is clear that with the market pricing in a 100% chance of tightening, investors are treading carefully. The dollar did not extend Friday’s losses versus Japan's yen but it traded lower against sterling, Swiss franc and the commodity currencies. What’s interesting about this pullback is that it comes amid a persistent rise in U.S. rates. Ten-year Treasury yields rose above 2.6% on Monday, a sign that bond traders are still positioning for a hawkish rate decision. Taking a look at Fed Fund futures, the market is pricing in 2 -- not 3 -- rate hikes this year, which means investors are not convinced that U.S. policymakers will be as aggressive as they have suggested, leaving room for new positions. If Fed Chair Janet Yellen makes it clear that there will be another rate hike soon -- we think she will (ie. March) -- we should see 116 in USD/JPY. The table below shows widespread improvements in the U.S. economy since the last meeting with activity increasing in the service and manufacturing sectors, inflation on the rise, core spending growing, sentiment holding firm and housing-market activity is resilient despite higher mortgage rates. Stocks also climbed to fresh record highs over the past month thanks in part to President Trump’s infrastructure and security spending plans. So not only do we believe that the dollar and USD/JPY in particular will trade higher following the Federal Reserve’s monetary-policy announcement, but we also believe that pullbacks before the rate decision should be bought as they are likely to be shallow.

Monday's Sterling enjoyed its strongest one-day rise versus the U.S. dollar in more than 2 weeks. According to an article in the Independent newspaper and a spokesman for U.K. Prime Minister Theresa May, Article 50 will not be triggered this week. In Monday’s vote, the House of Lords overwhelming opted to overturn the amendments to the Brexit bill. This sends the bill back to the House of Lords, which is unlikely to reject the will of the people -- although if it does, we could see more back and forth. Once both Houses of Parliament agree on the language in the bill, it will be sent for Royal Assent and become law, allowing May to trigger Article 50. So how quickly Article 50 is triggered will be partly determined by how quickly the House of Lords accepts the House of Commons’ decision. If Article 50 is not triggered until next week, we could see a further short squeeze in the oversold currency. But if Prime Minister May suddenly announces the trigger this week, traders can expect a knee-jerk breakdown in GBP that should not last for long as investors realize it will be months before the terms of exit are agreed to with the E.U. and years before an official exit happens. So in the meantime, it appears that the risk is to the upside for sterling.

Euro ended the day slightly lower against the U.S. dollar. Mario Draghi spoke but he offered very little in terms of market-moving comments, instead focusing on the need for productivity growth within the Eurozone. ECB’s Smets came across the wires on Monday, indicating that the bank has not taken any steps toward removing current QE. Smets stated that there was no signal for change of current policy because inflation has not improved much since the end of last year. ECB Visco chimed in and concentrated on the geo-political landscape and the current uncertainties that surround it. Highlighting current US policies and its protectionism, Visco said such actions could lead to adverse effects for EU growth moving forward. Visco also warned of quicker-than-expected increases to U.S. rate hikes to accommodate Trump’s policy changes if necessary. On Tuesday, the Eurozone will release industrial production as well as the German ZEW Survey. Given the political uncertainty in the region, we believe the risk is to the downside for these reports.

All three of Monday's commodity currencies traded higher against the greenback. The Kiwi got a boost today from NZEIR as forecasts were upgraded for 2018. GDP growth forecasts were kept unchanged for the near term but were revised higher for 2018. Household spending was also revised higher for the next 2 years but this increase was offset by a downward revision to net exports. Employment is expected to pick up for the region as labor demand remains strong and wages are expected to get a boost in 2018. Their currency outlook was also upgraded as they now expected NZD to remain high for the whole projection period up to 2020, mainly due to a more favorable New Zealand economic outlook. The Canadian dollar got a boost from reports that Kuwait is the first OPEC member to be open to extending the OPEC production-cut deal past June. This news comes as Iraq and Angola have also hinted at a willingness to follow such extensions. There are no major economic reports on the calendar for the commodity-producing countries Tuesday and that could give way to a further recovery ahead of FOMC.`