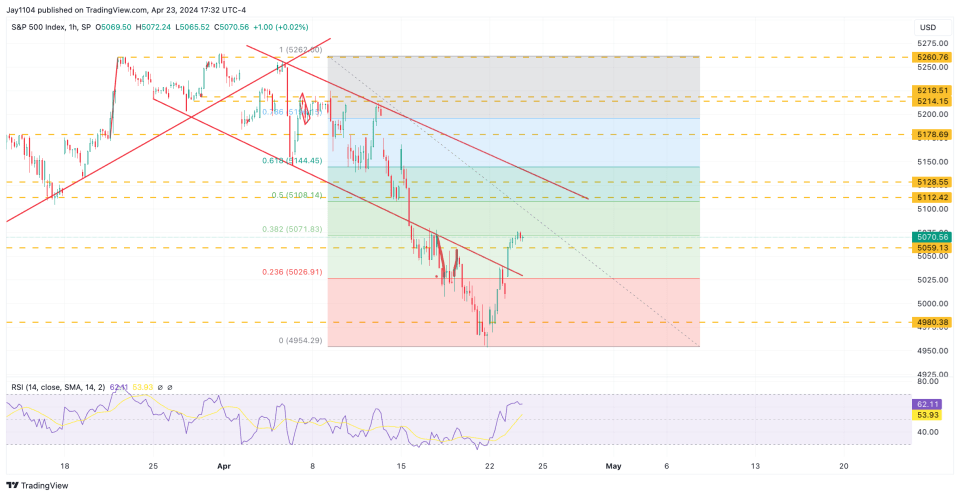

Stocks finished the day higher, with the S&P 500 up 1.2%, following yesterday’s advance. So far, the rally has been relatively ordinary and boring. It appears to be bouncing in ordinary negative gamma fashion, with these rallies emerging out of thin air. However, that will likely start changing as we go through the rest of the week, especially as we get more data; it seems likely that rates and US dollar will return from vacation.

We get the 5-year Treasury auction today, which could be a non-event but still needs to be watched. Yesterday’s 2-year auction was a non-event for the most part. But by Thursday, when the GDP data starts to come out, we could see rates begin to move, which is important.

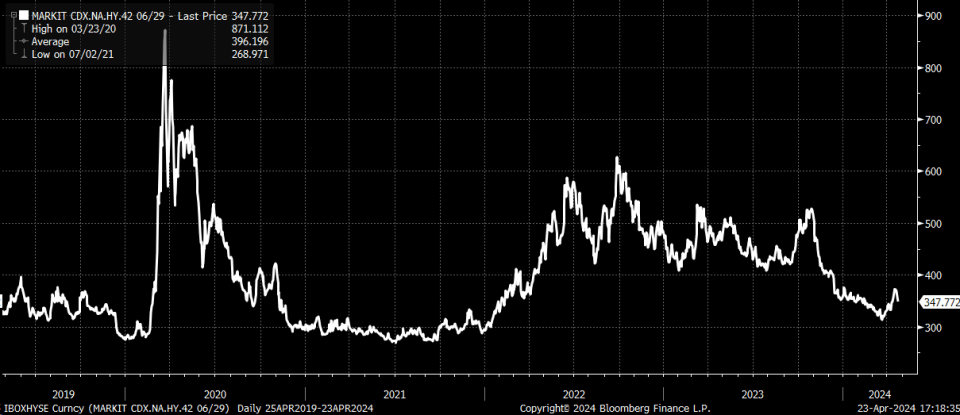

Generally speaking, we have seen credit spreads retreat, giving the green light to equities to bounce. Now, spreads have to continue to contract for stocks to rally, which is possible through the end of the day today. But if the data for the GDP comes in more in line with the Atlanta Fed’s GDPNow model of 2.9% and above consensus median estimates for 2.5%, then there is a good chance that rates and the dollar will start to move higher, which will lead to spreads starting to widen.

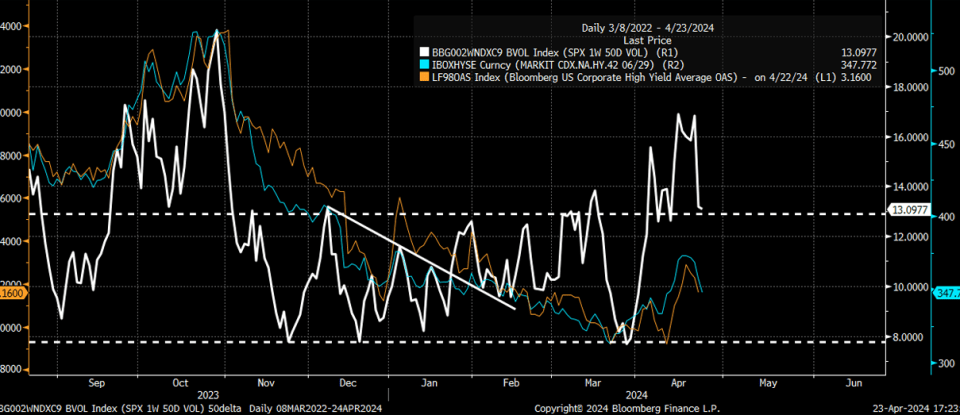

Additionally, next week, more data is on the way including non-productivity, employment cost index, jobs data, JOLTS, ADP, and ISM. The Fed meeting will also come on Wednesday, so it would only make sense to me that, given the amount of data to come, we could see implied volatility start to rise again, especially on shorter-dated measures like the S&P 500 50-Delta 1-week option IV, which was flat yesterday even though longer-dated IVs fell sharply.

So far, the S&P 500 has retraced 38.2% of the decline, which is nothing special.

Tesla Stock Jumps Following Earnings

Tesla (NASDAQ:TSLA) report results didn’t look great on the surface. Still, headlines about cheaper models were enough to get the stock over the $150 level needed to get market makers to start buying back hedges. Put gamma was the largest at the $150 strike price and the $140 strike price; the IVs were over 100%.

So, following the results, the IVs collapsed, and that was probably all that was needed to get the stock moving higher, even though the results were horrible on several levels, including a revenue and earnings miss. Gross margins were better than expected, though, coming in at 17.4% versus estimates of 16.5%; even automotive gross margins were better at 18.5% versus forecasts of 17.6%.

As long as it stays above $150, we could see a short squeeze up to the $170s.