By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Who would have thought that when the Federal Reserve raised interest rates by 25bp, the U.S. dollar would tank? But that's exactly what happened this past week as the greenback tumbled against all of the major currencies. Investors began unwinding their long dollar positions ahead of the rate decision on the view that Fed Chair Janet Yellen would not be hawkish enough -- and they were right. She did not suggest that the next hike would be in June and the dot plot forecast showed U.S. policymakers looking for 2, not 3, more rounds of tightening this year. Additionally, it was not a majority decision as Fed President Kashkari voted to keep interest rates steady. The market expressed its disappointment at the lack of overwhelming hawkishness by selling U.S. dollars and buying bonds, sending 10-year Treasury yields back down to 2.5%. The Fed is still the only major central bank planning to raise interest rates but it's going to be a few weeks and maybe a few more months before there’s enough data to convince it that June is the right time to tighten instead of September. For forex traders, the key question is whether the dollar is a buy-on-dip or sell-on-rallies in the coming weeks. We think that USD/JPY downside is limited to 112 because there are a number of Federal Reserve officials speaking next week and they will most likely take the opportunity to remind everyone that interest rates are still moving higher. Fed Chair Janet Yellen takes to the podium along with FOMC voters Evans, Dudley, Kaplan and Kashkari. There are no major U.S. economic reports on the calendar so Fed speak will be the primary driver of dollar flows. We don’t expect big moves and instead anticipate consolidative price action in USD/JPY.

The one currency that could breakout is sterling because the U.K. government could trigger Article 50 any day in the next 2 weeks. When that happens, we believe that sterling will fall quickly and aggressively as the inevitable becomes reality. But the recovery could be just as swift because the country’s actual final exit from the European Union will be years from now. However the U.K. can’t expect the EU to play nice as evidenced by Friday’s comment that trade talks will not happen before a Brexit payment deal. EU headlines could extend the losses for sterling but if Article 50 is triggered and there’s nothing more -- OR if the trigger is delayed another week -- losses in sterling should be limited thanks to the Bank of England’s unexpected hawkishness. Although recent data has been weak, policymakers noted that there were few signs of growth slowdown and while wages are softening, the talk in the central bank is not about easing but tightening. According to the minutes, a number of policymakers believe that a “rate hike could be needed sooner” with MPC policymaker Kristen Forbes voting for an immediate 25bp tightening. This dissent caught the market by complete surprise and sent sterling sharply higher. Forbes believes there is less justification to tolerate above-target inflation and for that reason sees the need for tightening. While we don’t expect the Bank of England to raise interest rates any time soon, the level of dovishness within the policy-making ranks is diminishing. Next week’s U.K. inflation and retail sales reports should show some improvement in the economy but the focus should be on Brexit headlines.

Unexpected hawkishness from the European Central Bank also supported the euro this past week. ECB member Nowotny said a rate hike may soon be needed. We knew from this month’s monetary policy announcement that Eurozone policymakers have grown less dovish but few expected the central bank to consider tightening, especially in light of the region’s political uncertainties. According to the latest polls on Friday, despite the far right’s failure in the Netherlands, Le Pen is closing the gap with Macron. Fundamentally, however, the Eurozone economy is improving and we expect this to be confirmed by next week’s PMI reports. Although we believe that the dollar could find some support against the yen in the near term, we are still looking for EUR/USD to test 1.08 as long as political headlines don’t stifle the rally. Of course this latter risk is a big one that could derail the currency’s rally at any point. The Swiss National Bank also left monetary policy unchanged this week but the franc caught a bid after SNB President Jordan said they need to remain vigilant in the current uncertain environment. He indicated that while they are not a currency manipulator, they have leeway to intervene and cut rates further.

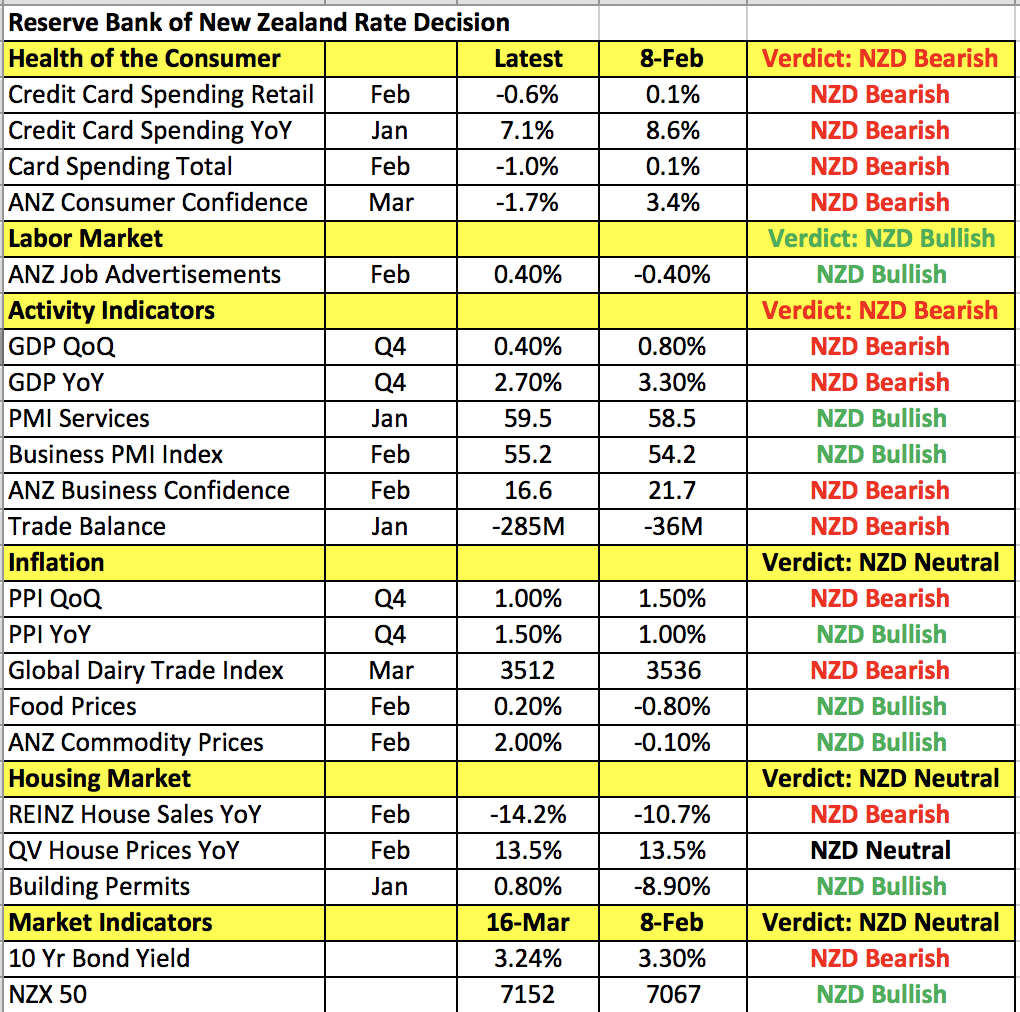

The Australian, New Zealand and Canadian dollars ended the week sharply higher against the greenback despite softer labor data from Australia and slower GDP growth in New Zealand. The strength of these currencies are directly related to U.S. dollar weakness but the higher these currencies climb, the more problematic they become for their respective economies. With that in mind, the Reserve Bank of Australia has been relatively optimistic and next week’s minutes should reflect that whereas the Reserve Bank of New Zealand has more to be worried about. The RBNZ meets next week and we think it will try to talk down the currency. Since its last meeting in February, consumer spending has fallen, GDP growth slowed, the trade deficit widened while dairy prices declined. There was some strength in the services and manufacturing sectors but with the currency so strong, we don’t think that will be enough to ease the central bank’s concerns. USD/CAD will also be in play as the currency pair attempts to find a bottom near 1.33. Canadian retail sales and consumer prices are scheduled for release and unfortunately, the trend of softer data could continue.