GBP/USD is showing limited movement on Wednesday, as the pair trades just shy of the 1.53 line in the European session. Taking a look at economic releases, there are no British events on the schedule. In the US, the Federal Reserve will release a policy statement, but is not expected to raise interest rates. On Thursday, the US releases two key events – Advance GDP and Unemployment Claims.

It was a poor start for British releases on Monday, as housing and manufacturing data slipped. BBA Mortgage Approvals dipped to 44.5 thousand, short of the forecast of 46.2 thousand. CBI Industrial Order Expectations slumped badly, with a reading of -18 points, its lowest level since July 2013. This points to weaker manufacturing growth due to less demand for British products both domestically and abroad. On Tuesday, British Preliminary GDP in the third quarter posted a gain of 0.5%, shy of the estimate of 0.6%. This is certainly a cause for concern, as Final GDP in the second quarter posted a gain of 0.7%.

US durables, which helps gauge the strength of the manufacturing sector, were dismal in the September reports. Core Durable Goods Orders fell 0.4%, compared to the forecast of 0.0%. It marked the indicator’s first decline in six months. There was no relief from Durable Goods Orders, which posted a sharp decline of 1.2%, although this was within expectations. This was the indicator’s second straight decline, and these weak figures underscore a weak manufacturing sector, which continues to be hampered by weak global demand for US goods.

Will we see some volatility from GBP/USD after the FOMC statement? The Federal Reserve is not expected to raise interest rates, but any hints about a hike could send the US dollar sharply higher. What the markets would really appreciate is some clarity about its monetary plans. Gone are the days of the indecipherable Fedspeak from Alan Greenspan, whose statements looked like they were written in English but were ambiguous and obtuse in the extreme. At the same time, the current Federal Reserve has failed to communicate effectively with the markets, which continue to receive conflicting signals from Fed policymakers regarding the timing of a rate hike. These mixed messages are no accident, but rather reflect the divisions between voting Fed members with regard to a rate hike. This has led to volatility in the currency markets based on the public remarks of Fed members, even though such comments may be no more than the personal view of that individual, and do not represent actual Fed policy.

GBP/USD Fundamentals

Wednesday (Oct. 28)

- 12:30 US Goods Trade Balance. Estimate -64.9B

- 14:30 US Crude Oil Inventories. Estimate 3.7M.

- 18:00 FOMC Statement

- 18:00 Federal Funds Rate. Estimate

Upcoming Events

Thursday (Oct. 29)

- 12:30 US Advance GDP. Estimate 1.6%

- 12:30 US Unemployment Claims. Estimate 264K

*Key releases are highlighted in bold

*All release times are GMT

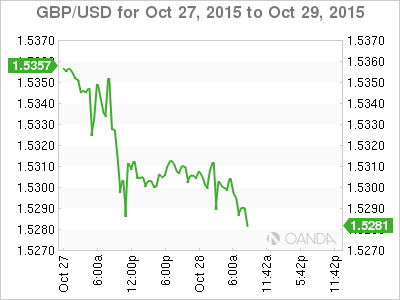

GBP/USD for Wednesday, October 28, 2015

GBP/USD October 28 at 11:30 GMT

GBP/USD 1.5286 H: 1.5314 L: 1.5282

GBP/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.5026 | 1.5163 | 1.5269 | 1.5341 | 1.5485 | 1.5590 |

- GBP/USD was flat in the Asian session and has posted slight losses in the European session.

- 1.5341 has switched to a resistance role.

- On the downside, 1.5269 is under strong pressure.

- Current range: 1.5269 to 1.5341

Further levels in both directions:

- Below: 1.5269, 1.5163 and 1.5026

- Above: 1.5341, 1.5485, 1.5590 and 1.5660

OANDA’s Open Positions Ratio

GBP/USD ratio has shown slight movement towards long positions on Wednesday. The ratio has a slim majority of short positions (52%), pointing to a lack of trader bias as to what direction GBP/USD will take next.