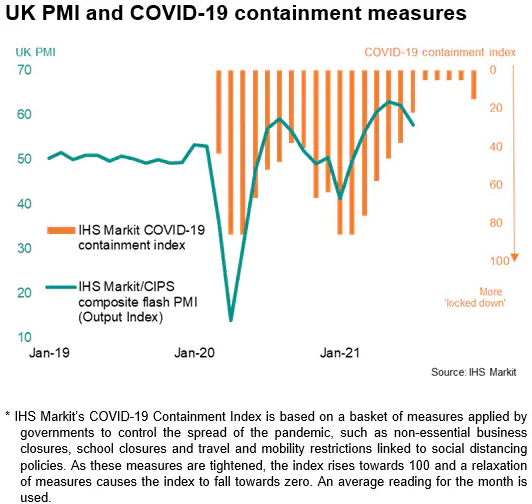

July saw the UK economy's recent growth spurt hit by a rising wave of virus infections, which subdued customer demand, disrupted supply chains and caused widespread staff shortages, and also cast a darkening shadow over the outlook.

Record expansion cools amid virus wave

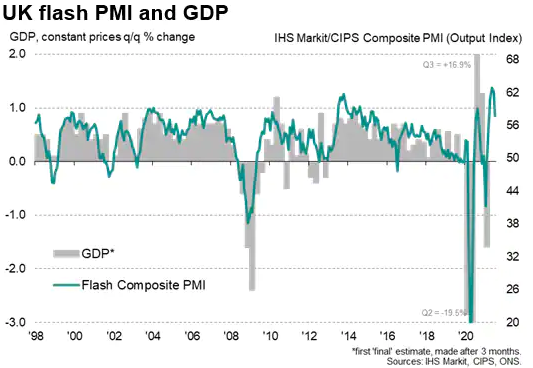

The IHS Markit/CIPS flash composite PMI output index, covering both services and manufacturing, fell further from its all-time high of 62.9 in May, down sharply from 62.2 in June to 57.7 in July.

Although the PMI remains elevated by historical standards, indicating that business activity continued to grow strongly, the decline in the index means the rate of expansion slowed to the weakest since March

While growth was buoyed by the easing of lockdown restrictions to the lowest since the pandemic began, July also saw widespread reports of virus-related factors subduing customer demand, disrupting supply chains and causing widespread staff shortages.

The PMI therefore indicates that GDP growth will likely have slowed again in the third quarter, after having rebounded sharply in the second quarter, as the rising wave of Covid inflections dampens economic activity once again.

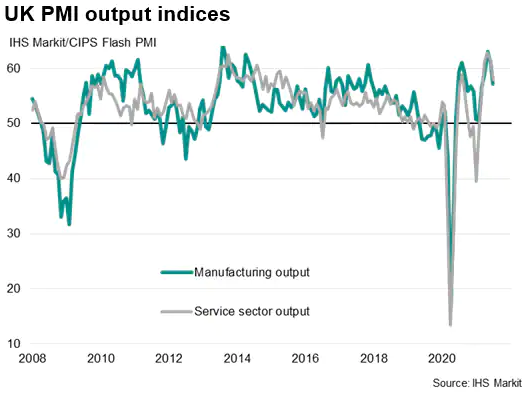

Transport, hospitality and other consumer-facing services companies were the hardest hit, though manufacturing also saw growth slow markedly during July. Business and financial services and the IT sector showed the greatest resilience.

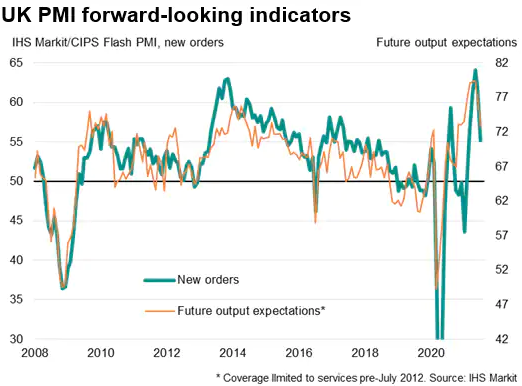

Although the July flash survey only covered three days of the full easing of Covid restrictions, any imminent re-acceleration of growth in August looks unlikely due to a steep slowing in overall new order growth during July.

Furthermore, concerns over the Delta variant overshadowed any optimism associated with the passing of "freedom day", and were a key factor alongside Brexit and rising costs behind a sharp slide in business expectations for the year ahead, which slumped to the lowest since last October.

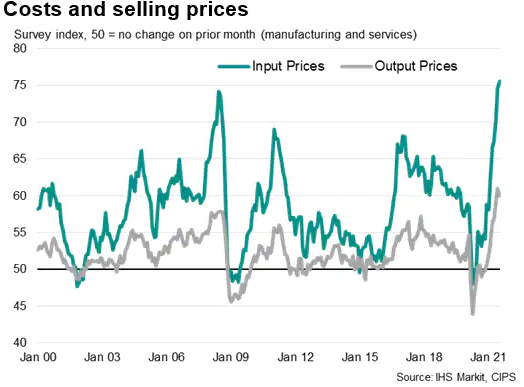

Although average selling price inflation meanwhile eased slightly during the month, the easing may prove short-lived, as firms' costs rose at a rate unprecedented in over 20 years of survey history. Supply shortages pushed up the price of goods, suppliers of services hiked prices and employee pay continued to rise.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."