- Markets ended the day flat after Fed's hawkish pause

- The pause will help Fed assess effects of previous hikes on the economy

- A couple of hikes remain on the table before the end of 2023

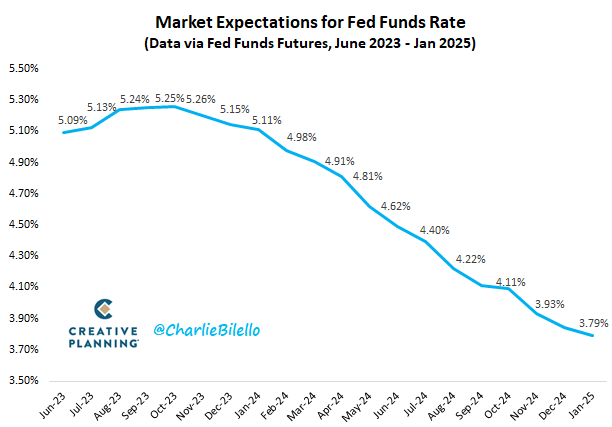

As expected, the Fed paused hiking rates for the June meeting, keeping them in the 5-5.25% range.

In terms of the future rates, however, there was an increase from 5.1% to 5.6%, suggesting the possibility of two additional 0.25% hikes by the end of 2023 (potentially in July and December?).

Powell spoke, and in addition to the usual topics such as targeting inflation around 2% and achieving maximum employment, there was a reiteration of the Quantitative Tightening approach.

It was also emphasized that all future decisions will be made on a meeting-by-meeting basis, taking into account the analyzed data.

The reason for the pause in rate hikes was to assess the (lagged) effects of the previous 10 hikes on the economy.

Currently, there are indications of a better balance between supply and demand in the economy, particularly in the labor market and real estate sector. However, these improvements are still not considered sufficient by the Federal Reserve.

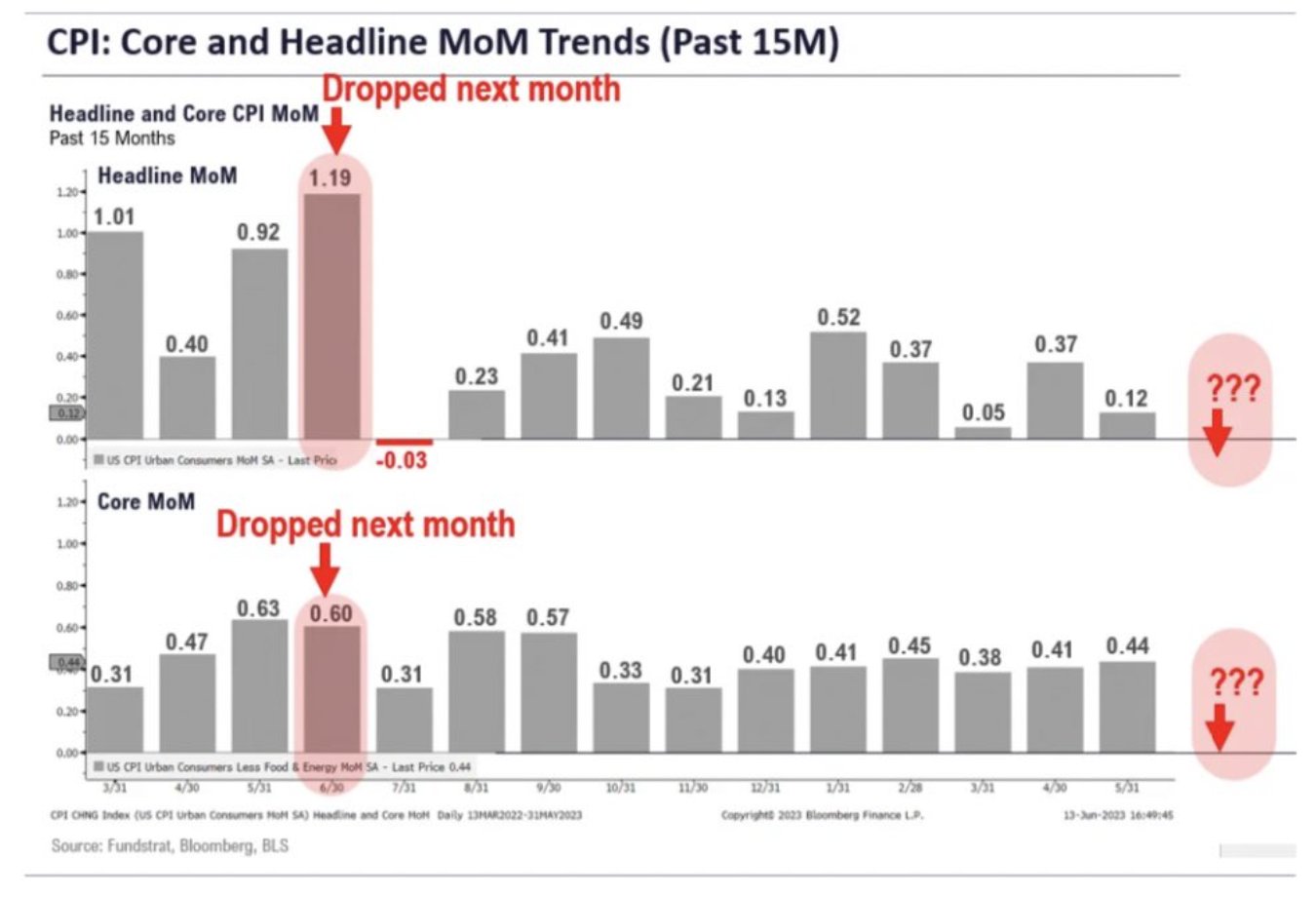

However, upon closer examination, it seems illogical to consider a hike in July. This is because several key inflation indicators are expected to significantly decrease next month.

It is indeed strange that the rate hikes did not occur when the CPI was at 4%, and Core CPI was at 5.3%. It raises questions as to why they would consider hiking rates when the projected CPI is 3%, and Core CPI is expected to be 5% in July. However, only time will tell.

In the meantime, the markets practically closed flat yesterday (after a good day on Tuesday), but it will be important to wait until the weekend to get a better idea.

Looking for more actionable trade ideas to navigate the current market volatility? The InvestingPro tool helps you easily identify winning stocks at any given time.

Start your 7-day free trial to unlock must-have insights and data!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest as such, it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remain with the investor. The author does not own the stocks mentioned in the analysis.