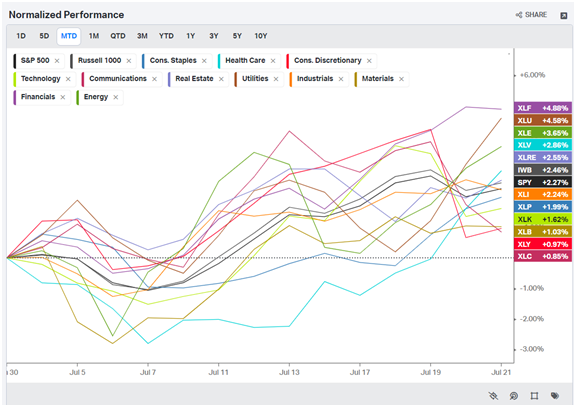

The last few weeks have been dominated by the rise of sectors like Financials (NYSE:XLF) and Utilities (NYSE:XLU), while Technology (NYSE:XLK) and Consumer Discretionary (NYSE:XLY) have not followed through with previous rallies.

I'm curious about where the upcoming rallies will take place. Will they continue to come from the value-related sectors, as they have in recent weeks, or will they come from growth sectors, as has been the trend for most of 2023?

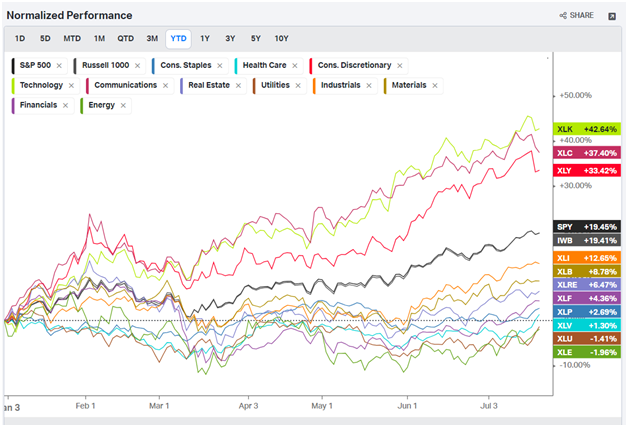

Looking at YTD returns, you can make the case that growth sectors seem stretched and even exhausted, while value sectors have lots of catching up to do.

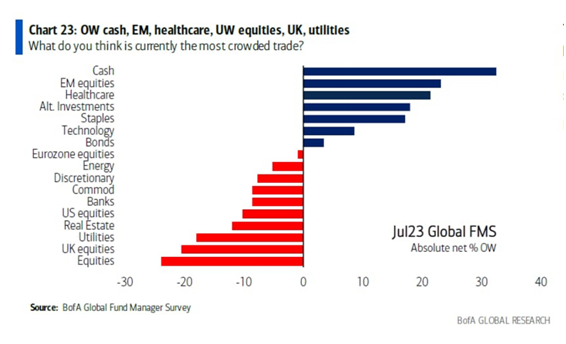

Most finance professionals see Financials and Utilities as sectors that have been mostly underweight in Bank of America clients’ portfolios. These surveys are usually counter-intuitive, suggesting the rally might carry on for these value sectors.

How the market will respond to the upcoming Fed hike and Powell's press conference remains to be seen. If there are no significant changes in tone, the Fed may indicate what the market already believes: that they will cease raising rates after the next meeting.

This will be the next critical factor to monitor for the continuation of this rotation.

Disclaimer: This is not financial advice, only the author's opinion.