- The EUR/USD bounced off the resistance at 1.12 amid softening Eurozone inflation data.

- Investors anticipate a pivotal US labor market report that could influence future direction.

- A breakout from the current consolidation range may set the stage for new trading opportunities.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

The EUR/USD had been an upward trend following the Fed's interest rate cuts, but it has been struggling to break through the 1.12 resistance level.

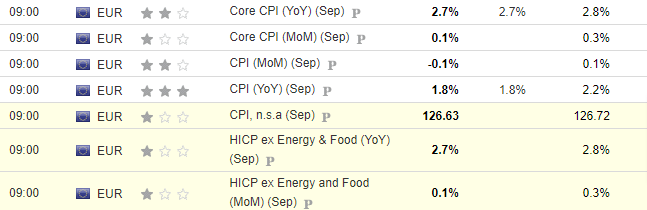

That resistance level held firm once again, as the currency pair rebounded lower following the latest preliminary Eurozone data that signaled softer inflation.

The data from the Eurozone showed that the annual inflation inflation softened to 1.8% in September from 2.2%, weighing on the euro.

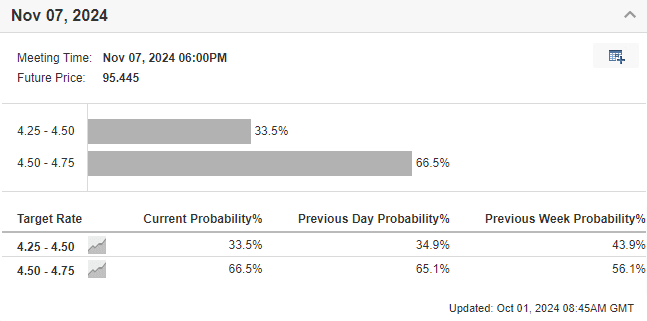

This rebound lower could be fueled further by shifting market expectations, with investors now favoring a 25-basis-point rate cut instead of a larger move.

The growing tensions along the Lebanon-Israel border have pushed investors toward safe-haven assets, benefiting the US dollar.

Looking ahead, the spotlight will shift to Friday’s US labor market report, a key driver of market sentiment and trading strategies for the EUR/USD pair.

Powell's Neutral Tone

In a speech yesterday at the National Association of Business Economists, Federal Reserve Chair Jerome Powell struck a neutral tone, reinforcing that rate cuts will continue but without a set path.

While his comments were not groundbreaking, market expectations have adjusted, betting on a smaller scale of cuts, leaving room for a dovish surprise in November.

Meanwhile, the European Central Bank (ECB) is expected to follow a similar course, likely cutting rates by another 25 basis points at its next meeting.

Focus Shifts to US Labor Market Data

With recent US labor market reports having significantly influenced both stocks and the US dollar, Friday’s data release is highly anticipated.

Forecasts suggest little change, with a slight uptick unemployment and non-farm payroll growth expected.

Investors will also be watching earlier reports on the ISM Manufacturing and Services Index, which are expected to show minimal deviation from the expected figure. Until the labor data hits, the market may remain directionless.

EUR/USD Faces Double-Top

The EUR/USD pair has been in a sideways consolidation after failing to break through the 1.12 resistance, which corresponds with the double-top formation.

This pattern typically signals a bearish reversal. The key support level is at 1.11.

A breakdown below 1.11 could extend the correction to 1.10, while a northward move remains possible if the data stays in line with forecasts, opening the door for another attempt at 1.12.

A decisive breakout from the 1.11-1.12 range will likely set the next direction, potentially following Friday’s data release.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.