European markets are trading softer on Tuesday with the major European equity indices dropping alongside the euro. Market jitters continue after Sunday’s French elections despite the initial kneejerk reaction higher at the open on Monday. The brief relief following a smaller voting percentage than expected for the far-right gas dissipated as investors focused on the political uncertainty stemming from the second round of voting this Sunday, whether it be a far-right government or a coalition between Macron’s party and the left.

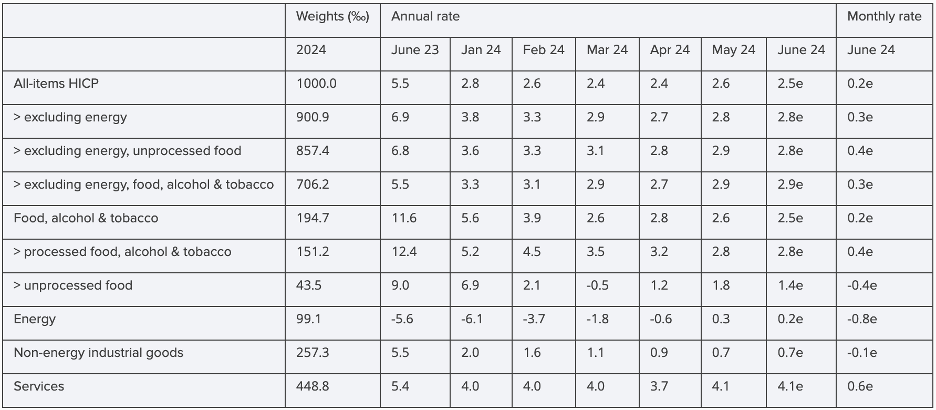

Elsewhere, the Eurozone CPI data for June released on Tuesday morning brought some small relief to investors as it showed a return to disinflation after the unexpected rise in May. Headline CPI came in at 2.5% and core at 2.8%, both in line with expectations. But the services sector remains a problem with a monthly rise of 0.6% and YoY growth unchanged at 4.1%, the highest level in 2024. The data proves that the drop in energy prices continues to be a big driver in the disinflation process, allowing markets to price in another possible rate cut from the European Central Bank (ECB) in September.

Source: refinitiv

EUR/USD has failed to capitalise on Monday’s bounce higher and the pair is back below 1.0750 and with a bearish bias. In all fairness, the confluence of moving averages around 1.0785 was bound to put downward pressure on the pair and it was highly unlikely that buyers would find enough courage to push past it in the first go. This area remains the key resistance blocking any further bullish momentum. As the RSI remains below 50, the path of least resistance for EUR/USD continues to be lower.

EUR/USD daily chart

Past performance is not a reliable indicator of future results.

Meanwhile, the DAX 40 is dropping 1.5% on Tuesday breaking below its 100-day simple moving average (SMA) for the first time since November. This is significant as this level has acted as support for the past two weeks by limiting the downside momentum. This RSI has also been rejected at the mid-line after the attempted rebound on Monday, which puts further downside pressure on the price. The German index is now threatening to drop below 18,000 at which point the area between 17,966 and 17,400 has offered support in the past few months.

DAX 40 daily chart

Past performance is not a reliable indicator of future results.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.01% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

The information provided is not to be considered investment advice or investment research. Capital.com will not be liable for any losses from the use of the information provided.'

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD, DAX 40 face increased bearish pressure as CPI fails to impress investors

Published 02/07/2024, 14:02

EUR/USD, DAX 40 face increased bearish pressure as CPI fails to impress investors

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.