After Trump health care bill loss, it is hard to believe that there can be easy tax reforms in US, as these tax reforms can drive the US budget deficit higher with no compensating from eliminating Obamacare.

The US Equities outlook is not bright as it has been before because of the lost reflation hopes.

The industrial commodities such as the Iron ore and copper as well came under selling pressure, as the financial stimulus plans of Trump are in serious check right now.

The greenback came under pressure as this lower US economic outlook drives the interest rate outlook down too and lowers the inflation pressure potential.

The US treasuries yields came under pressure with this current dovish sentiment which pushed the investors' trust in buying these notes up.

EURUSD could easily have a higher place with these growing worries about the economic outlook in US, While the cheeriness of watching higher growth rates and inflation rates in EU is still on.

The data which came out from EU yesterday have shown that March Germane IFO business climate rose to 112.3 which is its highest level since July 2011.

While the loans to the EU household sector rose yearly by 2.3% in last February to Eur5.75 trillion which is the highest since February 2011.

We have seen also last week EU flash PMI of March rising to 56.2 which is the highest since April 2011, after 55.4 in February, while the market median consensus was referring to decreasing to 55.3.

It's important to watch too by the end of the week the flash reading of EU CPI of March which is expected to show rising by 1.8% year on year, after increasing in February by 2% which has not been seen since December 2013.

You need to focus too on the Core figure of it which is expected to highlight increasing by 0.9% yearly, as it has been in January and December.

As meanwhile, The core figure became more important to the market participants, after Draghi had said several times recently before the EU parliament and after the recent ECB 2 meetings that the current rising of the inflation rate is mainly because of the oil prices yearly increasing.

Politically, The Single currency could be boosted also from another side by the loss of the polarization in Netherland and the progress of Merkel's popularity in Germany especially, after her meeting with Trump and Ardogan's criticism to her policies which are looking very suitable in Germany for dealing with him.

Merkel's CDU ruling party could accomplish unexpected success in the south west of Germany gaining 40.7% of Saarland votes, while its main competitor party SPD gained only 29.6% and the right wing party AFD which has nationalization and population tendencies gained only 6.2%.

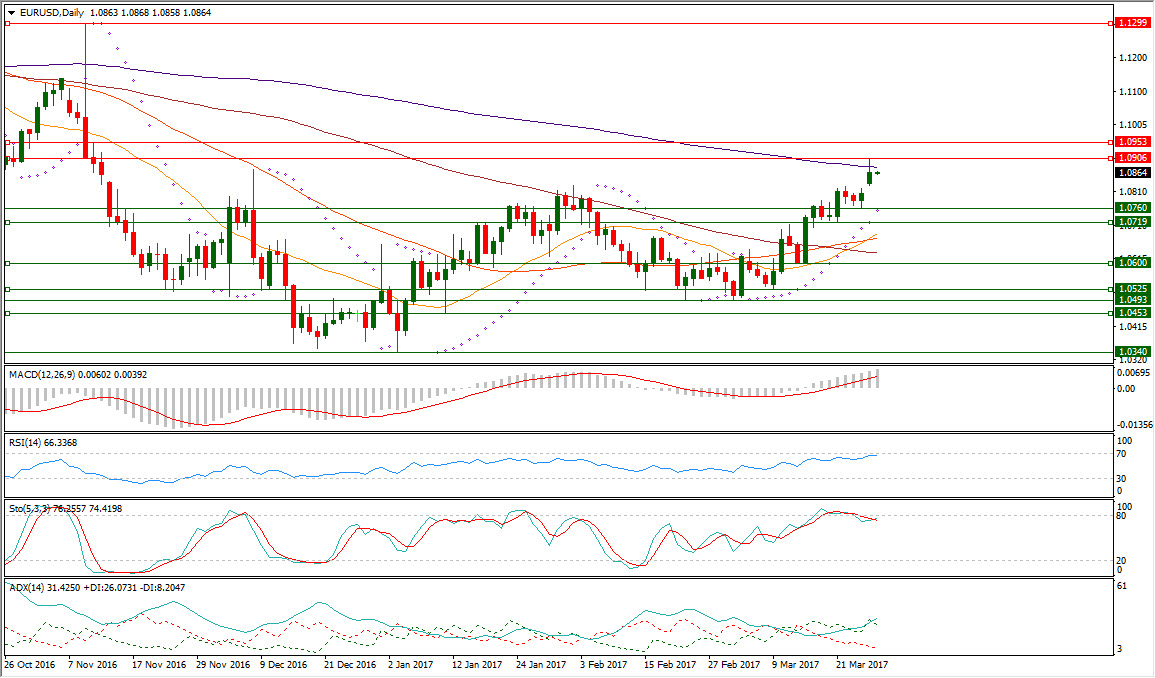

Technically, EURUSD could gain momentum, after surpassing last Feb. 2 high at 1.0828 and last Dec. 8 high at 1.0873

After forming series of higher lows above 1.0340 which has been reached on the third day of this year to be the lowest level since December 2002.

EURUSD could form a second bottom at 1.0493, before having higher lows at 1.0525, 1.06, 1.0719 and 1.0760 which drove this pair to reach 1.0906 yesterday.

By reaching 1.0906, the pair could have a place above its daily SMA200 but it retreated to be traded near 1.0960 below this average in its 18th day of being above its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 1.0754.

EURUSD daily RSI-14 is referring now to existence inside the neutral region reading 66.336.

Its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the neutral region at 76.225 leading to the upside its signal line which is at 74.419.

Important levels: Daily SMA50 @ 1.0673, Daily SMA100 @ 1.0631 and Daily SMA200 @ 1.0880

S&R:

S1: 1.0760

S2: 1.0719

S3: 1.0600

R1: 1.0906

R2: 1.0953

R3: 1.0000