After highlighting a range of Exchange-Traded Funds (ETFs) offering exposure to various asset classes, today we'll switch focus to another type of Exchange-Traded Product to consider: Exchange-Traded Notes (ETNs).

Below we breakdown down exactly how ETNs work and offer a commodities ETN worth watching:

What's An ETN?

An exchange-traded note is an unsecured debt security issued by a financial institution, usually a bank. Since an ETN's value is backed by the credit rating of the underwriting issuer, the price would likely decrease if the credit of the underwriter were to go down.

Most investors may feel confident that globally recognized issuers like Barclays (NYSE:BCS), Morgan Stanley (NYSE:MS) and UBS (NYSE:UBS) will always be able to repay the notes, but default risks do exist. For example, when the financial crisis of 2008 led to the collapse of Lehman Brothers, ETN investors at the time found themselves with unsecured claims in the bank's bankruptcy proceedings.

Like stocks and ETFs, ETNs also trade on major exchanges. ETNs track an index of securities, which may be tied to broad-based asset indices, emerging markets, commodities, volatility, foreign currencies, a specific industry or sector (such as oil and gas pipelines, biotechnology, consumer staples, or semiconductors) or other instruments. Therefore, returns usually depend on the performance of a market benchmark or strategy, minus any expense fees.

Unlike ETFs, ETNs are not registered investment companies, so investors do not actually own a share of the underlying portfolio of assets in the fund. Instead, they hold a bond-like certificate indicating the debt of the underwriter (e.g., the financial institution or the bank) to the holder of the ETN.

Similar to other debt securities, ETNs have a maturity date, but they are not intended to be held to maturity. ETNs generally do not make any interest payments like bonds, either.

Accordingly, returns to an investor generally come from trading the ETN. Market prices of ETNs fluctuate like stocks or ETFs. ETN issuers calculate the value of the ETN using a described formula, rather than using net asset value as is the case with ETFs.

An ETN issuer would publish a value at the end of each trading day, representing the amount the issuer would be obligated to pay the investor. However, market prices may vary from these published values if the syndicator has credit issues. Therefore, the price discrepancy is an important risk characteristic of ETNs.

Another difference between ETNs and ETF is trade volume, which tends to be much lower for most ETNs than comparable ETFs, so ETNs carry more liquidity risk.

Finally, in the US, investing in ETNs has different tax consequences than ETFs. Individuals need to do due diligence to find consider the potential tax implications given their specific circumstances.

Over the course of this week, we've addressed how investors can gain exposure to commodities using ETFs in two articles. For those interested in commodities investing using ETNs, here's one to consider:

iPath Bloomberg Commodity Index Total Return ETN

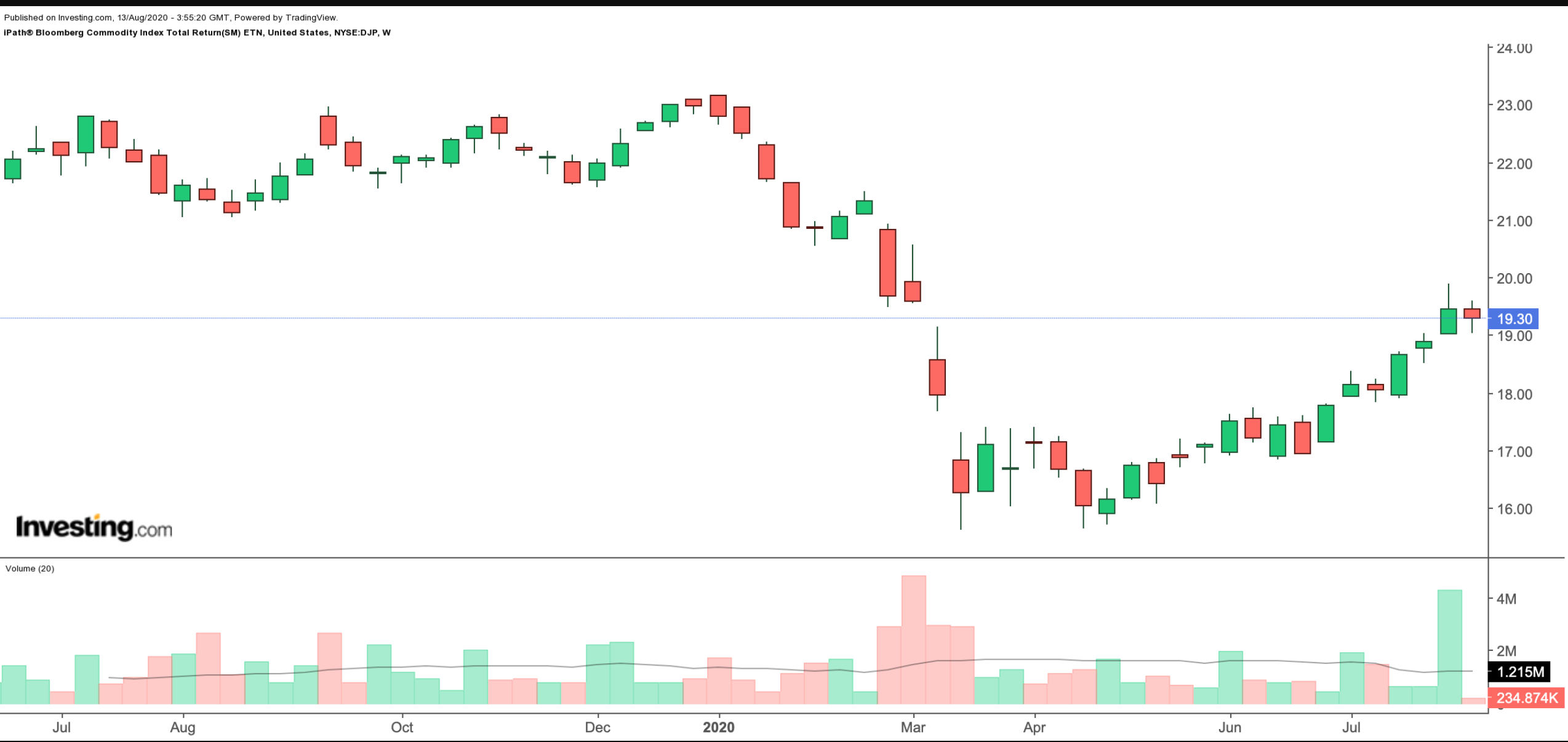

- Current Price: $19.30

- 52-Week Range: $15.61 - $23.16

- Investor Fee Rate: 0.70% per year, or $70 on a $10,000 investment

The iPath® Bloomberg Commodity Index Total Return ETN (NYSE:DJP), is issued by Barclays Bank.

DJP provides exposure to the Bloomberg Commodity Index Total Return. Current sector weightings are: Energy (23.35%), Grains Oilseeds (23.35%), Precious Metals (22.45%), Industrial Metals (18.70%), Softs (7.16%), and Livestock (4.99%).

The top component of the index is Gold (18.02%), followed by Copper (7.86%), Natural Gas (7.65%), Soybeans (6.09%), and Corn (5.99%).

Year-to-date, the ETN is down about 15.5%. However, since hitting an all-time low in March, the note is up around 25%, so some short-term profit-taking is likely, with a potential drop toward the $18 level.

Bottom Line

Different countries have a range of exchange-traded products, which may include ETFs and ETNs. DJP, the ETN covered today, is listed in the US. Readers who are not US residents may want to discuss with their banks or brokers how to access this ETN or other comparable products in their countries.

We’ll cover other ETNs, including inverse and leveraged exchange-traded notes, in the coming weeks.