- Crypto market rebounds after Bitcoin sell-off, but recovery remains uncertain.

- Ethereum finds support, eyes resistance as spot ETF news fuels buying.

- The crypto faces crucial levels as SEC decision on spot ETFs looms.

- InvestingPro Summer Sale is live! For less than $8 a month, unlock the AI-powered stock picks beating the market by 18.6% this year.

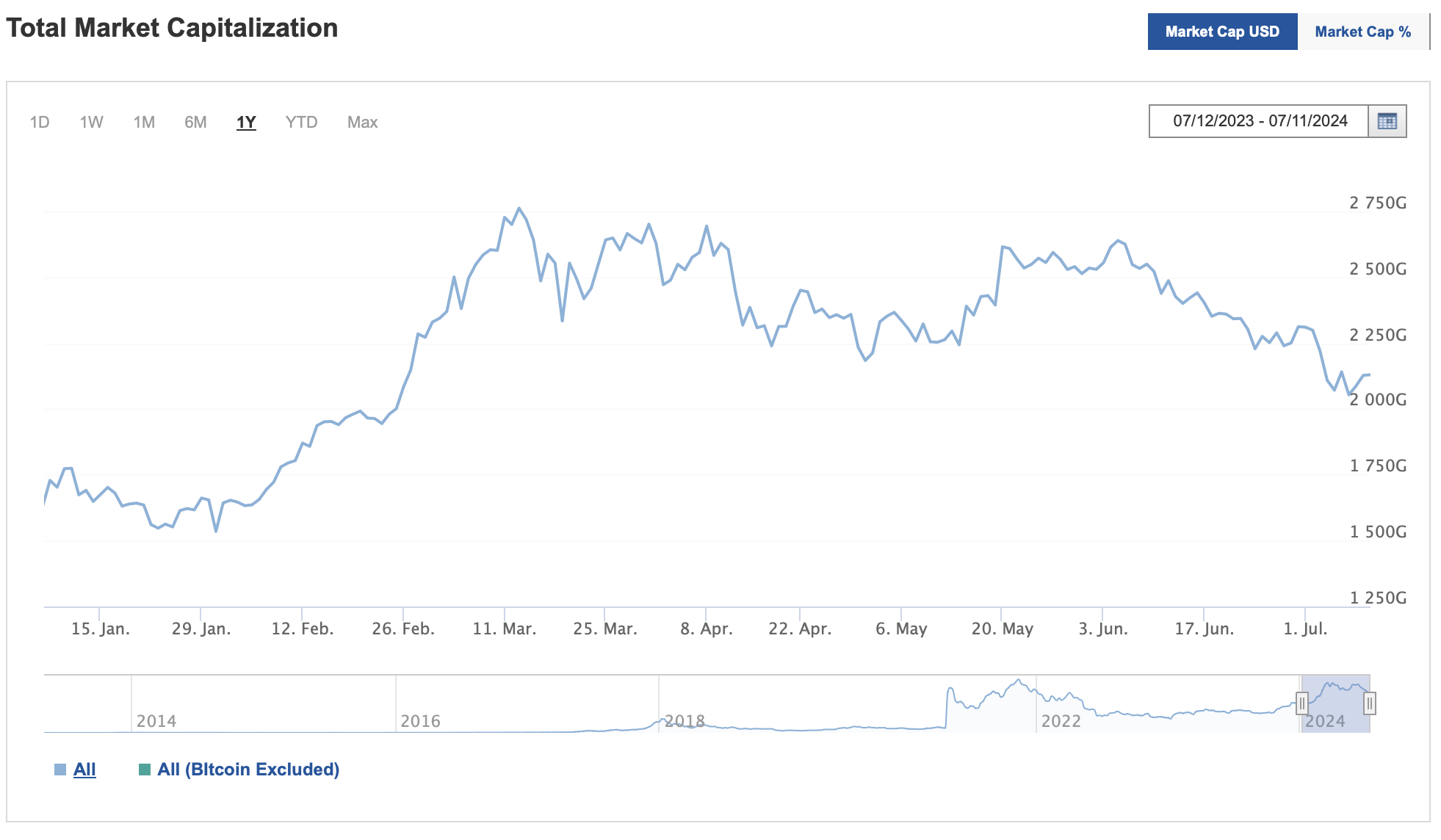

The cryptocurrency market has finally found some relief this week, pausing its persistent decline. While the Bitcoin sell-off has been the primary culprit behind the market's downturn, altcoins have also suffered. Despite significant challenges, such as the Mt. Gox situation and Bitcoin sell-offs by the German government, a surge in demand for US-based Bitcoin ETFs has provided a buffer against further declines.

This week, the cryptocurrency market halted its downward trend, providing a much-needed respite for investors. The primary driver of the decline has been the Bitcoin sell-off, which has also negatively impacted the altcoin market. Recent developments, such as the Mt. Gox situation and the German government's Bitcoin sell-offs, have cast a shadow over the market for the past month. However, the rising demand for US-based Bitcoin ETFs has offered some support against further declines.

Despite this, it's too early to declare a market recovery. The total cryptocurrency market capitalization has not yet recouped the losses incurred in early July, despite this week's partial recovery. For a full recovery, the market capitalization needs to close above $2.15 trillion (Fib 0.236) on a weekly basis, breaking through resistance up to $2.3 trillion. This could happen if the Bitcoin sell-off ends and positive developments materialize, such as the launch of spot Ethereum ETFs.

Ethereum Rebounds From Buy Zone

Ethereum has shown more resilience compared to the broader market throughout June. However, the SEC's delayed approval for ETF issuance dampened demand, leading to a significant drop in early July. Last week, Ethereum tested its April-May lows, falling to the $2,800 range, but saw rapid buying in this demand zone. This week, Ethereum has experienced positive price movements due to new developments for spot ETFs, reaching the critical resistance point of $3,100.

Ethereum Faces Crucial Resistance Levels Amid SEC Decision Anticipation

Ethereum (ETH) is approaching significant resistance levels that could determine its short-term trajectory. Based on the last bearish cycle, $3,125 aligns with a Fib 0.236 level, making it a critical resistance point. A clear daily close above this mark is essential for Ethereum to aim for $3,350, the 3-month exponential moving average, which could signal a trend reversal into positive territory.

A key catalyst for Ethereum's price movement will be the potential approval of the SEC's spot ETH ETF. While approval could boost demand and drive prices higher, it might also trigger a sell-off once the expectation materializes. Hence, Ethereum's ability to respond positively to the SEC decision is crucial for a sustainable recovery. If ETF inflows significantly increase demand, any initial selling pressure could be mitigated.

For Ethereum to break its short-term downtrend and target $3,350, it must first clear the resistance at $3,125. In the event of a pullback, $3,000 serves as the immediate support level. Failure to overcome current resistance could see a retest of this support. Holding $3,000 may pave the way for a stronger move past $3,125, while a break below $3,000 could trigger a decline towards the $2,800 demand zone.

The $2,800 support has held since April, but each test weakens it, raising the risk of a break. Should this level fail, Ethereum's next support could form around $2,600.

In conclusion, the Ethereum market is closely monitoring developments around ETF approval. A confirmed trend reversal requires Ethereum to establish a firm floor above $3,350 this month. Until then, traders should watch the $3,125 and $3,000 levels closely as indicators of potential movements.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.