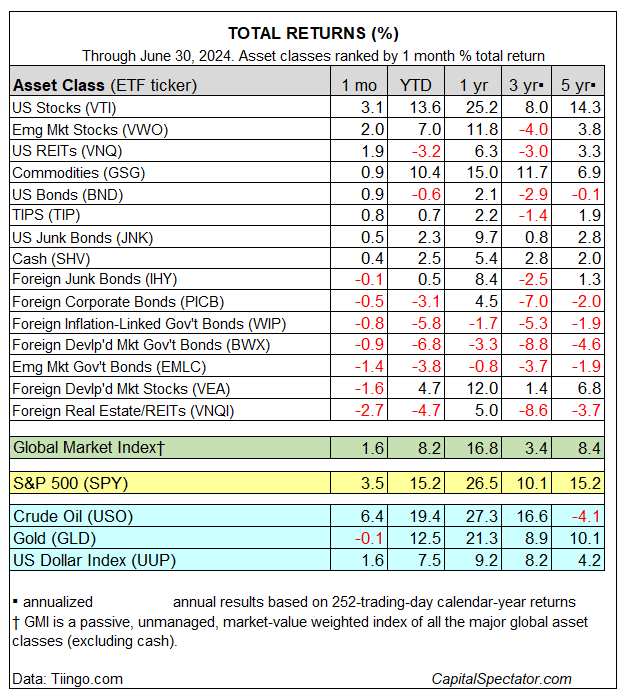

US stocks again secured the top spot for monthly performances in June for the major asset classes. The rally marks the second straight month that American shares led global markets, based on a set of ETFs.

Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) rose 3.1%, easily outperforming the rest of the field. VTI is now up 13.6% year to date, which is also the leading return for 2024.

Stocks in emerging markets (VWO) posted the second-best performance last month. The ETF’s 2.0% gain builds on its recent rebound, lifting the fund 7.0% so far this year.

US real estate investment trusts also extended their recent recovery. Vanguard Real Estate (VNQ), the third-best performer in June, rose 1.9%. That still leaves the fund modestly in the red for the year, although that’s a substantial improvement from earlier in 2024, when it was the worst year-to-date performer by far.

Despite solid gains in some corners, there was plenty of red ink last month for some markets. The biggest loss in June: foreign real estate (VNQI), which shed 2.7% and is off nearly 5% for the year so far.

The Global Market Index (GMI) extended its recent rally, rising 1.6% in June. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios. Year to date, GMI is up 8.2% — only US stocks (VTI) and commodities (GSG) are posting stronger gains for 2024.

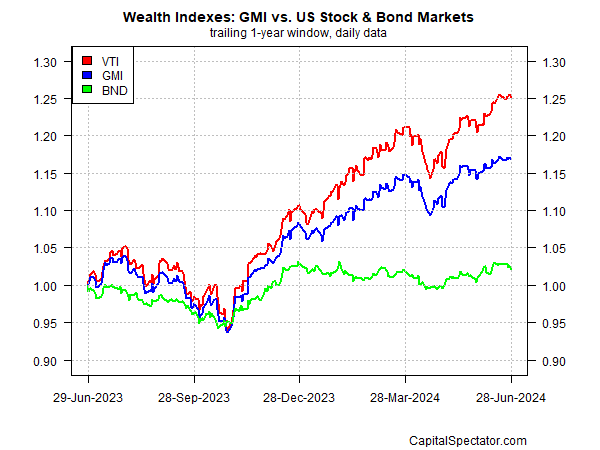

For the one-year window, GMI continues to reflect a middling performance relative to US stocks (VTI) and US bonds (BND).