A strong Q4 performance in recovering markets means Dentsu has posted good figures for FY21 and enters FY22 with positive momentum, particularly in the Customer Transformation and Technology (CT&T) activities. The strategic plan remains to build this area to 50% of revenue less cost of sales (RLCoS), from 29.1% in FY21. Medium-term guidance for group organic growth in RLCoS is upgraded from 3–4% to 4–5%, with 4% guided for FY22. A ¥40bn share buyback is planned, funded from year-end net cash following September’s sale (and leaseback) of the Shiodome building. The share price remains at a substantial discount to peers.

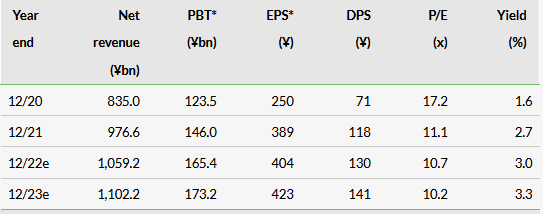

Note: *PBT and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments.

Broad-based strength in Q421

The good performance in Q421 was across both Dentsu Japan Network (DJN) and Dentsu International (DI), with the former posting organic progress at the RLCoS level of 17.3% and the latter 12.1%. Within DI, a very strong Media performance in the Americas in December lifted Q421 organic revenue growth there to 15.4%, despite tougher comparatives in Customer Experience Management (CXM). The cyclical recovery across the year delivered group FY21 organic RLCoS growth of 13.1%, with an underlying operating margin of 18.3%, up 350bp on the prior year. We have set our FY22 forecasts to match management guidance (an upgrade of 4% at the underlying operating profit level, with a margin of 17.7%) and initiated forecasts for FY23, with RLCoS up 4% year-on-year.

Acquisition fund to drive medium-term growth

A transformed balance sheet (year-end net cash of ¥144.4bn) allows management to drive investment to deliver growth, with an upper limit on leverage at 1.5x year-end net debt/EBITDA (medium-term target range of 1.0–1.5x). The top priority is capex, where ¥70bn of spend is identified across FY22–24. Second, a fund of ¥250–300bn for M&A is allocated over the same period, prioritising development in CT&T, alongside capability and geographic infill. As guided, the dividend payout ratio is set to lift from 30% in FY21, to 32% in FY22e and to 35% by FY24e. ¥40bn is also earmarked for a share buyback across FY22, with a maximum of 20m shares.

Valuation: Overstated discount

The share price has recovered from the dip in November last year and is now 21% off the low hit in early December. Across FY21–23e, the shares still sit at a substantial valuation discount to the peer set of 27% on EV/EBITDA and 23% on P/E. Given the improving quality of business with the increased emphasis on digital transformation, we still believe this differential is overstated.

Share price performance

Business description

Dentsu Group is a holding company with two operational networks: Dentsu Japan Network and Dentsu International. Operating in over 145 countries, Dentsu Group provides a wide range of client-centric integrated communications, media and digital services.

Progress along planned lines

Q421 closed strongly for DJN and DI, with the group in much better shape given the simplification of the structure and costs that have been taken out of the business under the accelerated transformation plan (described in detail in our initiation report). These cost savings were previously guided at the group level of ¥75bn annualised from FY22 (of which ¥50bn falling in FY21).

The operational changes carried out in FY21 across the group should enable Dentsu to benefit to a greater extent from the structural shifts in the global market, with the burgeoning demand from corporate clients to transform their businesses to enhance and upscale their digital approach. The proportion of RLCoS from CT&T rose to 29.1% for the year, from 27.5% in FY20. The percentage at DJN was flat at 24.4% but rose to 32.6% at DI (FY20: 29.7%), helped by favourable currency movements. The reorientation of the group is regarded as a continuing process, with the structural trend given an additional impetus by the effects of the pandemic, highlighting the importance of businesses having a multi-dimensional understanding of their own customers. The marriage of data with creativity and technology is regarded as key.

The objective is to build CT&T to half of the group revenue base over (unspecified) time, fuelled by internal organic growth and supplemented by M&A, with the hypothecation of a fund of ¥250–300bn to be applied across FY22–24e. We would anticipate that average deal size would be ahead of the ¥25–30bn region typical historically. LiveArea, bought in Q321, and already rebranded as part of Merkle within DI, has been reported to have cost around ¥250m, although the price has not been formally disclosed. LiveArea registered an impressive organic growth rate of over 30% in Q421. Acquisitions of ¥50bn and subsidiary investments of ¥107bn are disclosed in the FY21 summary cash flow statement.

The proportion of RLCoS from the digital domain was 35.7% (+0.9%) for DJN but decreased to 61.8% for DI (-5.7%), with the proportion diluted by a particularly strong showing from the Media segment as confidence stepped up more sharply towards the close of the year.

Click on the PDF below to read the full report: