We begin with an update on global manufacturing trends.

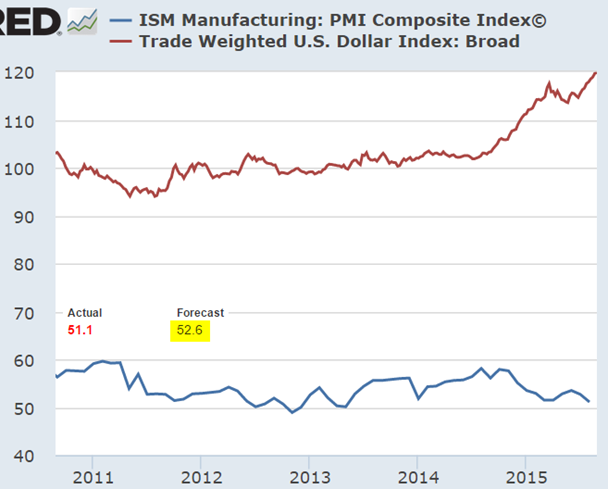

In the United States, the ISM Manufacturing PMI report showed how the recent US dollar strength is choking off American manufacturing recovery.

Source: St Louis Fed

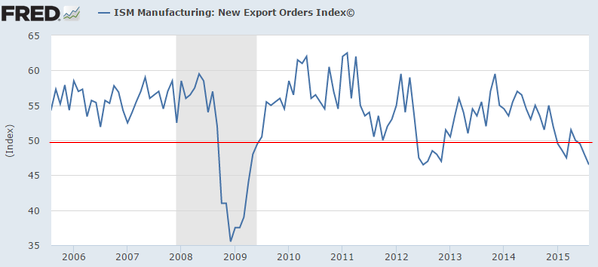

New export orders have weakened sharply as a stronger dollar makes US products more expensive for foreigners (note that PMI < 50 means contraction).

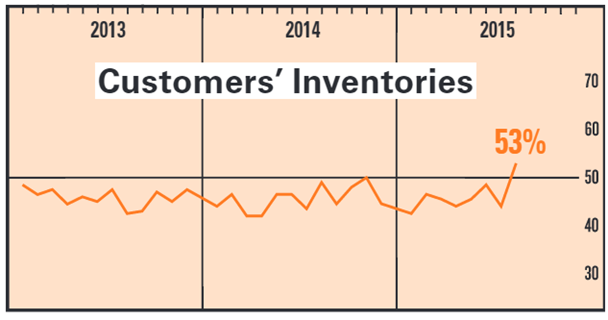

Moreover, over half the respondents indicated that customers' inventories were too high. This doesn't bode well for new orders going forward.

Source: ISM, h/t @NickatFP

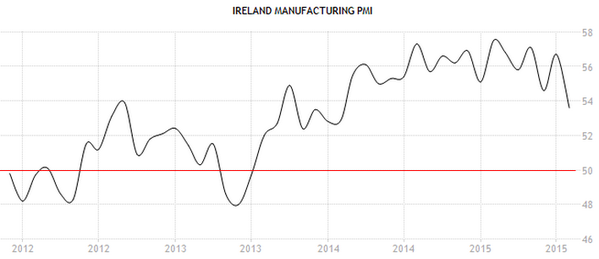

In Europe, the Markit manufacturing PMI report showed a surprising slowdown in Ireland's manufacturing sector.

Source: TradingEconomics.com

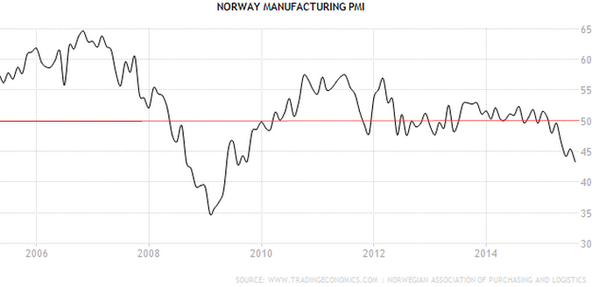

Energy markets weakness is taking its toll on Norway's manufacturing.

Source: TradingEconomics.com, Norwegian Association of Purchasing and Logistics

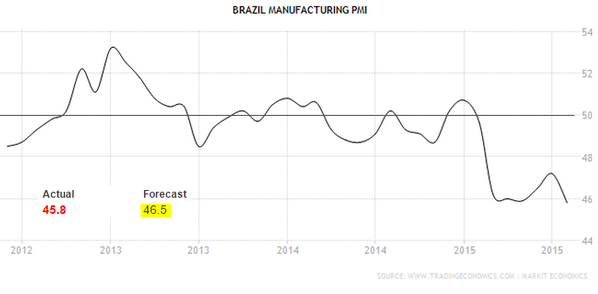

The manufacturing sectors in Brazil and Russia continue to contract.

Source: TradingEconomics.com, Markit Economics

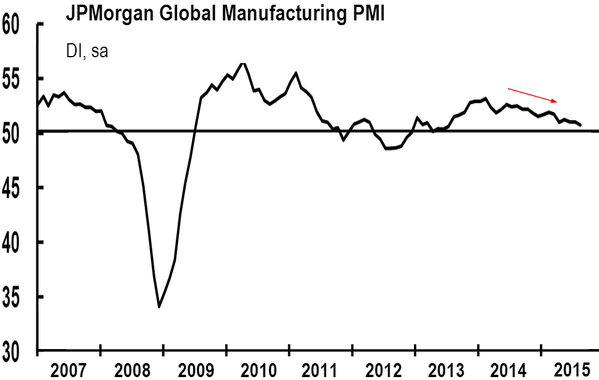

I discussed the situation in China and other Asian economies yesterday. Put all this together and it becomes clear that the slowdown in manufacturing activity is a global trend.

Source: Markit

_____________________________________________________________________

Turning to Asia...

We had another ugly market open in Shanghai. Time to arrest more people for spreading negative rumours?

Source: Investing.com

No worries, the "Beijing put" is still in play as China Securities Finance Corp will likely step in to buy shares of state companies again. After all the government already owns these firms — why not increase the holdings?

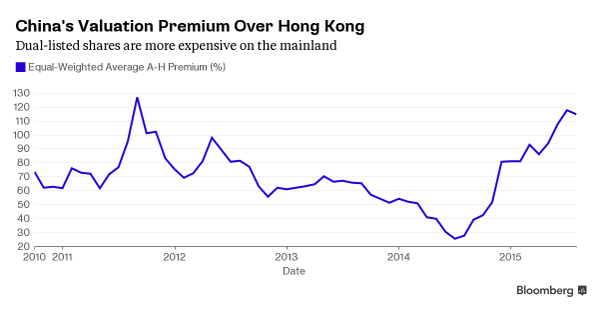

In spite of the recent selloff, according to some measures, mainland China's share prices are still quite rich.

Source: @business

_______________________________________________________________________

Commodity-export-dependent economies remain under pressure, and this is not limited to emerging markets.

Source: TradingEconomics.com, Australian Bureau of Statistics

Canada officially enters a recession - a mild one so far.

Source: TradingEconomics.com, Statistics Canada

_____________________________________________________________________

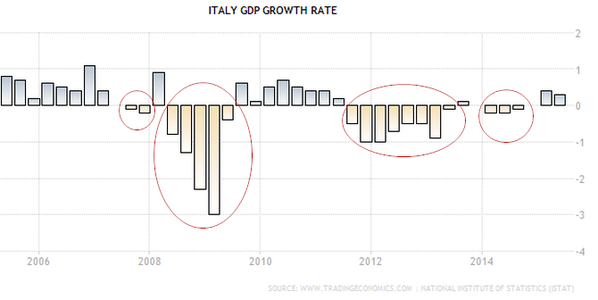

Turning to Europe, here are select economic trends. Italy had two consecutive quarters of growth for the first time since 2011. How long can it manage to stay out of recession?

Source: TradingEconomics.com, National Institute of Statistics (iSTAT)

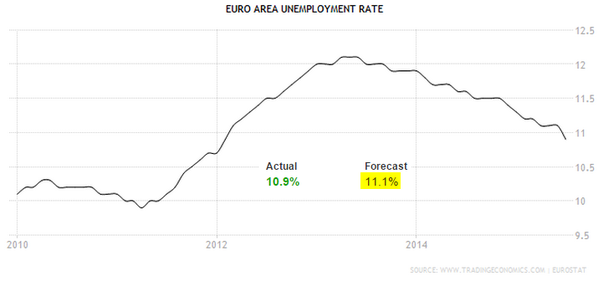

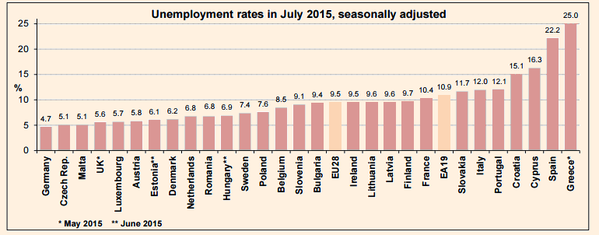

The Eurozone unemployment rate was better than consensus — down to a 3.5-year low. The health of the labour markets, however, remains highly uneven across the member states.

Source: TradingEconomics.com, Eurostat

Source: @fastFT

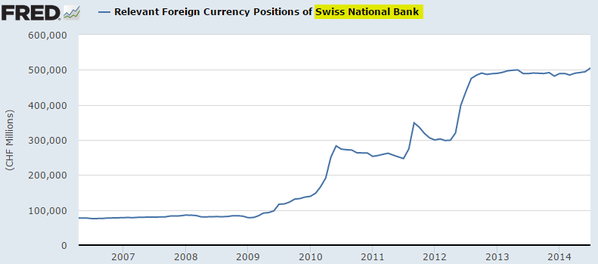

The Swiss National Bank's (Swiss central bank) FX holdings (mostly euros) continued to rise in July. The latest increase was driven by Greece, with some private-sector flows from Greece (and possibly other periphery nations) going outside the euro area. This tells us that the SNB is not willing to let the Swiss franc strengthen indefinitely.

Disclosure: Originally published at Saxo Bank TradingFloor.com