Early in another December week, the Brent price is falling again. The asset is trading below $71 and may continue plunging.

The negative news came from the media – Bloomberg reported a possibility of new lockdowns in Europe, the Netherlands-style, where social coronavirus-related restrictions will remain in effect until 14 January 2022. It is not beyond the reach of reason to suggest that other European countries may follow the Dutch path. This, in its turn, nay reduce business and consumer activity, as well as the demand for energy.

Last Friday’s report from Baker Hughes showed that the Oil Rig Count added 4 units, up to 475. This rising tendency is another factor that pressures oil prices.

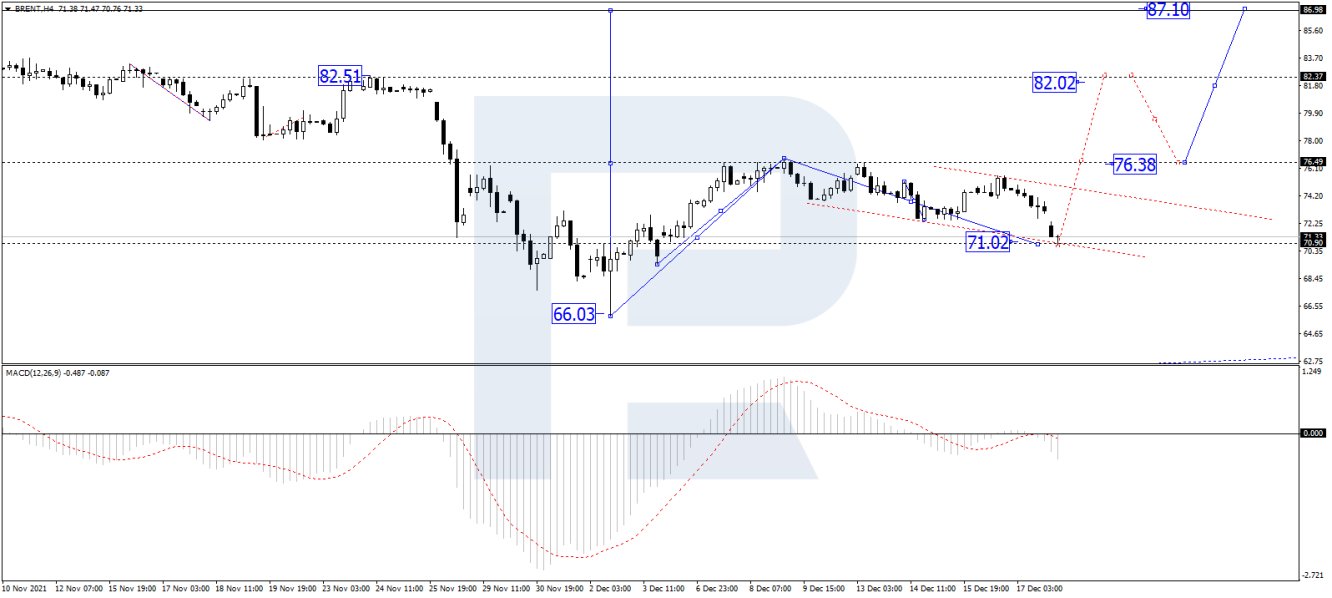

In the H4 chart, after rebounding from 74.00, Brent is growing towards 76.38 and forming the first wave within the uptrend; right now, the asset is correcting and may reach 71.00. After that, the instrument may form the second rising impulse to break 76.40 and then continue trading upwards with the short-term target at 82.00. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving above 0 inside the histogram area, which means that the correction in the price chart may be over soon and the line may continue its movement to reach new highs.

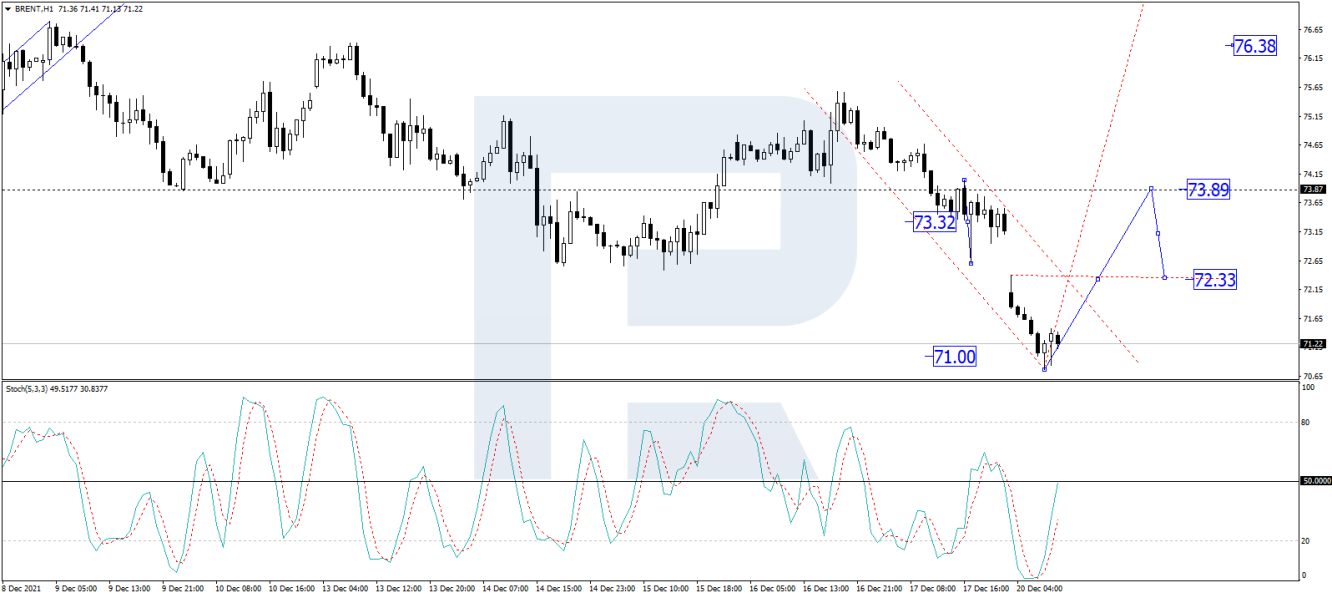

As we can see in the H1 chart, after forming a new consolidation range around 73.30 and breaking it to the downside, Brent has almost completed the correction by falling and reaching 71.00. Possibly, the asset may form a new consolidation range and later break it to the upside. After that, the instrument may resume growing with the first target at 73.89. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is steadily moving upwards to break 20 and then continue growing to reach new highs.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crude Oil Collapsed Early in the Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.