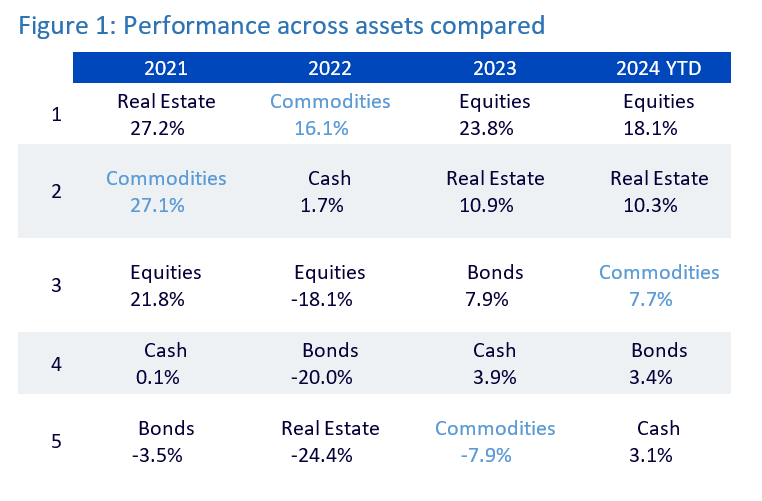

Our annual professional investor survey has revealed some interesting results. Firstly, more investors are in commodities this year (79% in 2024 vs. 71% in 2023). That is unsurprising given how 2023 was tough year for commodities (especially in comparison to 2021 and 2022) and the improvement in the asset class in 2024 (Figure 1).

Source: WisdomTree, Bloomberg

All returns are in USD. 31 Dec 20 to 4 Oct 2024. Data: Equity - MSCI World, Bond - Bloomberg Barclays Agg Sovereign TR Unhedged, Real Estate - EPRA/NAREIT Global, Bloomberg Commodity Total Return Index, Cash - US T-Bill 3 Mth.

Historical performance is not an indication of future performance and any investments may go down in value.

It has been a volatile year for commodities, with some sharp rallies, punctuated by some intense corrections. Those corrections have, however, opened great buying opportunities.

Precious Metals

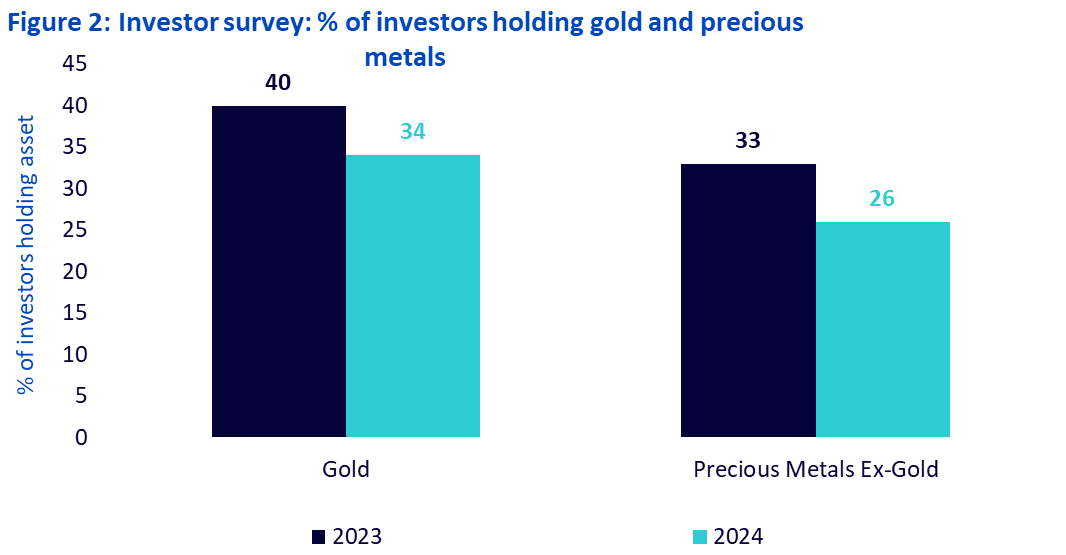

Precious metals have led the pack in performance this year, with close to a 32% year-to-date (YDT) return on gold and a 43% YTD return on silver Curiously, fewer investors in the survey had exposure this year than last year (Figure 2).

Source: WisdomTree, Censuswide

Pan-Europe Professional Investor Survey Research, a Survey of 817 professional investors across Europe, conducted June-July 2024.

Historical performance is not an indication of future performance and any investments may go down in value.

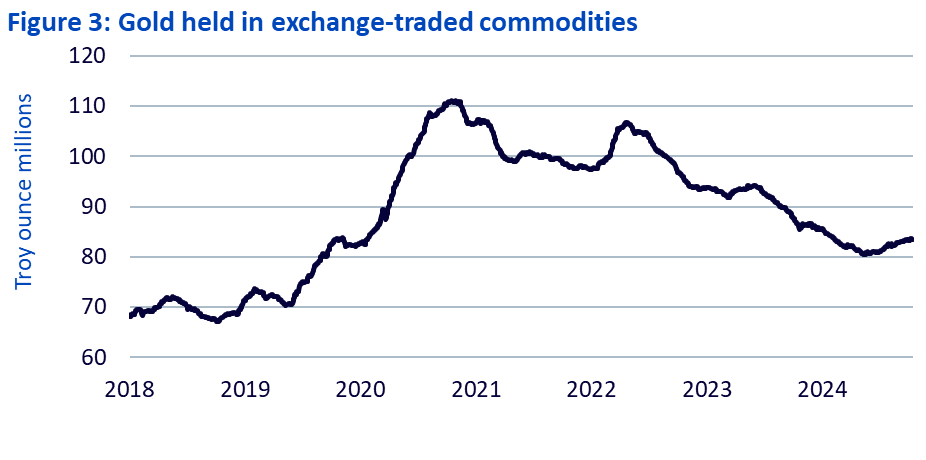

Beyond this survey, evidence from gold exchange-traded commodity (ETC) flows corroborate that there were continuous outflows from May 2022 to May 2024 (Figure 3). However, since then we have seen inflows resume. Throughout the period of outflows, gold prices had been notching fresh highs. Clearly, some investors have missed an opportunity. But it’s not too late. As we discuss in our latest gold outlook, gold will likely continue to hit new highs and our internal forecasts within our outlook point towards $3,030/oz by Q3 2025.

Source: WisdomTree, Bloomberg. Daily data from July 2018 to October 2024.

Historical performance is not an indication of future performance and any investments may go down in value.

Energy

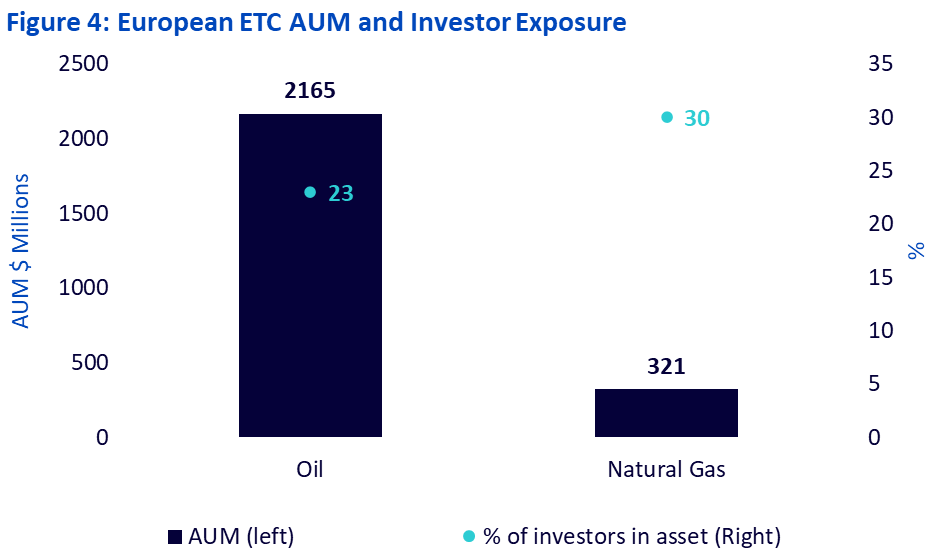

Another surprise when reading the results of this survey is that there are more investors in natural gas than oil. The gap has widened in natural gas’s favour over the past year. However, in terms of assets under management (AUM), there are far more assets in European-issued oil ETCs than in European-issued natural gas ETCs (Figure 4). The survey seems to indicate that while there are fewer oil investors, they must be larger in scale to account for the higher AUMs they collectively hold.

Source: WisdomTree, Censuswide

Pan-Europe Professional Investor Survey Research, a Survey of 817 professional investors across Europe, conducted June-July 2024. WisdomTree’s tracking of European AUM from multiple sources as of 18 October 2024. Includes delta-one and leveraged holdings. Oil includes both Brent and WTI exposures.

Historical performance is not an indication of future performance and any investments may go down in value

Until recently, US Henery Hub natural gas futures were the only investable ETC available on the market. So, this large pool of European investors hold a US-focused natural gas product. In September 2024 (after the survey date), WisdomTree launched a European Title Transfer Facility futures ETC. This could be a more attractive proposition for European investors hedging local energy price shocks and looking for tactical opportunities.

Industrial Metals

Looking at industrial metals, fewer investors have exposure to the asset class in 2024 (27%) compared to 2023 (29%). With industrial metal prices falling last year and many people focusing on metal supply surpluses in 2024, sentiment has been cooling. This year, prices have been volatile but are up. Industrial metals have risen 14% YTD and are the second-best-performing commodity subsector. We believe the cooling of sentiment was premature, and some investors missed an opportunity.

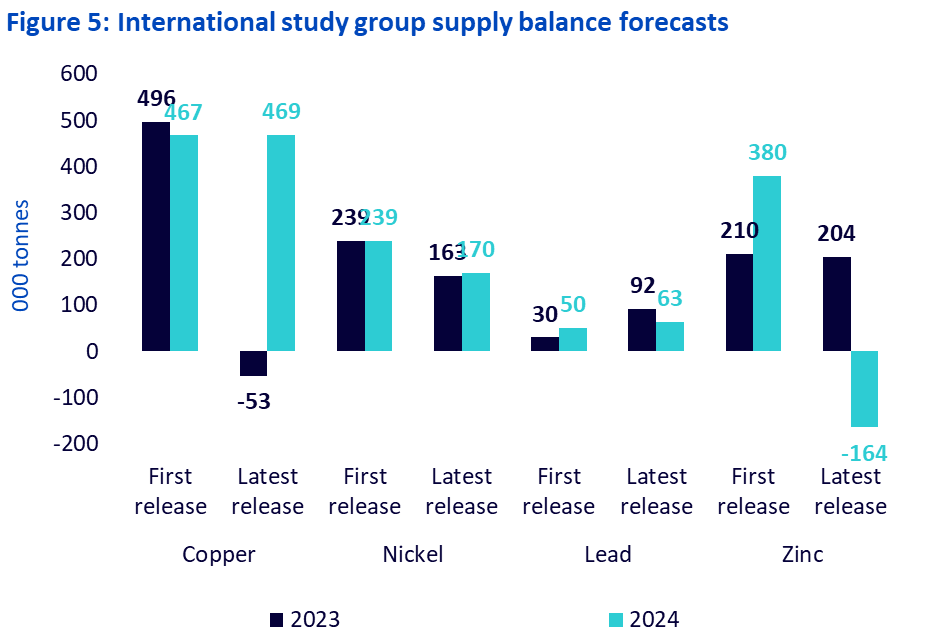

We would like to point out that supply-demand balance forecasts can be wildly out at times, and investors should continue to reassess production and demand dynamics. For example, in January 2022, the International Copper Study Group predicted that there would be a 467k tonne surplus in 2023 when, in reality, we had a 53k tonne deficit (Figure 5). In October 2023, the International Lead and Zinc Study Group predicted a 380k tonne surplus in zinc in 2024 (Figure 5). By September 2024, they revised this forecast to a 164k tonne deficit for 2024.

Source: International Copper Study Group, International Lead and Zinc Study Group, International Nickel Study Group, Latest forecasts from September and October 2024.

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

Broad Commodities

The investor survey revealed that fewer investors were exposed to broad commodity products in 2024 (24%) than they were in 2023 (28%). In terms of ETC flows, we have also observed that investors have been more selective, opting for large exposures to individual commodities rather than baskets. That may be a consequence of more tactical trades based on high-conviction views.

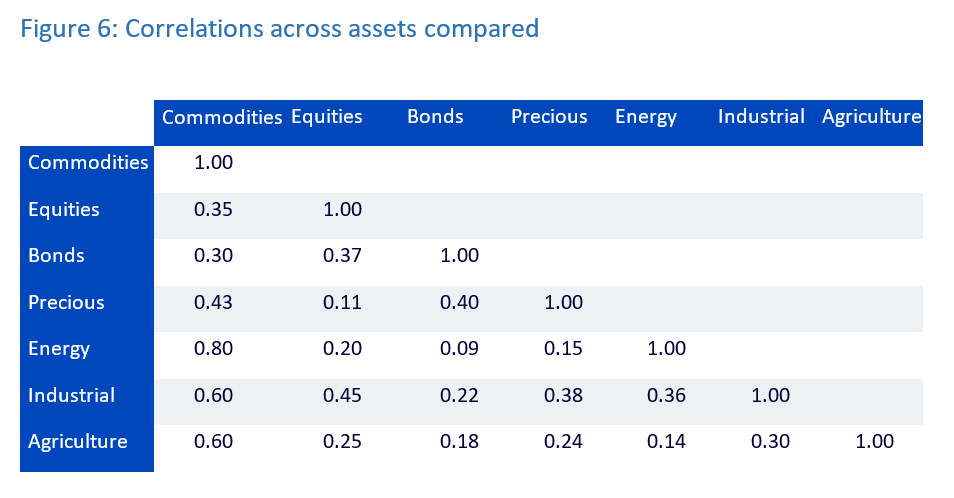

However, given the many uncertainties ahead of us, a large, diversified portfolio of commodities can help diversify risk. Commodities have a low correlation with other assets and, indeed, amongst each other, making a broad basket very appealing.

Source: WisdomTree, Bloomberg

All returns are in USD. September 1984 to September 2024. Data: Equity - MSCI World, Bond - Bloomberg Barclays Agg TR Unhedged, Bloomberg Commodity Total Return Index and sub-indices for its subcomponents.

Historical performance is not an indication of future performance and any investments may go down in value.

Where Could Investors Consider Putting Their Money?

Given that, according to our survey, 38% of investors are looking to increase their commodity exposure, where could they be looking?

Gold and Silver

As we discussed in our recent outlooks (Commodity Outlook: A strong setup for precious metals and Gold Outlook to Q3 2025), we are optimistic about precious metals and believe the complex has solid potential. It’s not just gold that will power forward. Silver, already outperforming gold YTD, could continue to outpace its yellow cousin, given that it could get a tailwind from increasing industrial demand, especially from the photovoltaics sector.

Strategic Metals

An energy transition, a data centre and artificial intelligence (AI) boom and a rapid rollout of 5G technology will all be a metal-intensive demand story. This could all be super-charged with China following through with the fiscal stimulus its economy needs, and many expect the government to maintain its growth targets. China’s industrial policy in recent years has shifted from expanding city limits to the energy transition. We believe that it is more beneficial to base metals like copper, aluminium and zinc rather than iron ore (a construction-driven material).

European Natural Gas

As we discussed earlier, European ETC Investors have a new tool to match their needs, a product exposed to the Dutch Title Transfer Facility (TTF) benchmark. TTF gas prices are up 25% YTD, while US-focused Henry Hub (HH) prices are down 9%. Given that 30% of European investors in the survey have exposure to natural gas (most of which will be to US Henry Hub, given the absence of a TTF ETC product at the time of the survey), we believe they could consider a product that may more closely match their needs.

In recent years, energy-priced shocks have hit Europe harder than the US, spiking European gas prices by a greater amount. With the European gas system more reliant on storage than ever, gas prices are likely to be more volatile. Natural gas stores in Europe are 95% full, but that only equates to 29 days of consumption, so if Europe is hit by any outages of liquified natural gas shipments, it remains vulnerable.

This time last year, natural gas storage levels were 98% full, and we had a mild winter. There is no guarantee of a mild winter again. In fact, a La Niña weather pattern, which has a 60% chance of forming this winter according to the National Oceanic and Atmospheric Administration’s Climate Prediction, usually brings colder weather.

***

Disclaimer: This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.