This article was written exclusively for Investing.com.

- Coinbase exploded to an unsustainable level on Apr. 14

- Stock found a bottom at $208 below the $250 reference price

- Pick-and-shovel play on cryptos: Volume will drive price, but bull market will help

- Way to participate in evolution of crypto revolution without holding volatile assets

- Earnings suggest COIN is the CME and ICE of the burgeoning asset class

On the first day of its public listing, Apr. 14, 2021, Coinbase Global (NASDAQ:COIN) stock reached a high of $429.54 per share. The leading cryptocurrency exchange’s market cap rose to the $100 billion level, higher than the market caps of both the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE).

The CME and ICE are well-established trading platforms with years of history before their respective IPOs in 2002 and 2005. Coinbase’s products have only been around for a decade.

Meanwhile, blockchain technology is evolutionary and revolutionary. Fintech reflects the modernization of finance, making it faster and more efficient. Jack Dorsey, the founder, and CEO of Twitter (NYSE:TWTR) and Square (NYSE:SQ), recently called cryptocurrencies 'the money of the internet.'

While the asset class faces more than a few hurdles, acceptance is rising. Technological advances will eventually solve custody, security, and carbon issues. However, the challenge to governments' control of the money supply remains a substantial challenge for the asset class.

The price action in COIN shares stabilized in the months following its listing on the NASDAQ. As the stock has settled into a trading pattern, the exchange provides an excellent investment vehicle for those wishing to dip a toe in the asset class without owning cryptocurrencies.

Coinbase exploded to an unsustainable level on Apr. 14

The pre-IPO reference price for Coinbase shares was $250. The stock opened for trading on Apr. 14 amid lots of fanfare.

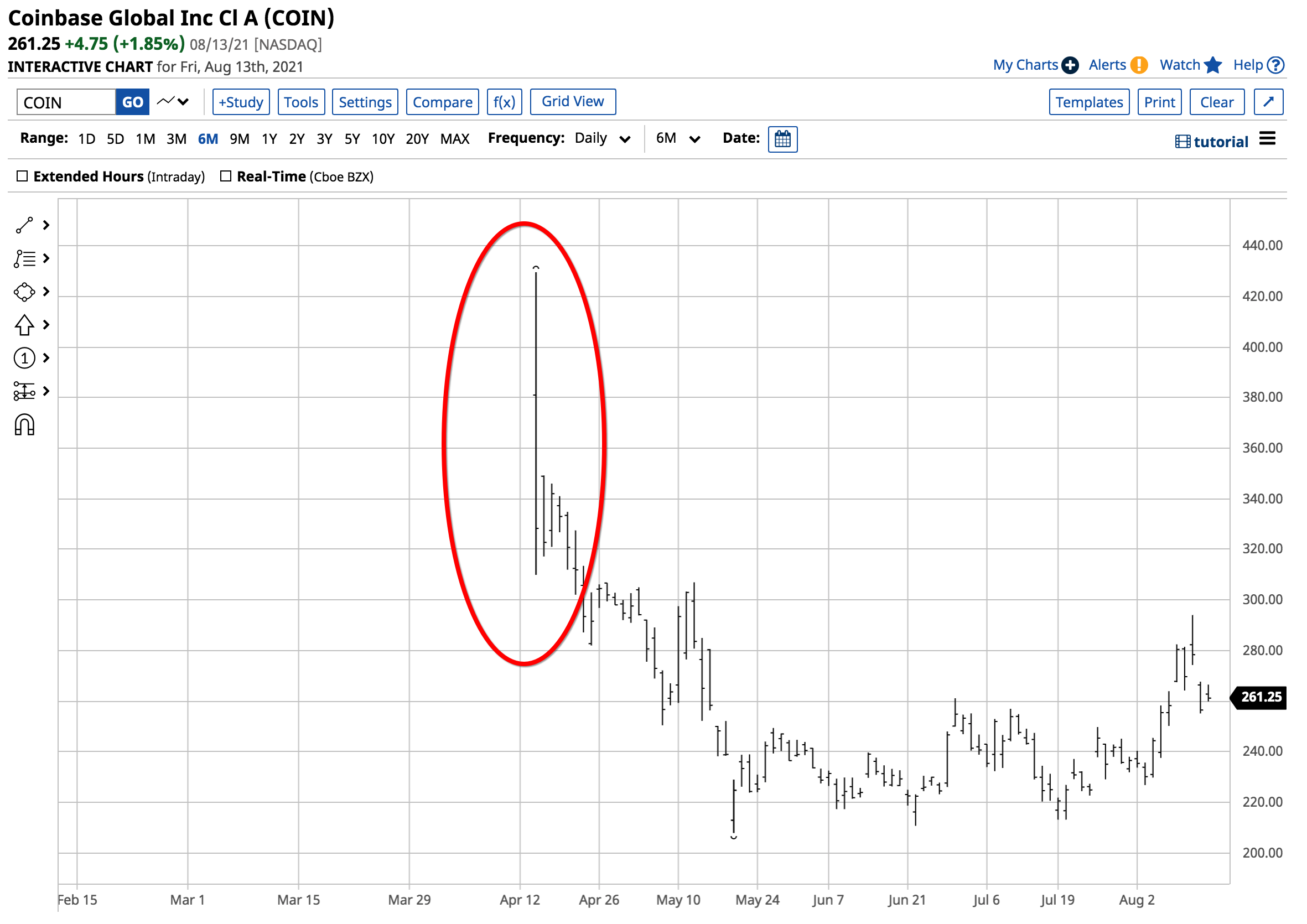

Source: Barchart

As the chart above highlights, COIN shares went public on the first day at $381 and rallied to a high of $429.54 in early frenzied trading. At its peak, the cryptocurrency platform’s market cap reached the $100 billion level. On that day, the leading cryptocurrency also reached a peak.

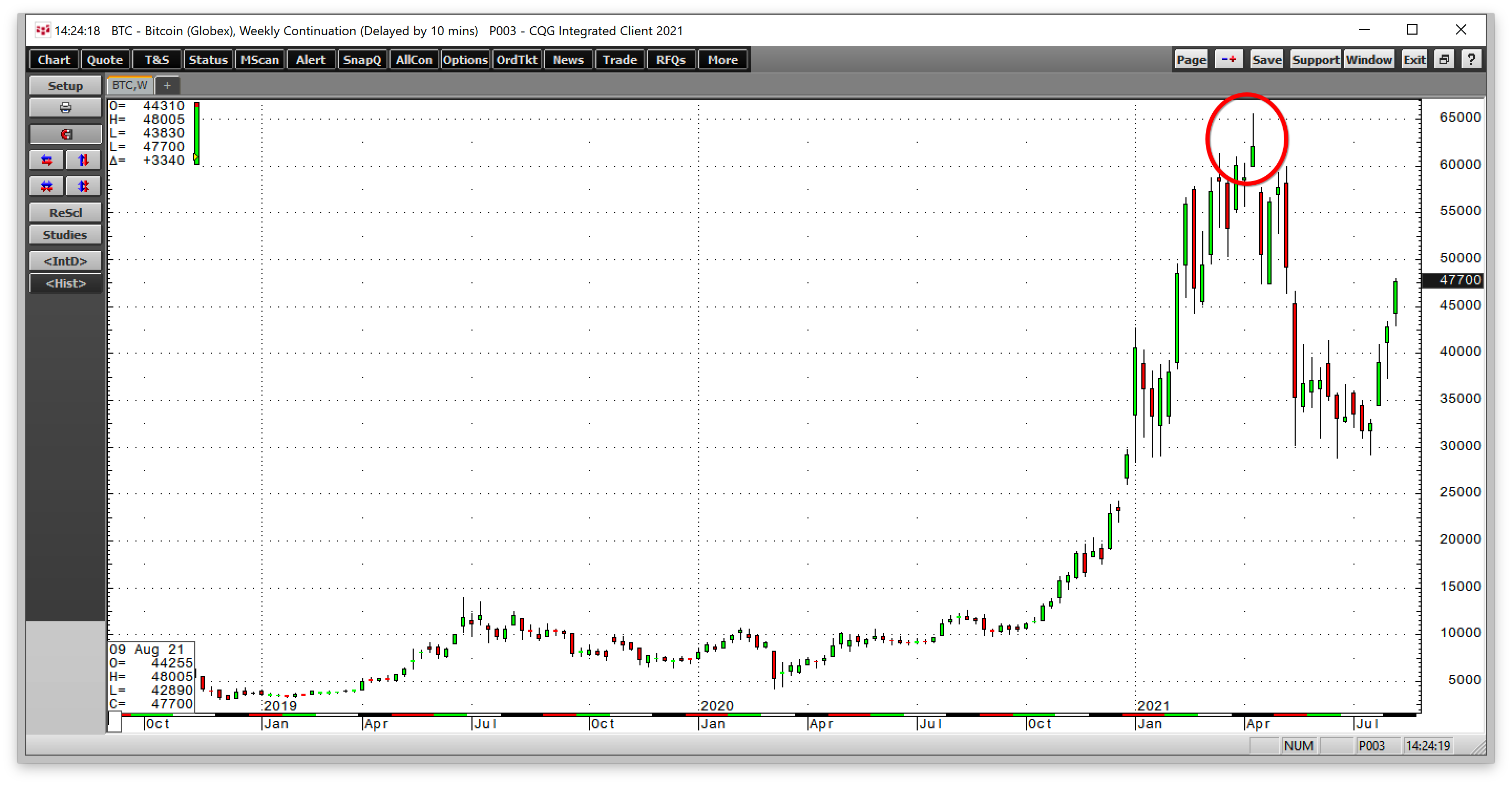

Source: CQG

As the weekly chart indicates, Bitcoin reached its all-time high at $65,520 on Apr. 14. The day Coinbase went public marked a pinnacle for both COIN shares and Bitcoin as both dropped like stones over the following weeks.

Bitcoin fell to a low of $28,800 in late June after COIN shares reached their most recent low.

Stock found a bottom at $208 below the $250 reference price

Stocks that come to market with a frenzy of buying tend to fizzle out over the weeks that follow the listing, and COIN was no exception.

Source: Barchart

The chart illustrates how COIN became a falling knife, as its price plummeted below its pre-listing $250 per share reference price to a low of $208 on May 19. Since the company did not go the traditional IPO route, in order to save the exorbitant fees, insiders and early investors were allowed to sell shares without restrictions once the NASDAQ listed COIN on Apr.14. The ability to so quickly monetize shares likely exacerbated the selling that more than halved the share price and market cap over the first month of trading.

Since then, COIN has stabilized. The stock has made higher lows and higher highs since May 19, with the latest high coming on Aug. 11 at $294. The volatile stock closed at the $261.25 level on Aug. 13, above the $250 pre-listing reference price.

Pick-and-shovel play on cryptos: Volume will drive price, but bull market will help

COIN is a trading platform, so it's not a direct investment in cryptocurrencies. The company provides financial infrastructure and technology for the crypto economy.

COIN’s website highlights that it is the “easiest place to buy and sell cryptocurrency.” COIN only offers trading and execution in select cryptocurrencies. With over 11,250 different tokens in the asset class, there is plenty of room for growth.

COIN is a pick-and-shovel play in the asset class as the company profits from volume instead of price action. The more market participants embrace cryptocurrencies, the higher COIN’s earnings will rise.

Since bull markets tend to attract the most participation, COIN shares will likely rise alongside Bitcoin and Ethereum prices, correlating the platform’s share price with cryptocurrency prices.

Way to participate in evolution of crypto revolution without holding volatile assets

Many investors have been sitting on the sidelines, kicking themselves for missing markets like Bitcoin that rose from five cents in 2010 to over $65,500 in 2021 at the high. At the $47,700 level on Aug. 13, one dollar invested in Bitcoin at five cents was worth $954,000.

Cryptocurrencies are alternative investments that carry a high level of risk. Meanwhile, COIN offers market participants a way to dip a toe into the burgeoning asset class via a mainstream investment vehicle that trades on the tech-heavy NASDAQ.

For many, COIN shares create exposure to cryptocurrencies without worrying about computer wallets, custody, storage, or other factors.

Earnings suggest COIN is the CME and ICE of the burgeoning asset class

On Aug. 10, COIN released its first quarterly earnings report since the shares listed on NASDAQ. The company reported second-quarter revenue of $2.23 billion versus the $1.85 billion forecast. Adjusted EBITDA was $1.15 billion versus the expected $961.50 million.

Trading volume rose to $462 billion, up from $335 billion in the fiscal first quarter. Retail monthly transacting users increased by 44% compared to the first quarter, to 8.8 million. Total verified users grew to 68 million from 56 million.

As of the end of last week, the entire asset class had a market cap at around the $2 trillion level. COIN will grow with the cryptocurrency, digital currency, and stablecoin asset class over the coming years. As the CME and ICE of the tokens that are the children of fintech, COIN is a company with excellent growth potential.