-

China Stocks Snap (NYSE:SNAP) 8-day winning Streak

-

Shanghai Composite drops over %

-

European shares open lower, Wall St futures down

-

Dollar rebounds & Gold back under $1800

-

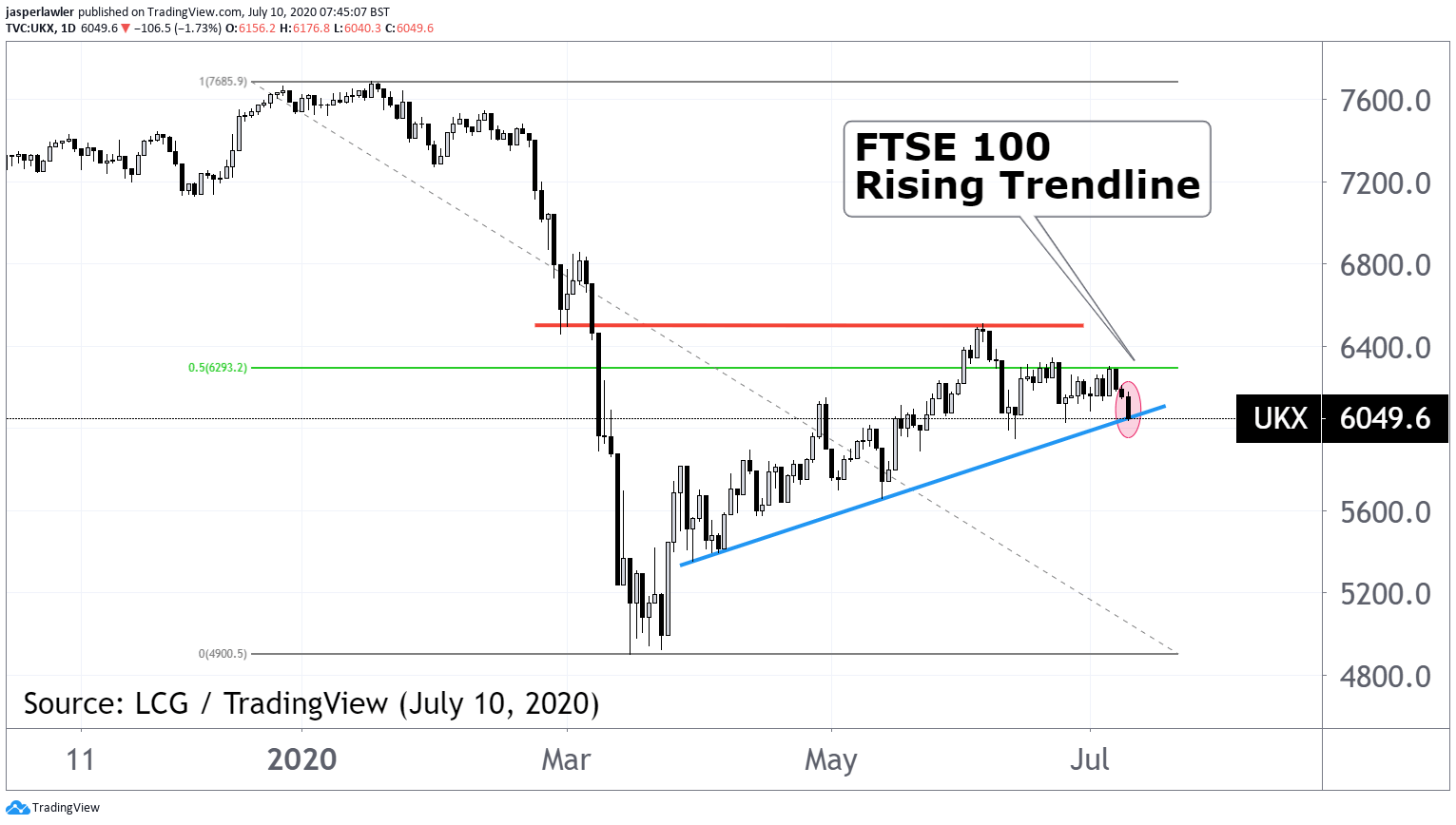

CHART: FTSE 100

China Stocks rollover

Chinese shares rolled over on Friday with some sharp losses. The Shanghai Composite lost over 2% while shares in Hong Kong were on course for similar declines. The down-day is more a symptom over over-extended momentum than anything but a delayed reaction to caution in state media played its part. Some consolidation seems necessary in what became an overheated market but we tend to think it will be short-term as Chinese retail investors buy the dip.

European open

Shares in Europe are nursing opening losses. Declines in China might be adding to the downside especially among China-sensitive assets like miners. Investors have demonstrated less faith in Europe's recovery than elsewhere in the world with a shallower rally since March. Now the onset of the quarterly and semi-annual reporting season will show whether they were correct to do so.

Earnings next week

Top US banks officially kick off earnings season next week. Apprehension before earnings season probably better explains the inability of stock markets to take out June peaks than rising COVID cases. Investors feverishly took on positions they thought would do best post-pandemic during the rally in May and now its wait-and-see time.

Dollar Rebound

A recovery in the US dollar came after the Dollar index struck 4-week lows and EUR/USD reached a monthly peak. It's both a technical pullback and a symptom of broader market caution where some investors are holding more cash.

Gold under 1800

News that Prime Minister Boris Johnson was admitted to hospital saw the British pound dip, only to recover quickly since it seems it was just precautionary. After declines on Friday, GBPUSD seems to have put in a base at 1.22 and GBPEUR at 1.13. Risks to UK sentiment could re-emerge if Boris's hospital stay extends for a few days leaving a leadership vacuum behind.

Chart: FTSE 100 (6-months)

The FTSE 100 is testing a rising trend line, which can be a high R:R entry point but a break lower would be a strong signal the uptrend has ended.