- GBP/USD boosted by dollar weakness, risk-on

- Several test long-term 200-day averages after impressive recovery

- Potential for reversal, but bears must see bearish signal first

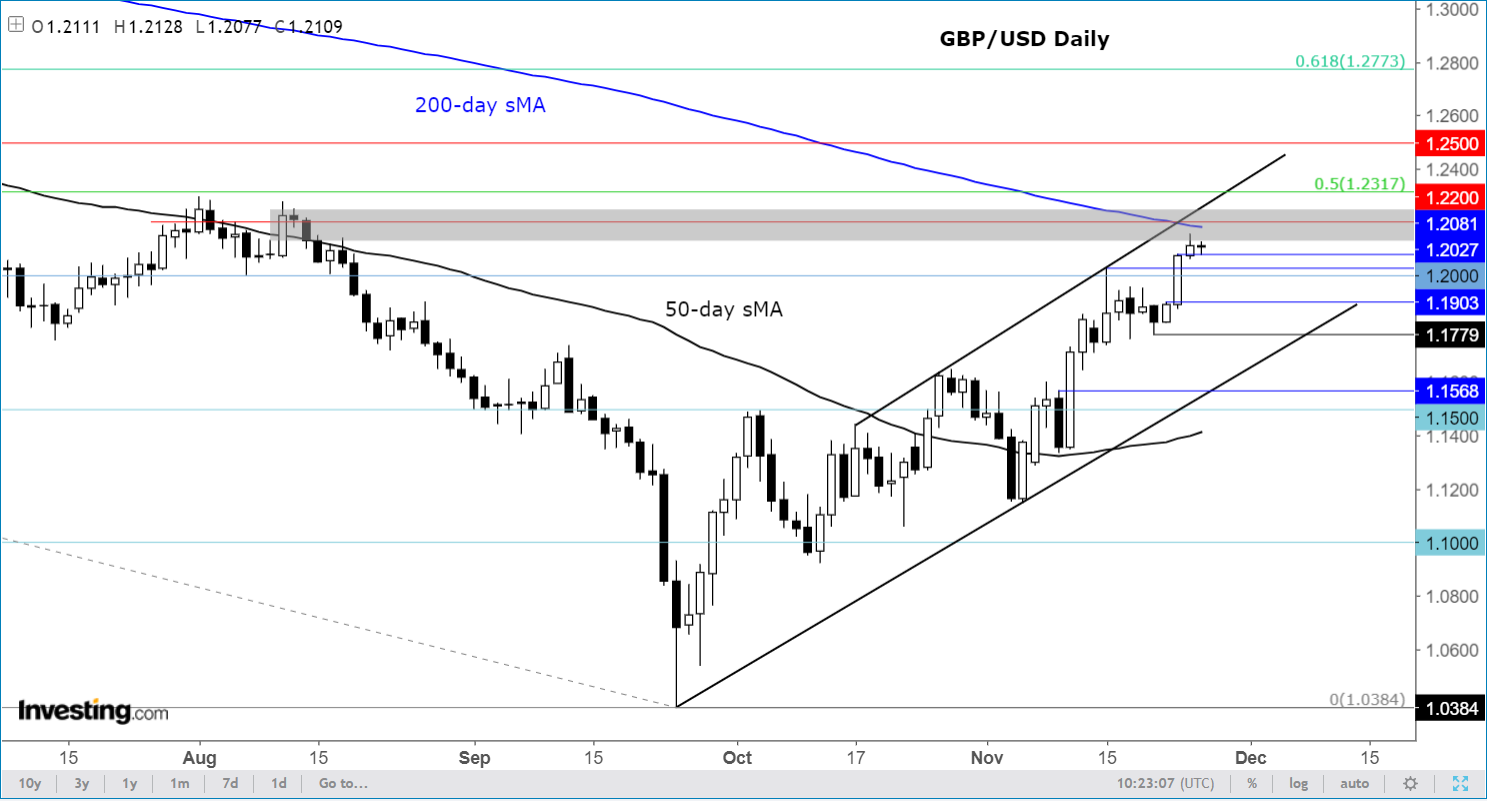

A number of financial markets are either near, at, or just above their long-term 200-day moving averages. The likes of EUR/USD, Dollar Index, NZD/USD, Russell 2000 and S&P 500 all come to mind. But I have just noticed that the GBP/USD is also very close to its own 200 moving average (MA) at just below the 1.22 handle, after rising a huge 1800 pips—or +17.5%—from the record low of 1.0343 hit just over two months ago. Everything has been driven higher because of the peak inflation narrative and thus expectations of a sooner-than-expected pause in rate increases.

Have risk assets risen too high, too fast?

The sheer size of the recovery across assets crosses (excluding China and crypto) means the markets may have gotten too far ahead of themselves. For after all, the Fed is still tightening its policy and big macro risks remain elevated due to the still-very high inflation across the world, and not to mention anemic growth. In the week ahead, Fed Chair Jerome Powell will be speaking on Wednesday, and we will also have lots of data to look forward to as well. If Powell reiterates the Fed's commitment to bringing inflation down through further rate rises and highlights that one or two inflation reports are not enough to suggest the Fed's job is done, then this could trigger a dollar recovery.

What has driven the GBP/USD higher?

The GBP/USD’s recovery above the 1.20 handle has been supported in large part because of the US dollar falling across the board, owing to expectations that peak inflation has been reached and that the Fed will slow down and eventually pause its rate hikes.

But looking at a number of pound crosses, the UK currency has shown some relative strength of its own too in recent times. Investors probably feel that Prime Minister Rishi Sunak appears more resolute than his predecessor in trying to address rising borrowing costs, with the PM also seen determined to soften the blow the ailing economy is facing from multiple fronts.

Why is the 200-day so significant anyway?

Well, it is a measure of the long-term trend. More often than not, price tends to gravitate towards it after periods of excessive, on-directional, moves.

In the case of the GBP/USD, the slope of the 200-day is negative, meaning that despite the big recovery, the long-term trend remains objectively bearish. As such, there is always the danger that the longer-term bearish trend could resume at any moment.

So, be on the lookout for any signs of a bearish reversal on the short-term charts as we get closer and closer to it, and resistance around the 1.2200 area.

It should be pointed out, though, that just because we are talking about the 200-day, it doesn’t mean the trend will reverse. We must see a bearish reversal signal first, before putting our bearish caps back on.

Disclaimer: The author currently does not own any of the instruments mentioned in this article.