- Bitcoin benefits as US dollar and yields reverse

- Recession fears weigh on interest rate expectations

- BTC could be heading to $25,000

For the first time in weeks, Bitcoin has created a decisive bullish move, raising hopes that it may have bottomed out after a turbulent first half of the year.

Bitcoin’s sharp reversal since the middle of the week has coincided with a tumble in US bond yields and the dollar, and a rally in US stocks and gold. In other words, it has been a risk-on period for the financial markets as a whole, and not necessarily a crypto-specific rally.

That poor US GDP print has re-affirmed my view that the Fed will have to slow down the pace of the hikes and potentially go in reverse in early 2023. After all, that is what the Fed Chair had implied the day before.

Powell indicated at the FOMC press conference on Wednesday that the pace of interest rate hikes will slow, and that future hikes will depend on incoming data. He said:

“While another unusually large increase could be appropriate at our next meeting, that is a decision that will depend on the data.”

Well, GDP was quite poor, so I highly doubt that there will be a hattrick of 75 basis point hikes.

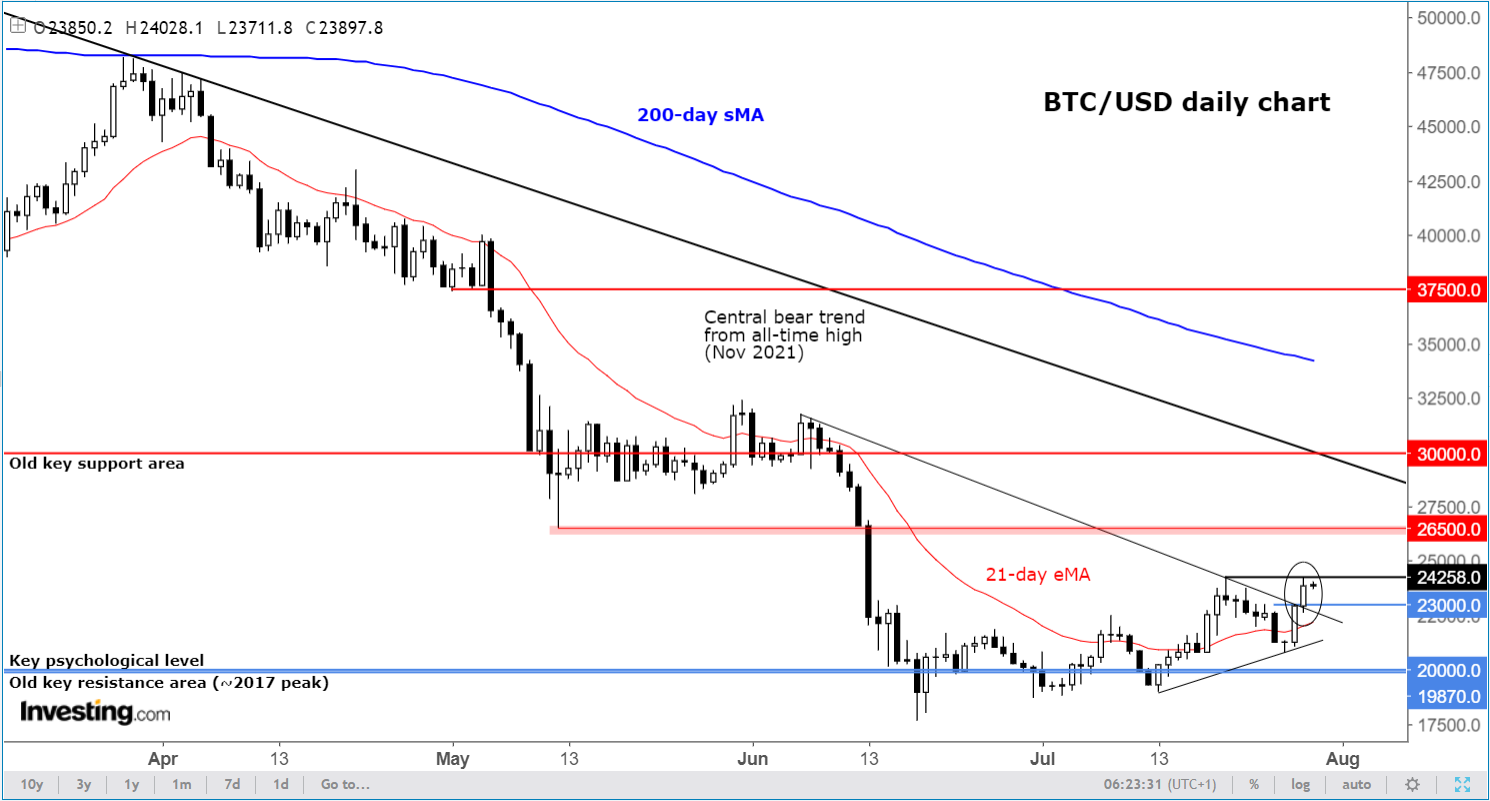

Anyway, what’s important is that this week’s moves have left Bitcoin in a good technical shape as we approach the end of the week—and month:

Following the completion of a three-bar reversal pattern on Wednesday, Bitcoin showed follow-through in the buying momentum as it broke above a short-term bearish trend line on Thursday, before stalling ahead of its intramonth peak at $24,260-ish.

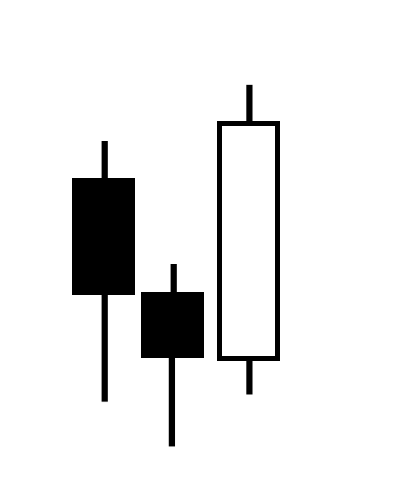

A three-bar bullish reversal pattern looks something like this:

Source: TradingCandles.com

A three-bar bullish reversal pattern can be found on all timeframes, but the higher the time frame the better the signal tends to be. As the name suggests, it consists of three bars, with the first being a large bearish-looking candle. The second candle usually is a small hammer-like candle, although it can be any shape. The third candle is usually a large bullish-looking candle that ends up above the opening price of the first candle. If it closes above the high of the first candle, even better.

In essence, a three-bar reversal pattern shows a shift from previous selling to strong buying.

Now the fact that this happened above the now-rising 21-day exponential moving average made it all the more bullish, even more so as the bearish trend line also broke down.

From here, it looks like Bitcoin is going to at least probe liquidity above that $24,260 level mentioned earlier. Above this level, there are no prior reference points until $26,500—the low from May. Obviously, it pays to keep an eye on the next round level at $25,000 that comes in between these two levels.

Without getting too ahead of ourselves, there is even the possibility we might see the next psychological level of $30,000 in the not-too-distant future, where Bitcoin had previously spent several weeks before breaking down. Incidentally, around $30,000 is also where the long-term bearish trend line comes into play. Thus, we may see BTC pause there, at the very least.

Let’s take it a step at a time and re-assess the situation if and when we get there. For now, we have some solid bullish-looking price action to work with, and the focus should be the next level of potential resistance at $26,500.

Disclaimer: The author currently does not own any of the securities mentioned in this article.