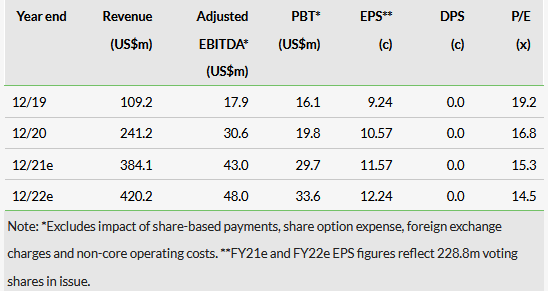

Driven by its investment programme, CentralNic Group (LON:CNIC) delivered record like-for-like organic revenue growth throughout FY21 (Q121: 16%; H121: 20%; 9M21: 29%), culminating in 37% organic growth for FY21. Management expects to report FY21 revenue of c US$410m (7% above our forecast of US$384m) and adjusted EBITDA of c US$45m (5% above our forecast of US$43m), implying year-on-year growth of 70% and 47%, respectively. The adjusted FY21 EBITDA margin of 11.0% softened from 11.7% in H121 and 12.7% in FY20. Although a revenue breakdown was not provided, we assume this results from the continued outperformance of Online Marketing over Online Presence. Net debt fell to US$76m from US$85m, despite c US$20m spent on the acquisitions of Safebrands, Wando, the White & Case website portfolio and NameAction, as well as payment of the final consideration for Team Internet. Adjusted operating cash conversion remained over 100%. We will review our forecasts with the FY21 preliminary results, expected on 28 February 2022.

CentralNic provides domain name services and online marketing, focused on consolidating a highly fragmented global market. It offers a broad range of internet services, including reseller services, to corporates and SMEs (Online Presence), as well as monetisation services (Online Marketing) to domain investors. The group strategy is to benefit from structural market growth, building its two segments and diversifying the group’s revenues through cross-selling and upselling services.

Based on the expected FY21 revenue of US$410m, CentralNic has delivered both year-on-year revenue growth of 70% as well as a five-year revenue CAGR of 70%. Using the expected FY21 adjusted EBITDA of c US$45m, adjusted EBITDA rose 47% y-o-y, with a five-year CAGR of 52%. This highlights that CentralNic offers some of the strongest growth among its peers, yet, whether we compare CentralNic to web services or online marketing, the shares continue to trade at a material discount to its global peers.

Share price performance

Business description

CentralNic Group provides the essential tools for businesses to go online, operating through two divisions: Online Presence (Reseller, Corporate, and SME); and Online Marketing. Services include domain name reselling, hosting, website building, security certification and website monetisation.

Full PDF available here: