- Market timing is investors' worst enemy

- And, buy and hold is investors' best friend in the long term

- Despite knowing this, most investors tend to lose a lot of money

- Dotcom bubble

- Twin Towers

- Subprime Crisis

- European Debt Crisis

- Max drawdown: -50.5%

- Downturn duration: about two years and six months

- Max drawdown: -57.5%

- Downward duration: about 1.5 years

Despite the emergence of Artificial Intelligence (AI), I firmly believe that the human brain remains the most fascinating and influential element in the financial markets.

To become a skilled investor, it is essential to analyze fundamentals and technicals and study behavioral finance. This field of study is crucial because it examines how human behaviors significantly impact market movements.

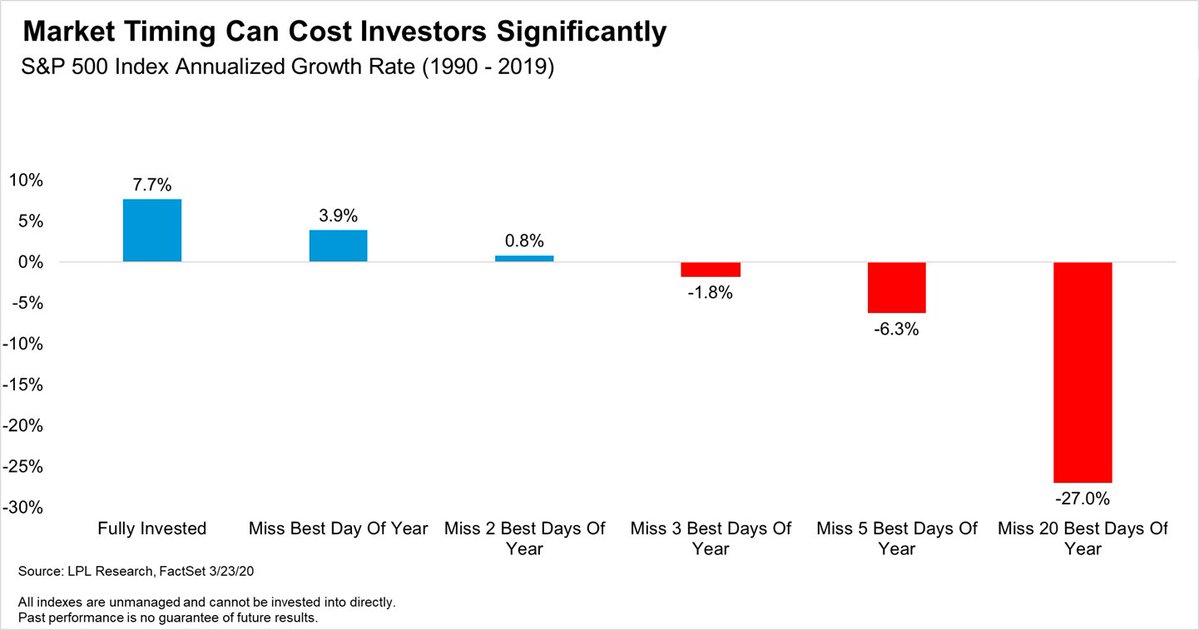

With that in mind, let's discuss the Buy and Hold strategy. To start, I'd like to share a familiar image (see below) that many people may recognize or have come across:

Now, this image tells us a simple story: market timing is a lose-lose game for the average investor.

Let's then look closely at the period between 1990 to 2019 for the S&P 500, where we had:

We also went through what is technically called 'the lost decade,' which is the period from 2000 to 2009 when the U.S. stock market gave a negative return, which is quite rare.

Despite this, the result is a 7.7% compounded annual return.

All good? Not really.

Because to (almost) quadruple your money, you would have gone through the following hard times:

Dotcom bubble

Subprime bubble

During such events, the investor would have had to do something straightforward: Disconnect everything, stop following the markets, follow nothing and no one, and isolate completely.

The challenge is emotional and social, as it's difficult to witness such declines and resist the urge to conform to others.

Why Do Investors Lose Money?

Consider a period of 29 years. Whether it is considered long or short depends on individual perspectives.

With the average human lifespan now exceeding 85 years, investing for 29 years represents approximately 30-33% (or even less) of a person's total life span.

Depending on one's viewpoint, this can be seen as either a significant or relatively small portion of one's life.

Investing for a substantial portion of our lives can yield considerable benefits, even though it may seem lengthy in a world where a video on TikTok is ignored if it lasts more than 30 seconds.

Maybe that period is too much, but that is how markets work.

Have you ever noticed that when you open a new account on a broker, there are always disclaimers that say, "70-80% of users lose money?"

And then THE QUESTION of the century, in my opinion, is the following:

Despite being aware of these facts, why do most investors persist in searching for the top stocks, trying to time the market, and ultimately losing money or missing out on potential gains?

Based on observing human behavior over the years, I have identified five potential motivations:

1. Ego

Most investors THINK they can do better than the market, pick the stocks that will perform the best, and figure out when is the best time to buy and when to sell. THINK! But then lose money, or at least make less than simply buying an ETF on S&P 500.

2. Boredom

Buying and holding an ETF for 29 years and ignoring everything is no fun. It is more fun to buy and sell, get in and get out, and always feel that thrill, which is more betting than investing.

3. Social Proof

The investor seeks confirmation from other human beings. We are social animals, if we do Buy and Hold, everyone will criticize us because we do something 99% of people don't. So we are uncomfortable; we are 'contrary' to the masses. This discomfort leads us (if we can't manage it) to align ourselves with others and thus lose money

4. Ignorance

Let's face it. If few people make good money in the markets, the same can be said about people who KNOW how the markets work. Everyone thinks they know, but few really know. Many investors simply invest at random or based on assumptions in their heads that have no basis, and as a result, in the long run, they lose money. This is called the 'Dunning-Kruger' effect, a cognitive distortion in which individuals who are inexperienced and unskilled in a field tend to overestimate their preparation by wrongly judging it to be above average.

5. Fear/Fearlessness

The human brain reacts emotionally to market extremes; our reptilian, prehistoric brains, especially in panic situations, tend to do what they have been accustomed to for centuries: running away. That's why people sell (instead of buying at better prices) when markets crash, the primitive man in them prevails, and so they run away (except to miss the big bounce that always happens shortly after the worst period)

So get bored, damn bored, and those 10, 20, 30 years will fly by in no time!

If you have any other factors or reasons that you believe impact investors' performance, let me know in the comments section below.

InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets is evaluated from multiple points of view and is highly risky; therefore, any investment decision and the associated risk remain with the investor.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI