- All headlines seem to be about Warren Buffett selling shares of Apple and Bank of America.

- However, the Oracle of Omaha has retained some stocks, three of which we will discuss in the article below.

- These are fundamentally sound companies that offer consistent dividends.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Warren Buffett's Berkshire Hathaway B (NYSE:BRKb) made significant portfolio changes in the second quarter, reducing its holdings in Apple (NASDAQ:AAPL) and Bank of America (NYSE:BAC) while amassing a substantial cash position.

While these moves dominated headlines, the Oracle of Omaha retained several core holdings that align with his long-term investment philosophy.

Buffett favors companies with solid fundamentals, consistent dividend payments, a consumer focus, and robust business models. His portfolio includes several stocks that embody these characteristics.

Below, I’ll discuss three stocks that the legendary investor has retained, which investors seeking fundamentally strong companies might consider adding to their portfolios.

1. Coca-Cola

Coca-Cola (NYSE:KO) is a household name. Its best-known brands include Coca-Cola, Fanta, and Sprite, and it is headquartered in Atlanta, Georgia.

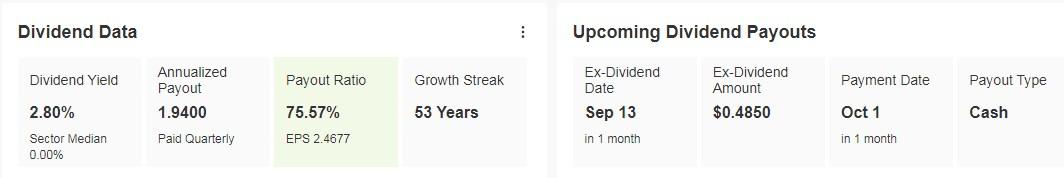

On October 1, it will distribute a dividend of $0.4850 per share and to be eligible to receive it, shares must be held before September 13. The dividend yield is 2.80%. It has been paying dividends for 54 consecutive years.

Source: InvestingPro

On October 22 it will present its results. EPS (earnings per share) is expected to increase by 6% by 2024.

Source: InvestingPro

In its first-quarter earnings report it showed solid performance, net revenue growth of 3% to $11.3 billion and earnings per share grew 3% to $0.74.

Of particular note was the gross profit margin, which stood at 60.53% for the last twelve months, reflecting efficient operations and a solid pricing strategy.

The company announced a five-year strategic partnership with Microsoft (NASDAQ:MSFT) to accelerate generative artificial intelligence initiatives. This partnership reflects Coca Cola's technology transformation.

It has 20 ratings, of which 15 are buy, five are hold and none are sell.

The company trades at a high price-to-earnings (P/E) ratio of 27.35, implying a premium to near-term earnings growth.

It is an interesting stock to buy on cuts and with an eye on the medium term.

2. Kroger

Kroger (NYSE:KR) is one of the largest grocery retailers in the world with supermarkets and stores across the country. It was founded in 1883 and is headquartered in Cincinnati, Ohio.

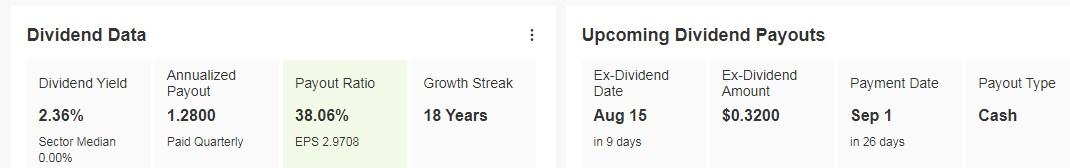

It pays a dividend of $0.32 per share on September 1, and to receive it, shares must be held before August 15. The dividend yield is 2.36%. It has been increasing the dividend for its shareholders for 15 consecutive years.

Source: InvestingPro

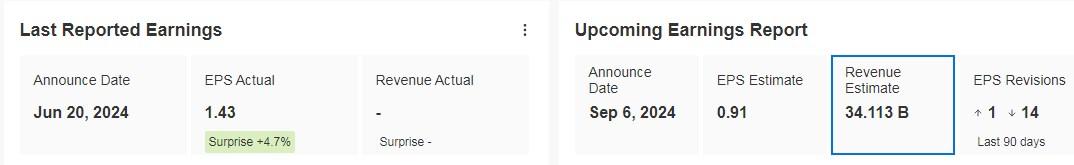

On September 6 we will know the report of its accounts. In the previous quarter it showed total sales with a slight increase over the previous year.

Source: InvestingPro

Its strength lies in its strong brands, a wide network of stores and a strong online activity.

It is expanding its brand portfolio with the addition of Field & Vine, a line of fresh produce grown by U.S. farmers that includes blueberries, blackberries, raspberries and strawberries.

With a market capitalization of $37.41 billion, the stock is still not too expensive from a valuation perspective.

It has 17 ratings, of which 16 are buy, 1 is hold and none are sell.

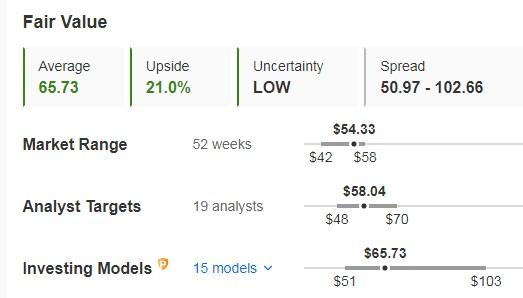

Its fair value or fundamental price is at $65.73, which is 21% above the trading price before the open of trading on Monday.

Source: InvestingPro

3. American Express

American Express (NYSE:AXP) has more than 1700 branches in over 130 countries around the world.

The business model revolves around its integrated payments platform, which connects millions of consumers and businesses around the world.

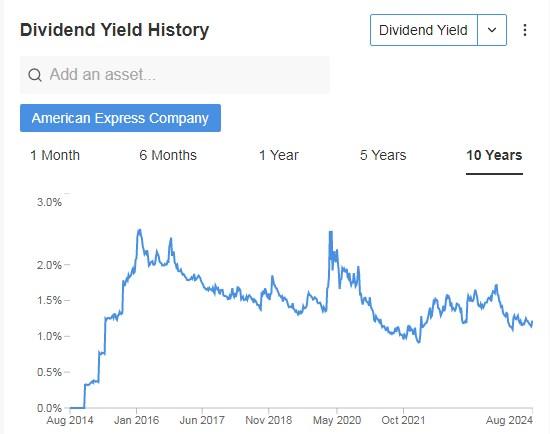

It recently announced a dividend of $0.70 per share, an annual yield of 1.20%. It has been distributing payments to its shareholders for more than 50 consecutive years.

Source: InvestingPro

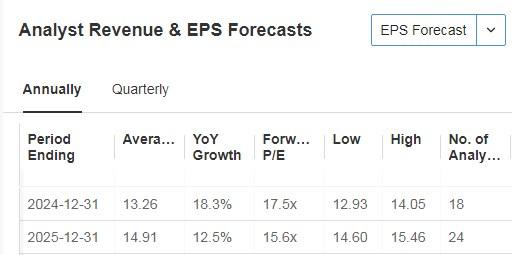

On October 18, we will know its accounts. For 2024 the forecast is for an increase in EPS of 18.3% and revenues of 9.2%. It reported significant earnings growth of 44% in the second quarter, which is a record in revenue.

Source: InvestingPro

To highlight its stable revenues, well-managed expenses and stable credit quality.

The company agreed to acquire Tock, a provider of event management and booking technology, for $400 million.

In addition, American Express Global Business Travel launched a new integration aimed at streamlining expense management for small businesses, further consolidating its position in the business services sector.

It has 24 ratings, of which 11 are buy, 11 are hold and 2 are sell.

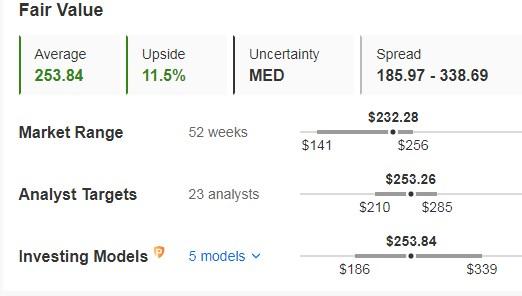

Its fair value or fundamental price is at $283.54, 11.5% above its trading price before the open of trading on Monday. The market sees potential at $253.26.

Source: InvestingPro

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.