Why consider BRLA?

Latin America offers the prospects of higher economic growth compared with developed markets, along with modest equity valuations in absolute and relative terms. BRLA has two very experienced managers, who can draw on BlackRock’s extensive resources when required. As well as covering the two major markets in the region, Brazil and Mexico, Vecht and Brinkmann are always looking for opportunities in the smaller countries, regardless of whether they are part of the benchmark. The fund currently has exposure to non-index Argentina and Panama.

Regular quarterly dividends are paid, equivalent to 1.25% of BRLA’s calendar quarter-end US dollar NAV, aiming to help narrow the trust’s discount and make BRLA more attractive to income-orientated investors. Distributions can be paid out of income or capital, ensuring the managers are not forced to seek a higher portfolio yield, which may be at the expense of capital growth.

In an environment of elevated investor risk aversion, BRLA’s 8.6% discount is narrower than the 10.6% to 12.5% range of historical average discounts over the last one, three, five and 10 years. There is scope for the trust to be afforded a higher valuation when there is a more certain macroeconomic backdrop, or if BRLA’s relative performance improves.

- NOT INTENDED FOR PERSONS IN THE EEA

BRLA: Managers remain positive on the outlook for LA

Vecht highlights that 2023 was a very strong year for BRLA and Latin America, which outperformed other regions and emerging markets. He notes that 2024 has been more challenging for the performance of Latin American stocks as expectations for US interest rate cuts have moved out and investor appetite for companies that are beneficiaries of artificial intelligence continues to gain momentum. There have not been many changes to the portfolio as the managers are comfortable with their current holdings. They generally prefer domestic-focused businesses, including those in the consumer discretionary, consumer staples and financial sectors.

Reasons to be upbeat about Latin America

Despite a lack of investor interest in Latin America, which is now less than 10% of the MSCI Emerging Markets Index, the managers remain positive on the region’s prospects. With increasing geopolitical tensions, the world is moving towards three blocks: US-aligned, China-aligned and non-aligned, which includes Latin America. This ensures that Latin America can trade with both aligned blocks. It is benefiting from shorter supply chains and incremental spending being directed away from China. As an example, Mexico is benefiting from global manufacturers seeking to set up operations in ‘friendly’ nations.

Vecht says that Latin American countries have employed sensible monetary policies. Their central banks are used to dealing with inflation, unlike those in developed markets and, as inflation moderates, interest rates are now coming down in most Latin American countries, which should support economic activity and asset prices. This in turn could lead to an increase in both foreign direct investment and local investment.

In Brazil, the Selic base interest rate has declined from 13.75% to 10.50% and the managers expect further reductions, particularly if US interest rates start to come down. Mexico’s economy is considered defensive as both its fiscal and current accounts are in order, says Vecht. The June 2024 Mexican presidential elections led to volatility for the country’s financial assets and significant weakness in the Mexican peso. Despite investor concerns about the impacts of the landslide win by President-elect Claudia Sheinbaum and the Morena party, having recently visited the country, the managers believe that the government will remain relatively pragmatic and fiscally prudent; they have used market weakness to add to BRLA’s Mexican exposure.

The Latin American investment backdrop

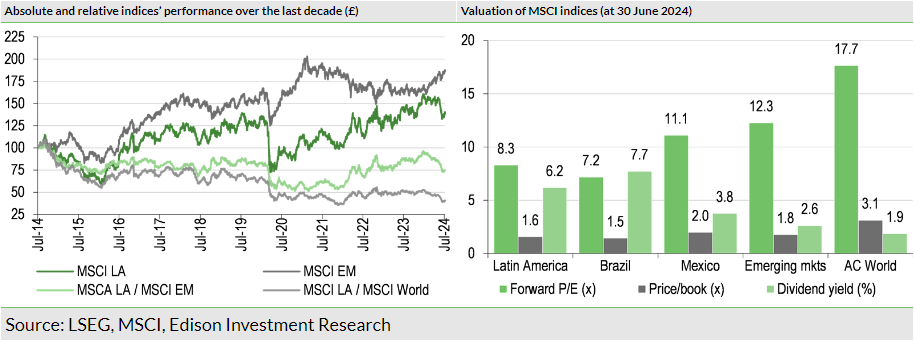

As shown in Exhibit 1 (left-hand side), Latin American shares have performed relatively poorly over the last decade, generating around half the return of the world market. However, this may provide an opportunity for global investors given the outperformance and elevated valuations in some developed regions.

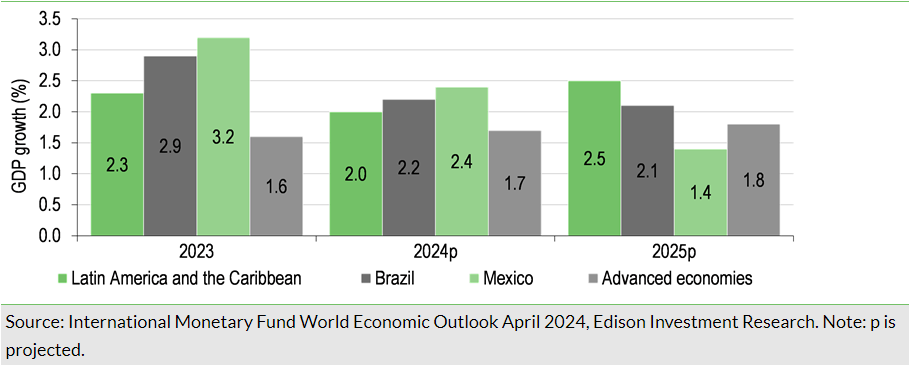

Latin America has relatively favourable growth and valuation attributes. As shown in the chart on page 1, the International Monetary Fund economic growth projection is higher for Latin America and the Caribbean compared with advanced economies in 2024, and the divergence is wider for 2025.

In terms of the valuation of MSCI indices, at the end of June 2024 in Exhibit 1 (right-hand side), Latin America looked more attractive than the broader emerging markets, with lower forward earnings and price-to-book multiples and a more-than-double dividend yield. Compared with the MSCI All-World Index, the MSCI Latin America Index was trading at around a 50% discount on a forward P/E and price-to-book multiple basis, while offering a dividend yield that was around three times as large.

Current portfolio positioning

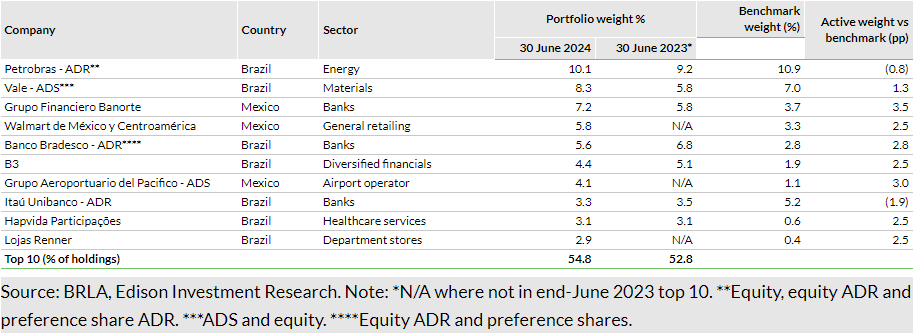

BRLA’s top 10 holdings are shown in Exhibit 2. They made up 54.8% of the fund at the end of June 2024, which was a higher concentration compared with the 52.8% top 10 weighting a year earlier; seven positions were common to both periods. It is interesting to note that the managers appear to be seeking incremental value by investing in a wider range of share types, which are shown in the table and the notes below.

Looking at some of the portfolio transactions in recent months, in June 2024, the managers sold Lundin Gold as the investment thesis had largely played out and in May 2024, they sold BRLA’s holding in Chilean pulp and paper producer Empresas CMPC. The company had benefited from firming pulp prices due to industry supply disruptions, which may not continue. Mexican highway operator Promotora y Operadora de Infraestructura was added to the portfolio; it is conservatively run and has an undemanding valuation. Earlier in 2024, Vecht and Brinkmann initiated a position in personal care company Kimberly-Clark (NYSE:KMB) de México, as they see potential for earnings estimate upgrades, while the holding in Brazilian housebuilder MRV Engenharia e Participações was sold, along with Argentinian steel pipe manufacturer Tenaris, as the investment case had played out. Brazilian investment management platform XP has re-entered BRLA’s portfolio, as the company has strong operating leverage to falling interest rates.

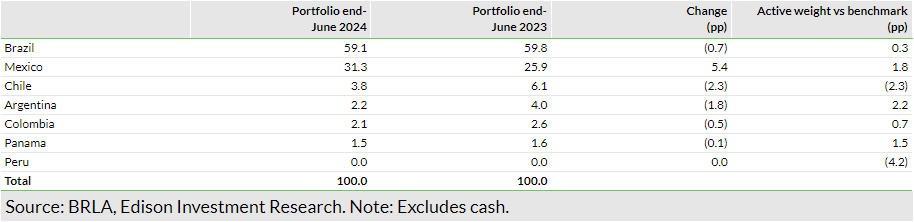

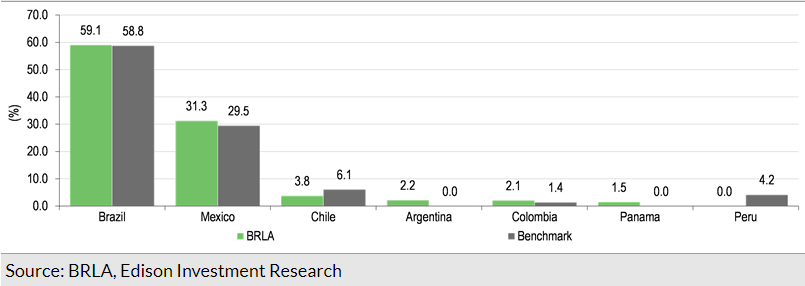

The Latin American market has a unique structure, with the MSCI Emerging Markets Latin America Index dominated by two countries, Brazil (heading towards 60%) and Mexico (c 30%). The three remaining constituents – Chile, Peru and Colombia – make up the remaining c 12%. BRLA’s managers are comfortable investing outside of the index – at the end of June 2024, 2.2% was invested in Argentina, with 1.5% in Panama.

As shown in Exhibit 3, in the 12 months to the end of June 2024, the largest changes in BRLA’s geographic exposures were a notably larger Mexican allocation (+5.4pp) and a lower weighting in Chile (-2.3pp). BRLA has a near-market weight in Brazil, and no Peruvian stocks (-4.2pp), due to political and economic uncertainty in the country.

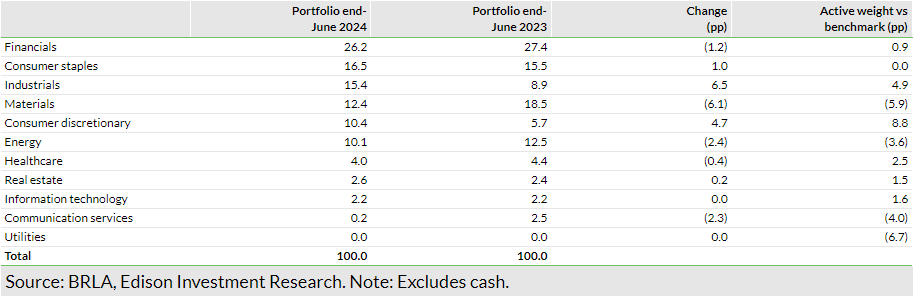

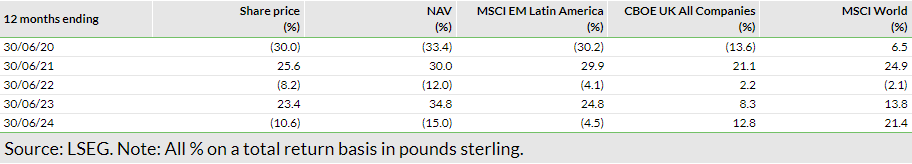

In terms of BRLA’s sector exposure, which is highlighted in Exhibit 5, in the 12 months to the end of June 2024, there was a higher allocation to consumer discretionary stocks (+4.7pp), which has contributed to the trust’s largest overweight position (+8.8pp) as this sector has a very low index weighting of around 2%. Other notable changes are a higher weighting to industrials (+6.5pp) and a lower allocation to materials (-6.1pp). BRLA continues to have a zero weighting in utility stocks as Vecht and Brinkmann struggle to find attractive growth opportunities in this sector.

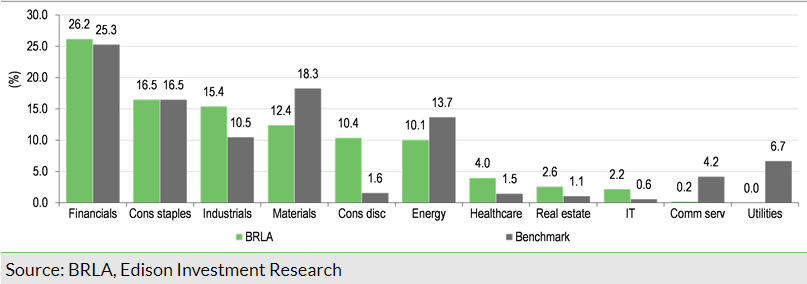

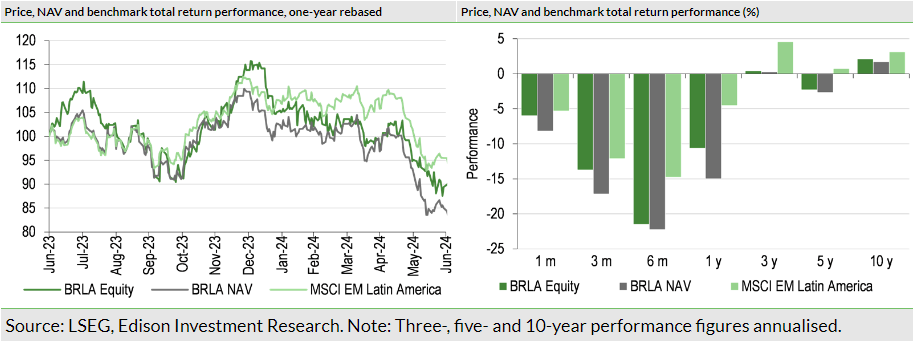

Performance: Ahead of the reference index in FY23

BRLA outperformed in FY23. In US dollar terms, the trust’s NAV and share price total returns of +37.8% and +35.3%, respectively, compared with the reference index’s +32.7% total return (in sterling terms: NAV +29.9%, share price +27.6% and index +25.2%). Looking at geographies, the largest positive contributor was Mexico due to successful stock selection. On a sector basis, the best performers were industrials and materials, while consumer staples and healthcare were the largest detractors.

In terms of stock-specific performance, the largest positive contributor was Vale (a Brazilian iron ore miner), which was an underweight position in H123 during a period of weaker iron ore prices due to lower Chinese demand. The managers added to the position in H223, which proved timely. Brazilian investment management platform XP and homebuilder for low-income households MRV Engenharia benefited from lower interest rates, while not holding WEG, a Brazilian equipment maker, also added to BRLA’s relative returns. In Mexico, overweight positions in FEMSA (strong operating performance from its convenience store chain Oxxo, although this position has now been reduced as margins are coming under pressure) and Fibra Uno Administracion, a real estate company that is benefiting from nearshoring, added to the trust’s performance, as did an underweight exposure to Cemex (a cement producer that was operating in an environment of rising input costs). Other positive contributors to BRLA’s performance were Ecopetrol (a Colombian petroleum producer) and Chilean lithium producer SQM ahead of a partnership with state-owned Codelco, which has extended its Atacama mining lease until 2060.

Conversely, detractors to BRLA’s performance included Brazilian supermarket chain Assai due to liquidity issues at parent company Casino. Brazilian retailers Arezzo and Grupo De Moda Soma experienced margin pressure due to tax reform, while Mexican producer Mag Silver suffered from lower silver prices.

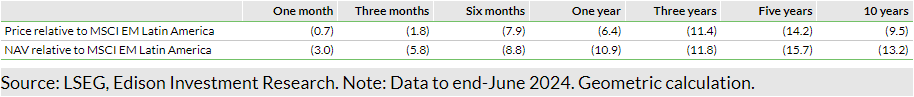

Dividends: Based on quarterly NAV

Since July 2018, quarterly dividends are paid, equivalent to 1.25% of BRLA’s calendar quarter-end US dollar NAV. This policy aims to help narrow the trust’s discount by making it more attractive to income-orientated investors. Distributions are made in May, August, November and February, and can be paid out of income or capital, ensuring the managers are not forced to seek a higher portfolio yield, which may be at the expense of capital growth.

In FY23, BRLA’s revenue per share was 30.45c, which was a 26.6% decline versus 41.48c per share in FY22 and was largely due to lower payments from portfolio companies. At the end of FY23, the trust had c $5.9m of revenue reserves and c $158.8m in capital reserves. It is possible that in FY24, capital reserves will be required to supplement income to pay the dividend, whereas previous dividends have been funded from income and revenue reserves. The FY23 dividend of 28.82c per share was 25.9% lower than the 38.87c per share total distribution in FY22 (25.87c regular + 13.00c special dividend per share).

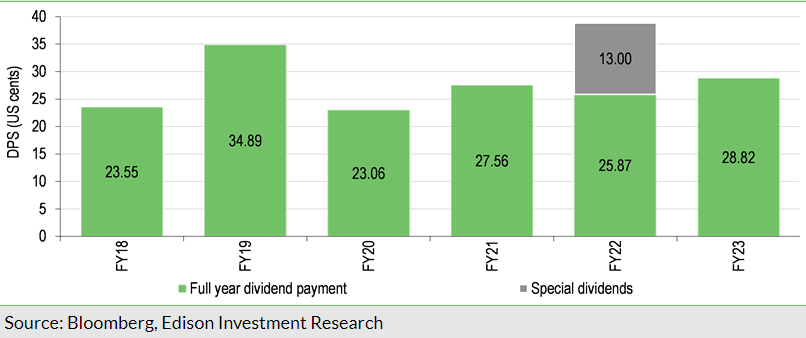

Valuation: Double-digit discount remains

BRLA’s 8.6% discount to cum-income NAV compares with the 4.5% to 18.6% range of discounts over the last 12 months. It is narrower than 10.6% to 12.5% range of average discounts over the last one, three, five and 10 years. The trust’s discount widened following the May 2022 tender offer but had been in a narrowing trend since the introduction of its new dividend policy in July 2018 (based on 1.25% of quarter-end NAV rather than the level of income).

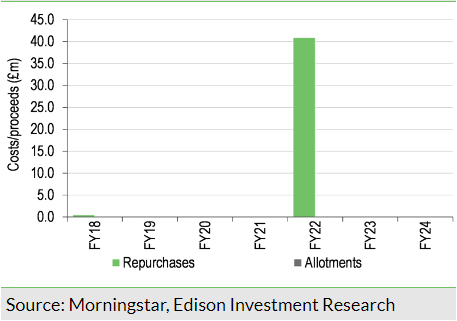

The board employs a discount control mechanism aiming to reduce BRLA’s discount volatility, favouring a conditional tender offer rather than share repurchases. Subject to the biennial continuation votes in 2024 and 2026 being passed, a 24.99% tender offer will be triggered if the trust outperforms its benchmark by less than 50bp per year (the previous hurdle was outperformance of 100bp per year) over the four years ending on 31 December 2025, or if BRLA’s average share price discount to cum-income NAV exceeds 12% over this period.

We note that neither of the conditions that would trigger a tender offer were being met at the end of FY23, as the trust was outperforming its benchmark and the trust’s average discount was less than 12% for the calculation period.

The May 2022 tender offer was undertaken as BRLA’s NAV had underperformed the benchmark by 94bp per year over the four years ending 31 December 2021. Around 9.8m shares (24.99%) were redeemed with proceeds of 417.0889p per share returned to shareholders.

Fund profile: Diverse Latin American equity portfolio

Launched in July 1990, BRLA has been managed by BlackRock (NYSE:BLK) since March 2006. Its shares are quoted, in sterling, on the Main Market of the London Stock Exchange, while its financial statements are reported in US dollars, and its NAV is quoted in both US dollars and sterling.

On 9 September 2022, the trust’s board announced management changes to take place with immediate effect. Former co-manager Sam Vecht is now BRLA’s lead manager and Christoph Brinkmann is the trust’s deputy portfolio manager.

Vecht is a managing director in BlackRock’s Global Emerging Markets Equities team and has extensive experience in the investment trust sector, having managed a range of UK investment trusts since 2004 (and has co-managed BRLA’s portfolio since December 2018). He has also been portfolio manager for the BlackRock Emerging Markets Equity Strategies Fund since September 2015 and the BlackRock Frontiers Investment Trust since 2010, both of which have invested in Latin America since launch.

Brinkmann is a vice president in BlackRock’s Global Emerging Markets Equities team, who has covered multiple sectors and countries across Latin America. He joined BlackRock in 2015 after graduating from the University of Cologne with a master’s degree in finance and a CEMS master’s degree in international management (CEMS is a global alliance of leading business schools, multinational companies and non-government organisations).

The trust’s performance is benchmarked against the MSCI Emerging Markets Latin America Index. To mitigate risk, there is a series of investment limits in place. BRLA’s exposures to Brazil, Mexico, Chile, Argentina, Peru, Colombia and Venezuela may deviate from those of the benchmark by a maximum plus or minus 20pp, while other countries are plus or minus 10pp. Up to 15% of the portfolio, at the time of investment, may be in a single company; the fund may not hold more than 15% of a company’s market capitalisation; and a maximum 10% of BRLA’s gross assets may be invested in unquoted securities. Derivatives may be used for efficient portfolio management or to reduce risk (covering up to 20% of the portfolio) and currency exposure is unhedged. The managers can employ net gearing of up to 25% of NAV (in normal market conditions) with the aim of enhancing returns. BRLA’s board considers 5% gearing a neutral level over the longer term, and borrowing is utilised actively in a range of 5% net cash to 15% geared (at the time of drawdown).

Investment process: Bottom-up stock selection

Vecht and Brinkmann aim to generate long-term capital growth and an attractive total return from a diversified portfolio of companies whose shares are listed in, or whose main operations are in, Latin America. They are supported by the extensive resources of BlackRock’s Global Emerging Markets team, which is made up of around 30 investment professionals researching more than 1,000 companies across global emerging markets including Latin America. The team’s analysts look for companies where they have a differentiated view on earnings with a one- to two-year view. Stocks are assigned a rating between strong buy, buy, hold, sell and strong sell. Vecht and Brinkmann select BRLA’s investments on a bottom-up basis while taking the macroeconomic environment into account. They seek companies that have positive fundamentals in terms of good long-term earnings growth and cash flow generation, robust balance sheets and well-regarded management teams, and which are trading on reasonable valuations. An assessment of a company’s ESG credentials is an important element of every investment decision (see section below). BRLA’s resulting portfolio is a high-conviction fund of 30–50 positions across the market cap spectrum.

BRLA’s approach to ESG

BRLA’s board believes in the importance of good ESG behaviours by investee companies. Latin American economies are large global commodity producers and there are concerns about climate change, biodiversity, and proportionate and sustainable use of resources. The board considers that there is significant room for improvement in terms of disclosure and adherence to global best practices for many corporates throughout Latin America, and the region lags global peers in terms of ESG best practices. It receives regular reports from the managers on ESG matters and discusses with them when significant engagement is required with investee companies. BlackRock has extensive resources, on which the board and the managers can draw to understand the ESG risks and opportunities facing the companies and industries in BRLA’s portfolio. While stocks are not excluded purely for ESG reasons, any issues are considered when the managers weigh up the risk and rewards of investment decisions. The board believes that communication and engagement with portfolio companies can lead to better outcomes for shareholders. During 2023, there were 53 ESG engagements (58 in 2022) with 25 (23 in 2022) portfolio companies, which represented 74% of the year-end number of holdings (75% in 2022).

Gearing

At the end of 2023, BRLA had an overdraft facility for up to $25m with The Bank of New York Mellon (NYSE:BK) (International), at an annual rate of the Secured Overnight Financing Rate +0.97%. Gearing is actively employed with up to 25% of NAV permitted. During FY23, net gearing averaged 3.1% (range of 0.3% to 8.9%), which was lower than the average 8.2% in FY22, and the historical range of a net cash position to c 12% geared.

Fees and charges

BlackRock is paid an annual management fee of 0.80% of NAV, charged 75:25 to the capital and income accounts, respectively. No performance fee is payable. BRLA’s FY23 ongoing charge of 1.28% was 15bp higher than 1.13% in FY22.

Capital structure

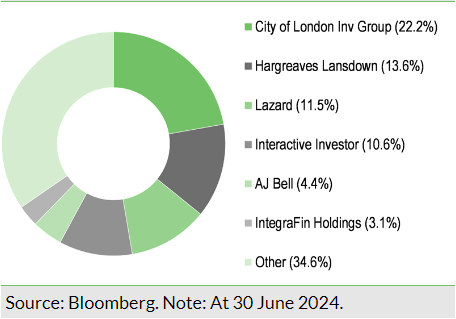

BRLA is a conventional investment trust with one class of share; there are c 29.4m ordinary shares in issue (plus a further c 2.2m held in treasury). At the end of FY23, the shareholder breakdown was as follows: retail 54.6% (53.2% at end of FY22); mutual funds 19.0% (19.8%); pension funds 15.3% (17.3%); charities 6.4% (5.7%); and other 4.7% (4.0%).

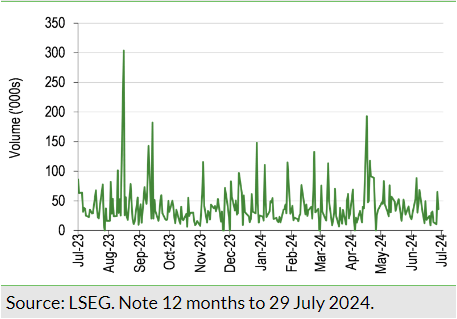

The trust’s average daily trading volume over the last 12 months was c 40k shares. BRLA is subject to a two-yearly continuation vote, with the next due at the May 2026 AGM. In the May 2024 continuation vote, 44.3% of available votes were cast with 99% in favour of the trust’s continuation.

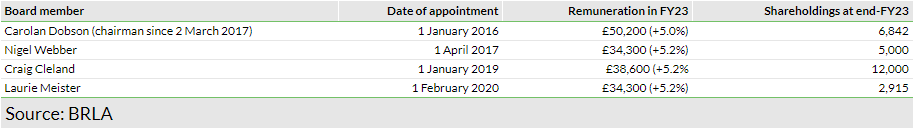

The board

____________________________________________

General disclaimer and copyright

This report has been commissioned by BlackRock Latin American Investment Trust and prepared and issued by Edison, in consideration of a fee payable by BlackRock Latin American Investment Trust. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom