On Monday, the shares of Samsung Electronics (LON:0593xq) experienced an interim increase of 7.5 per cent in Seoul. Despite this recovery, the overall balance for 2024 remains bleak – the share price is still well in the red.

Share buyback to stabilize

Market observers see the recently announced share buyback as a positive signal, even if long-term challenges remain. Jay Kwon, an analyst at JPMorgan (NYSE:JPM), commented: ‘The sudden buyback was surprising and is likely aimed at preventing a further decline in the share price.’ In the long term, however, the strategy for regaining technological leadership is crucial.

Samsung plans to buy back and cancel 3 trillion won of shares by February 2025. A further 7 trillion won is to be used at a later date. According to Sanghyun Park of Clepsydra Capital, this measure also serves to support the founding family. The background to this is the financial burden on the family from inheritance taxes and loans secured against Samsung shares. A significant drop in the share price could trigger margin calls and exacerbate the family's financial situation.

Problems with the younger generation

Samsung is not only under pressure on the stock market, but also in its domestic market. The company is increasingly losing market share to Apple (NASDAQ:AAPL), particularly among the younger generation in South Korea. A survey conducted by Gallup Korea in July showed that 69 per cent of South Koreans use Samsung smartphones, while 23 per cent prefer iPhones. However, in the 18-29 age group, this ratio is reversed: here, Apple has a market share of 65 per cent, while Samsung has 32 per cent.

Apple's influence is also growing among 30- to 39-year-olds, with a share of 41 per cent compared to Samsung's 56 per cent. By contrast, Samsung dominates among older generations, which could be problematic in the long term, since younger consumers will ensure future growth.

Brand loyalty and competition in the smartphone world

The problem for Samsung lies less in the present than in the future. In South Korea, consumers are particularly loyal to their brands. While 34 per cent of customers worldwide are willing to switch brands for their next purchase, this figure is only 10 per cent in South Korea, according to Gallup.

Samsung and Apple are competing globally to attract customers to their respective ecosystems – Android and iOS. In South Korea, however, Apple seems to be succeeding in retaining young customers in the long term. This development could endanger Samsung's market position in its home country in the long term.

Is the share buyback sufficient to stabilise the price in the long term?

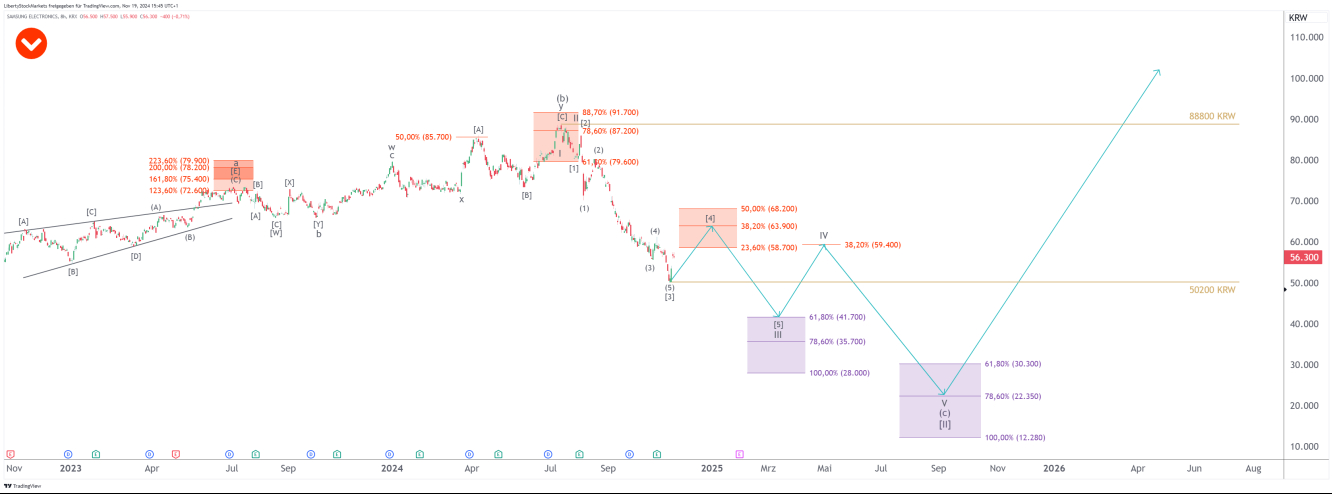

The chart shows the recent increase triggered by the announcement of the share buyback programme. We can imagine that the stock will manage to continue its recovery into the red box zone between 58700 KRW and 68200 KRW. But then it should be over again. We expect the downward movement to continue into the final target field at 30300 KRW to 12280 KRW. Only there do we see a very good chance for the share to turn around sustainably.

We have undertaken the downward movement by drawing on ideal targets. And so we come to this result. For us, this is all a stroke of luck, because we can sit back and relax and wait for the stock to reach its target and form a sustainable upward trend. We plan to buy. We do not believe that the last word between Apple and Samsung has been spoken. Samsung has very clever minds and a lot of money (the company). In addition, the global market share is still impressive.

You should buy stocks at the bottom of very large corrections. It doesn't always take smaller, more exotic companies. Samsung could soon have exactly this setup.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.