Since Donald Trump was elected as the new US president, Bitcoin has experienced an unprecedented rally. However, the upturn is not only driven by market optimism, but possibly also by Trump's own financial interests.

Bitcoin rally: Trump fuels the euphoria

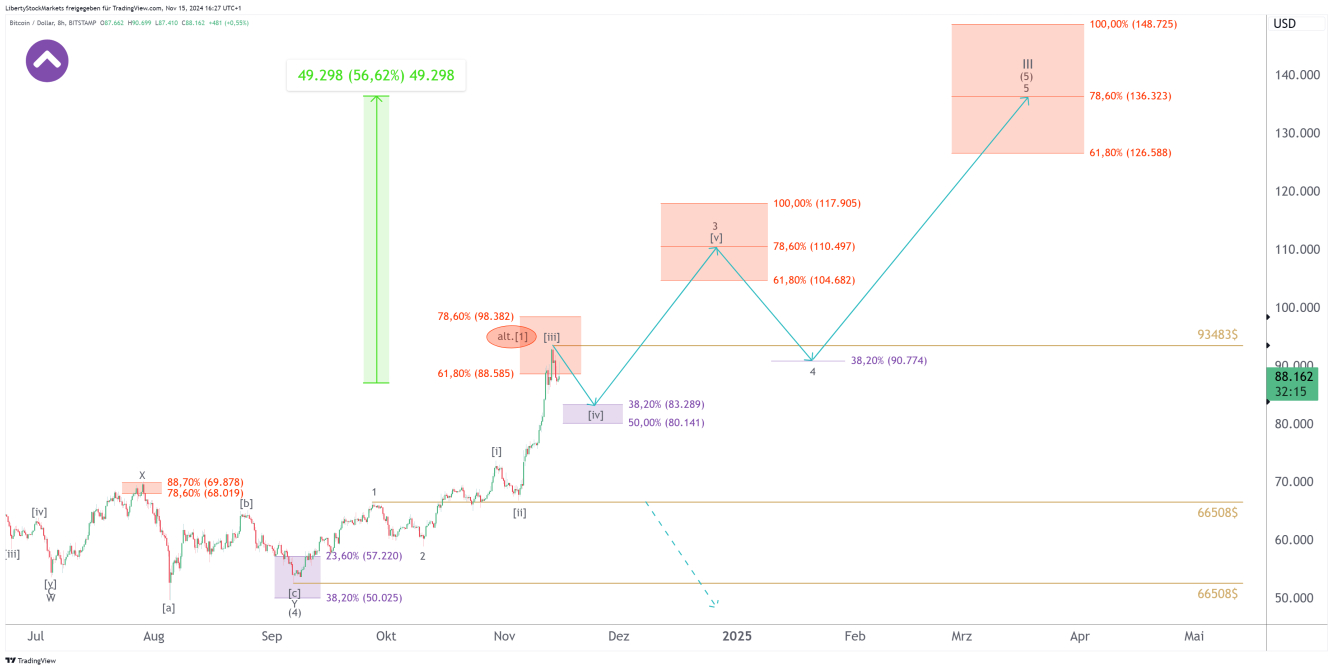

The crypto markets are celebrating Trump's election victory with a massive increase in the prices of almost all cryptocurrencies. Above all, of course, Bitcoin. On Wednesday, the cryptocurrency reached a new all-time high of $93,483, up from $38,505 in January. Analysts are calling this price increase of over 140% the classic ‘Trump trade’, as the crypto markets are considered to be one of the main beneficiaries of Trump's victory.

Bitcoin has its sights set on the $100,000 mark

We are also convinced that the crypto market is benefiting massively from Donald Trump, but it can't be just that. After all, a great many people have to be of the same opinion to cause such a rapid and strong increase.

Which coin has the greater potential? Bitcoin or Ethereum?

Bitcoin could drop a little further down into the purple box at $83,289 to $80,141, where it would offer a perfect opportunity to buy. Because after that, we expect prices to continue to rise. We see the overarching long-term target at the very top of the red box at $126,588 to $148,725. That is a potential of over 50% to 65%.

Ethereum started a little later than Bitcoin and has not yet reached a new all-time high. In this respect, the risk is even greater for Ethereum that this coin will slump down again. However, we estimate the probability of a continuation of the upward movement to be higher.

We think that in the long term, Ethereum will rise to the two boxes at the top of the chart at $6,474.6 to $7,458.2 and $7,944.7 to $9,837.2. That is a potential increase of almost 190%. And so we see the potential for Ethereum as higher, because this coin still has some catching up to do.

But the bottom line is that Bitcoin will also go above $100,000 in the long term and will be able to settle above that. You can find more information on our website. There we go into detail and show exactly where the best buying opportunities arise.

Trump plans comprehensive crypto reforms

Trump is positioning himself as a crypto supporter and has announced ambitious plans to make the US a global ‘crypto centre’. These include the creation of a ‘Bitcoin and Crypto Advisory Council’ within the first 100 days of his term in office. This is intended to create a clear regulatory framework to promote innovation in the industry.

In addition, Trump plans to replace the current SEC chairman Gary Gensler, who is considered crypto-critical. Insiders speculate that Hester Pierce, known as ‘Crypto Mom’ and an advocate of flexible regulation, could succeed him.

A national bitcoin reserve?

Trump goes even further: he proposes the establishment of a ‘national Bitcoin reserve’ to strengthen US finances. This concept is reminiscent of the existing state reserves in gold and oil. Market analysts see this as a potential revolution in monetary policy, while the majority of economists are sceptical. They criticise Bitcoin's high price volatility and its limited functionality as a store of value compared to the dollar or gold.

World Liberty Financial: Trump's crypto project

However, Trump is not only pursuing political interests in the crypto sector, but also personal ones. His latest project, World Liberty Financial (WLFI), was launched in October. It offers its own token that can be bought but not traded – in effect a donation that only gives buyers a vague say in the organisation.

So far, however, WLFI has only reached a fraction of its target volume. According to the project's ‘gold paper,’ most of the revenue will go to an ‘inner circle’ that includes Trump himself: 75% of the proceeds will go to his company DT Marks DEFI LLC.

Criticism of Trump's approach

Anthony Scaramucci, former head of communications under Trump, has harshly criticised WLFI. He describes the project as a ‘transparent scam’ and warns investors not to participate. Trump, on the other hand, praises the WLFI token as an opportunity to ‘help shape the future of finance.’ However, critics see it more as a chance to strengthen Trump's own finances.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin is booming after Trump's election victory – personal interests at play?

Published 15/11/2024, 15:41

Bitcoin is booming after Trump's election victory – personal interests at play?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.