This article was written exclusively for Investing.com

- Collapse in April and May

- Consolidation and recovery

- A move near the midpoints

- Three factors supporting cryptos in early September

- Higher highs by the end of 2021

Over the past years, the burgeoning cryptocurrency asset class has provided market participants with a wild and volatile ride. The ascent of Bitcoin over the past decade has given new meaning to the term bull market. Ethereum, the second-leading cryptocurrency, has also been a bullish beast.

Cryptocurrencies reflect a libertarian philosophy that returns the power of money from governments, central banks, monetary authorities, supranational and private financial institutions to individuals. Prices come only from bids and offers in the market.

Detractors argue they have no intrinsic value but provide utility for nefarious endeavors. However, the opposition’s criticism likely comes from the desire to maintain the status quo. After all, government power derives from control of purse strings. The ability to expand or contract the money supply is a crucial root of power.

Cryptocurrencies are a logical and rational result of technological progress. Blockchain technology is the backbone of fintech, which increases the speed and efficiency of settling transactions, providing a chain or record of ownership.

Cryptos reflect the trend towards globalism as they transcend countries’ borders and are fungible instruments. Fiat currencies derive their value from the full faith and credit of countries that issue legal tender. Cryptocurrency values come solely from market participants that establish the prices. While government’s monetary policy can impact fiat currency values, they play no role in the crypto universe.

The recent price action could mean we will see new highs in Bitcoin and Ethereum over the coming weeks and months. The overall asset class’s market cap could head to a new peak by the end of 2021.

Collapse in April and May

Bitcoin futures reached a record high at $65,520 on Apr. 14, the day cryptocurrency exchange Coinbase Global (NASDAQ:COIN) went public on the NASDAQ. New highs in cryptocurrency have been event-driven over the past years.

When futures burst on the scene in late 2017, the leading crypto rose to over the $20,000 level for the first time. Since COIN is a trading platform that enhances liquidity and execution, the listing pushed the price to its most recent high.

Source, all charts: CQG

The weekly chart highlights Bitcoin’s correction to a low of $28,800 per token during the week of June 21.

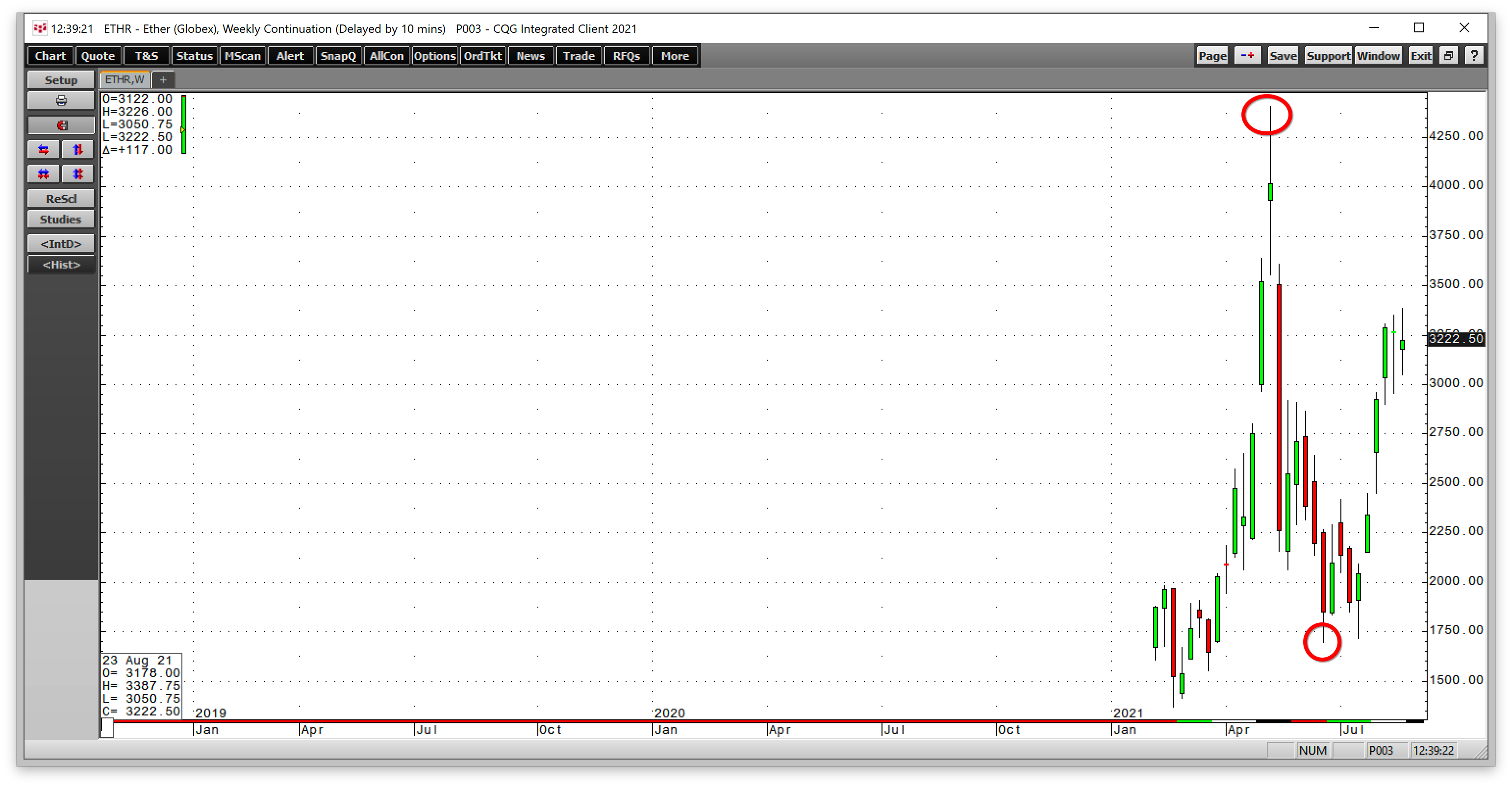

Meanwhile, it took the second-leading cryptocurrency longer to reach its high, but like Bitcoin, it fell to a low in late June.

The weekly chart shows Ethereum futures rose to a high of $4,406.50 in mid-May before falling to a low of $1697.75 during the week of June 21.

Both Bitcoin and Ethereum more than halved in value as the parabolic rallies turned into falling knives.

Consolidation and recovery

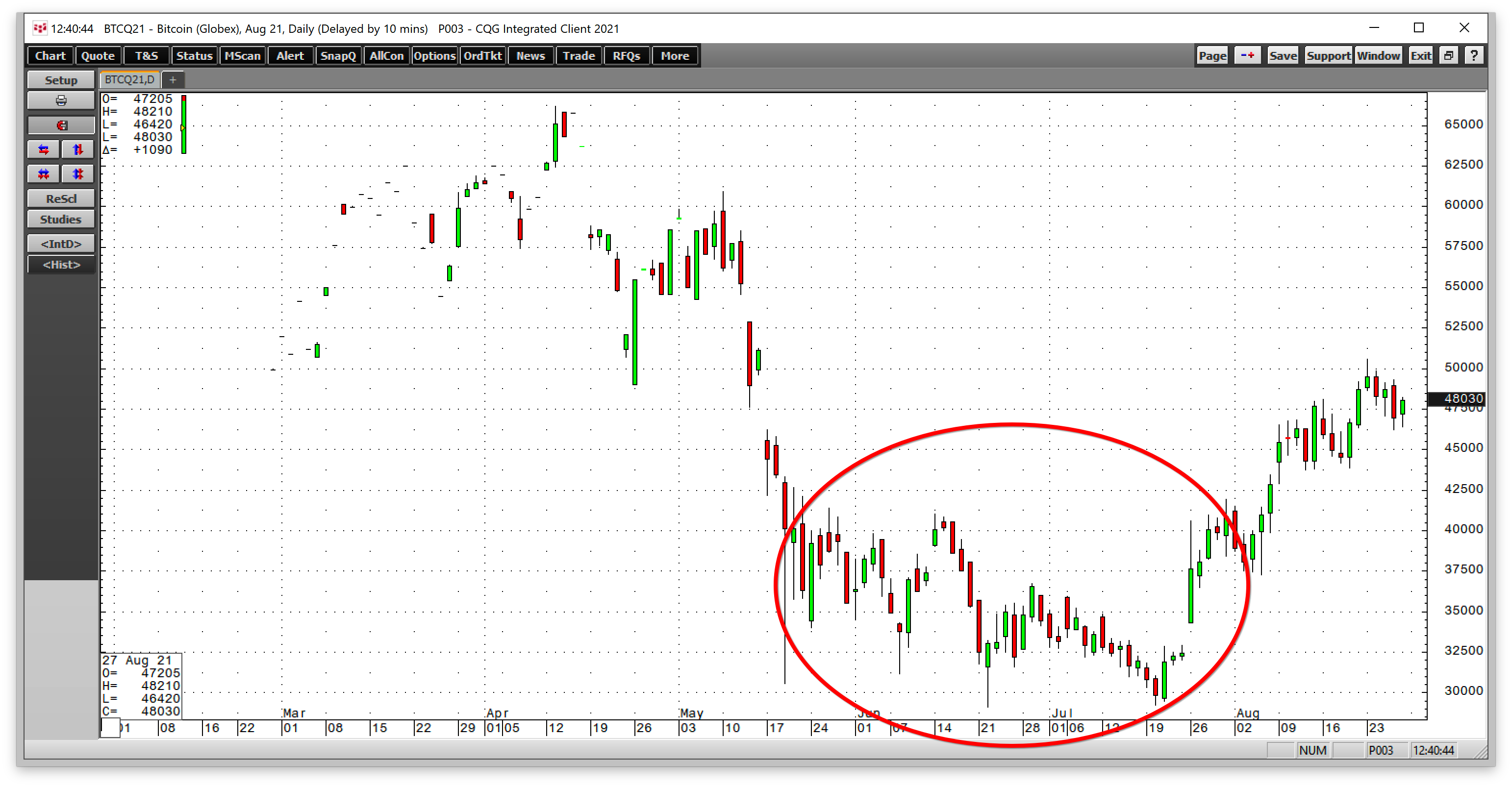

From May through early August, Bitcoin consolidated and digested the wild price action, with the price trading mainly below the $40,000 per token level.

The daily chart illustrates the consolidation with a bearish bias until late July.

Ethereum’s consolidation was shorter, with the price below the $2440 level until late July.

A move near the midpoints

Over the past weeks, both cryptos recovered. The midpoint of Bitcoin and Ethereum’s trading ranges since the April and May highs are $47,160 and $3,052.125, respectively. At the end of last week, Bitcoin was trading at the $48,000 level, with Ethereum at $3,220. Bitcoin and Ethereum made a 50% retracement of the moves.

Meanwhile, on Aug. 23, Bitcoin probed above the $50,000 level for the first time since mid-May. Ethereum rose above $3,000 per token for the first time since May 17 on Aug. 9, reaching a high of nearly $3,390 on Aug. 23.

Three factors supporting cryptos in early September

With the market cap of the cryptocurrency asset class back over the $2 trillion level at the end of last week, the bulls are back in control. Three factors continue to favor the upside for Bitcoin, Ethereum, and many other of the over 11,460 tokens trading in the asset class.

- Inflationary pressures keep rising because of the Fed’s dovish monetary policy and fiscal stimulus from the US government. Even if the central bank begins to taper its quantitative easing program, the government is close to approving trillions in infrastructure and other spending initiatives. Rising prices across all asset classes are bullish for cryptocurrency values.

- Faith and credit in fiat currencies continue to erode. People continue to lose faith in government officials. The governor of New York State recently resigned in disgrace. The governor of California faces a recall election in mid-September. Polls show a decline in support for the Biden administration after a series of policy missteps. Cryptocurrencies embrace a libertarian ideology that returns the control of the money supply from the government to individuals. As the faith and credit in the dollar, euro, and other reserve currencies decline, cryptocurrencies are an alternative.

- The US departure from Afghanistan has been nothing short of a disaster. It took twenty years, trillions of dollars, four Presidents, and many lives to replace the Taliban with the Taliban. Tens of thousands of people, or more, are trying to flee the brutal regime with the deadline this week, on Aug. 31. Many are leaving with only the shirts on their backs. Those fortunate enough to have savings in cryptocurrencies can transport their wealth on a flash drive or access it abroad with a secure password. Cryptocurrencies transcend borders and have become the ultimate flight capital instruments.

Afghanistan’s collapse and return to the Taliban is a defeat for the US and NATO allies. The lives of those left behind are in danger. The foreign policy ramifications are substantial and could empower and accelerate moves by China and Russia. China plans are to reunify with Taiwan, which they consider a part of Chinese sovereign territory. Russia could use US foreign policy and perceived military weakness as a reason to increase its sphere of influence in Ukraine and other former Soviet bloc countries.

Hostile regimes in North Korea and Iran are likely to use the situation to provoke the US and allies over the coming months and years. Moreover, Afghanistan is again an area where terrorist groups can flourish. Last week, a terrorist attack killed a dozen US troops and many civilians.

Those who fear political change and violent outbreaks in their homelands are likely to look to cryptocurrencies as a way to protect and transport their wealth in times of upheaval.

Higher highs by the end of 2021

I expect we will see higher highs in Bitcoin, Ethereum, and the cryptocurrency asset class by the end of 2021. However, there are risks in the volatile asset class.

At a cyber security summit of US technology companies and financial institutions at the White House on Aug. 25, the attending CEOs asked the President to crack down on cryptocurrencies. Cryptos have been the favorite monetary instruments for hackers and those demanding ransom.

Meanwhile, the digital currencies' role as flight capital in a dangerous world could trump any efforts to control the global cryptocurrency asset class. I believe that flight capital is now one of the most compelling reasons for people worldwide to hold at least part of their wealth in digital tokens.