- Bitcoin has retreated this week, despite other risk assets doing well this week.

- Short-term traders may have exacerbated the decline by selling into last week's rally.

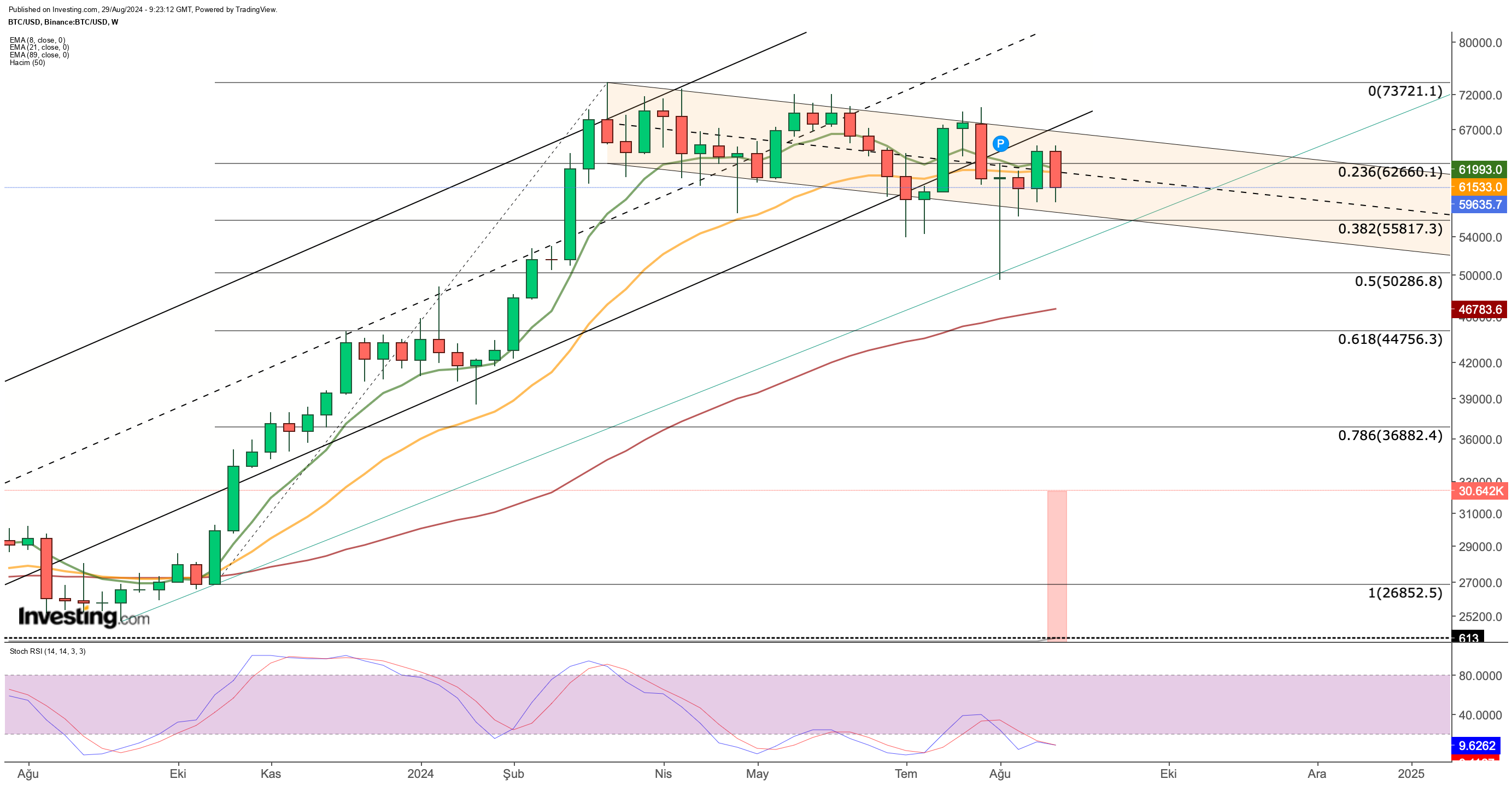

- Bitcoin's technical outlook remains bearish, with a potential move toward $56,000 in the offing.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

Bitcoin prices have retreated from last week's highs, currently trading around $59,400. Despite a lack of negative sentiment in global markets, the crypto has experienced a nearly 10% decline this week.

Short-term traders, who suffered losses during the early-month price decline, may have sold into last week's rally, contributing to the recent downturn. The surge in crypto futures trading suggests a potential effort to offset losses from earlier.

Large investors' transfer of funds to exchanges after the recovery may have also played a role in Bitcoin's decline. The liquidation of a significant amount of futures has led to the crypto settle at levels near $59,000.

Markets will focus on macroeconomic data in the last two working days of the week.

Focus Turns to Key Macro Data Ahead

Markets will closely watch macroeconomic data in the final two trading days of the week. Today, the U.S. will release crucial figures, including unemployment claims and Q2 GDP.

Fed Chair Powell emphasized that the Federal Reserve will focus more on the labor market, making unemployment claims a key data point for market watchers.

A figure above expectations could negatively impact markets, reminiscent of the recession fears at the start of the month. Meanwhile, the Q2 GDP is projected to grow by 2.5%. A lower figure could stoke concerns about an economic slowdown.

In a negative scenario, Bitcoin may accelerate its downward trend. Conversely, if the data supports a soft landing for the U.S. economy, Bitcoin could rebound and test resistance levels.

Additionally, Friday's PCE data could further impact volatility. Despite the Fed's focus on the labor market for the remainder of the year, inflation data remains a critical concern. Unexpected deviations could complicate the market outlook.

Technical Outlook for Bitcoin Remains Bearish

Bitcoin's price continues to exhibit a bearish trend. On the weekly chart, the cryptocurrency shows a pattern of lower highs and lower lows.

Recently, Bitcoin fell below the $61,500-$62,000 range, which aligns with the middle band of the descending channel, pushing the price towards negative territory.

If this trend persists, Bitcoin could move towards the $56,000 area in the short term, assuming the current downward cycle continues. Should the cryptocurrency fail to find support at $56,000, the decline might accelerate, potentially targeting the $45,000 region.

Conversely, if Bitcoin holds above the support line at $55,800 and market sentiment improves, the focus could shift to the resistance zone around $62,000. Surpassing this resistance would indicate a break above the descending channel and could pave the way for a move towards the $70,000 region.

We will monitor Bitcoin's movement in relation to the channel boundaries established since the March peak to gauge future trends.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.