- Three of the biggest US banks open the Q1 earnings season this Friday

- What are the earnings forecasts for Wells Fargo, JP Morgan and Citigroup?

- What's the outlook for their stocks?

- Arm yourself with cutting-edge tools to pick the right stocks for less than $10 a month with InvestingPro!

- ProPicks: equity portfolios managed by a fusion of AI and human expertise, with proven performance.

- ProTips: Digestible information to simplify masses of complex financial data into a few words.

- Exclusive pro news: To understand what's going on in the market before anyone else.

- Fair Value and Health Score: 2 summary indicators based on financial data that instantly reveal the potential and risk of each stock.

- Advanced stock screener: Search for the best stocks according to your expectations, taking into account hundreds of financial metrics and indicators available on InvestingPro.

- Historical data for thousands of metrics on tens of thousands of global stocks: To enable fundamental analysis pros to dig into all the details themselves.

- And many more services, not to mention those we plan to add soon!

The Q1 earnings season is almost here, and as usual, the big US banks will start it off. JPMorgan (NYSE:JPM), Wells Fargo (NYSE:WFC), and Citigroup (NYSE:C) are expected to report their results on Friday before the markets open.

Investors will be looking beyond just earnings and sales. They'll want to know about the health of the commercial real estate sector and if there's a strong demand for loans.

Investors will also want to know what's expected for the upcoming quarters, especially considering the recent shift in rate cut expectations by the Fed.

While a higher interest rate environment generally boosts bank profitability, its impact can vary depending on the bank's activities.

To help investors navigate the releases from these three major banks, we'll analyze them in this article. We'll delve into consensus earnings forecasts and explore each stock's outlook from both models' and analysts' perspectives.

One important aspect we'll consider is Fair Value, an exclusive indicator available on InvestingPro. It offers a target price for each stock, based on recognized valuation models. This helps determine if a stock is overvalued or undervalued.

InvestingPro subscribers can access detailed information on each model used and can customize the list of models considered for Fair Value calculations to suit their valuation preferences.

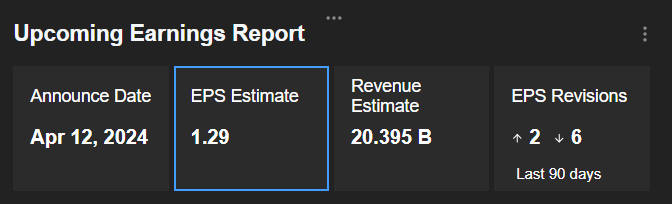

Citigroup

Citigroup is expected to post Q1 EPS of $1.29, 53% higher than in Q4, but almost 30% lower than in the same quarter last year.

Source : InverstingPro

Sales are expected to reach $20.395 billion, up 16% quarter-on-quarter, but down 5% year-on-year.

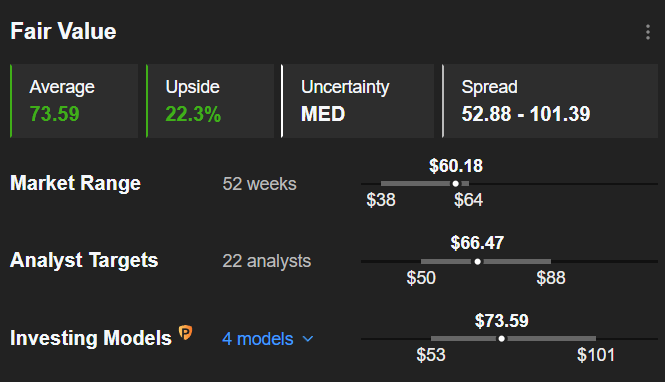

Regarding the outlook for Citigroup shares, the average target of the 22 analysts who follow the stock is $66.47, 10.4% higher than Wednesday's closing price.

Source : InverstingPro

In addition, the InvestingPro Fair Value, which synthesizes 4 financial models adapted to banks, stands at $73.59, i.e. 22.3% above the current share price.

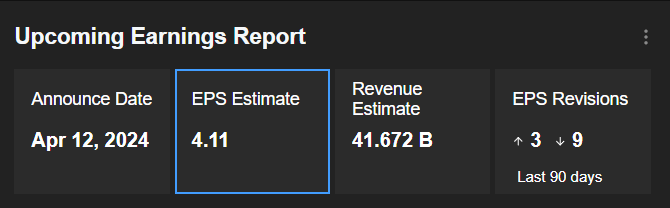

JP Morgan

For JP Morgan, the $4.11 EPS forecast by consensus would represent an increase of 35.2% on the previous quarter and stable year-on-year.

Source: InverstingPro

Sales are expected to reach $41.672 billion, 8% higher than in Q4 2023, and 8.6% higher than a year earlier.

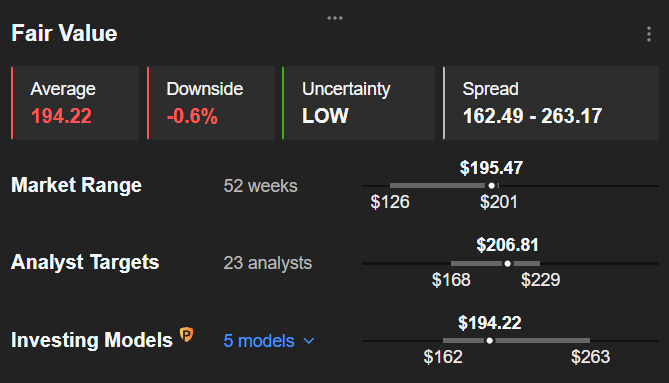

On the other hand, analysts and valuation models attribute disappointing potential to the stock. Indeed, the 23 analysts who follow the stock post an average target of $206.81, or just 6.5% above the current price.

Source : InverstingPro

InvestingPro models are even less optimistic for the stock, assigning it a Fair Value of $194.22, slightly below Wednesday's closing price.

Wells Fargo

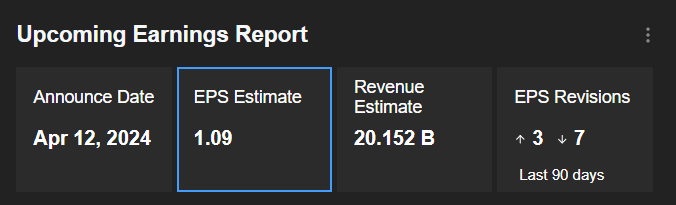

Finally, Wells Fargo's EPS forecast of $1.09 would translate into a 15.5% drop in earnings compared with the previous quarter, and 11.4% year-on-year.

Source : InverstingPro

Sales are expected to be roughly stable year-on-year and quarter-on-quarter, at $20.15 billion.

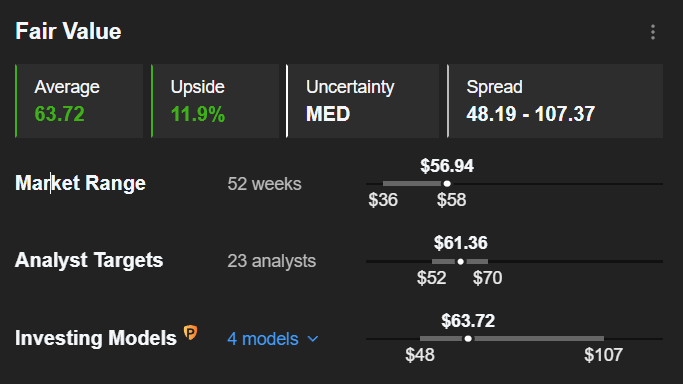

As for the share's potential, analysts have set an average target of $61.36, 7.7% above the current price.

Source : InverstingPro

InvestingPro's Fair Value is a little more ambitious, at $63.72, almost 12% above the current price.

Conclusion

Consensus forecasts anticipate that JP Morgan will lead in earnings and revenue growth. However, analysts and valuation models suggest it has the least room for upside compared to the other stocks discussed.

Conversely, Wells Fargo is expected to experience a significant decline in earnings, though it shows moderate bullish potential. Ultimately, Citigroup seems to strike the best balance between analysts' confidence in earnings quality and the stock's potential for upward movement.

***

INVESTINGPRO PROMO CODE: ACTUPRO

Subscribe to InvestingPro to benefit from the tools used in this article and many others! You'll know which stocks to buy and which to sell to outperform the market and boost your investments, thanks to a host of exclusive tools.

These tools, which have already proved their worth to thousands of investors, will meet the expectations of those looking for turnkey solutions and advice, as well as those who wish to research and choose stocks for their portfolios.

In particular, you'll find :

Disclaimer:This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.