- Berkshire Hathaway, led by Warren Buffett, is a financial conglomerate with a focus on long-term investments.

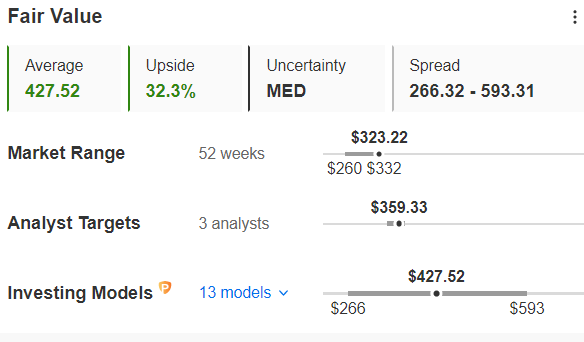

- InvestingPro's Fair Value Index suggests that the stock has high growth potential.

- The company is set to report earnings on May 8, and barring any negative surprises, the stock has plenty of room to rally.

Warren Buffett, also known as the Oracle of Omaha, has been chairman of the US financial conglomerate Berkshire Hathaway Class A (NYSE:BRKa) since 1970.

As of 2022, it was the world's seventh-largest publicly traded company by market capitalization ($741.5 billion), with a focus on investing in companies that are expected to create value over the long term.

What makes it different from other listed companies are its two share classes: A and B. Class A is mainly held by Warren Buffett, who owns around 15% of the company, and is also one of the most expensive in the world.

Berkshire Hathaway B (NYSE:BRKb), on the other hand, has a more affordable share price and is aimed at a wider range of equity investors.

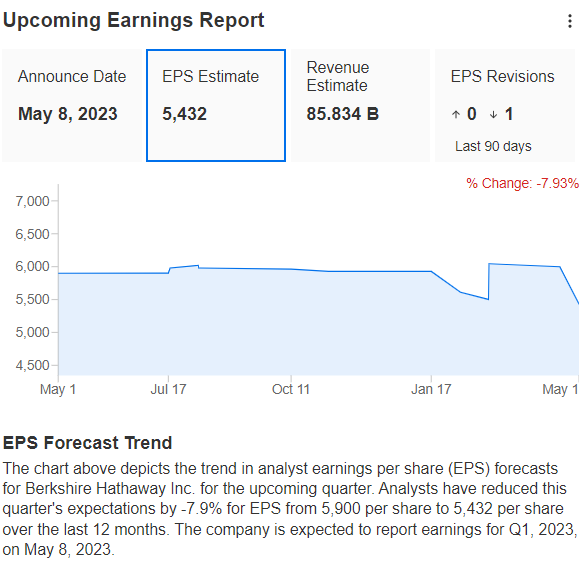

On Monday, May 8, the company will release its first-quarter results, which could provide a significant boost to the stock price.

Berkshire Hathaway's earnings per share are expected to be $5.432 per share (Class A), $3.5 per share (Class B) and revenues are expected to be just over $85 billion.

Source: InvestingPro

Berkshire Hathaway’s High Growth Potential

The shares of this financial conglomerate have a high growth potential as measured by InvestingPro's Fair Value Index. For class B shares, it is currently 32.3%, with the potential for a breakout to new all-time highs.

Source: InvestingPro

From a technical point of view, the rally has slowed somewhat. We are now in the midst of a local correction. The first support levels to look out for are around $320-316.

The bullish scenario assumes that growth continues, with the first hurdle at the all-time high of $360.

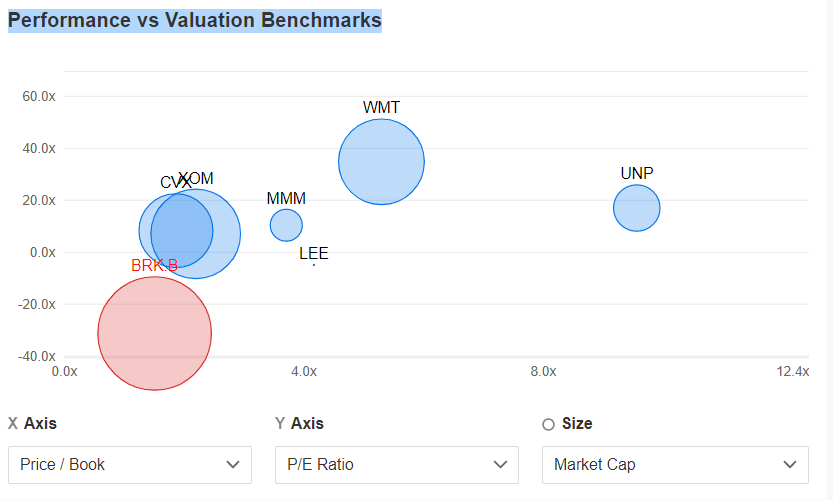

Fundamentals Indicate Attractive Valuation

Using InvestingPro tools to compare Berkshire Hathaway with its peers based on price/earnings and price/book shows the potential for further growth.

Among the 7 companies with similar characteristics, both the P/E ratio (1.5x) and the P/B ratio (-31.3x) are the lowest.

Source: InvestingPro

In conclusion, if we don't see any major negative surprises in Monday's Q1 2023 report, Berkshire Hathaway's share price currently has a lot of potential for further gains based on technical and fundamental indicators.

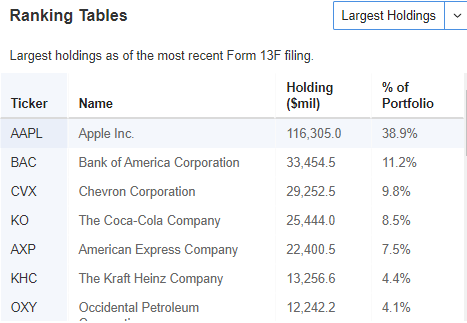

What Does Warren Buffett’s Portfolio Look Like?

InvestingPro tools allow us to view the portfolios of the biggest players in the market. This includes Berkshire Hathway, managed by Warren Buffett.

According to the latest data (14.02.2023), the largest holdings are Apple (NASDAQ:AAPL) and Bank of America (NYSE:BAC).

Source: InvestingPro

Given the presence of Coca-Cola (NYSE:KO), Chevron (NYSE:CVX) and American Express (NYSE:AXP), this is a portfolio driven by a long-term strategy of value investing through large and established brands in the market.

Using InvestingPro to look at the performance over the last 5 years, a clear increase in the value of the portfolio (+58.25%) is evident. Despite a poor 2022 for equities, the portfolio did not lose much.

Source: InvestingPro

So What Can We Expect in the Second Half of 2023?

A lot will depend on what the Fed does. The stock market could get a boost if it starts a cycle of rate cuts. It's also worth keeping an eye on the increasing involvement of conglomerates in the Japanese market.

Berkshire has been focusing more on the Japanese market. Recently, its stake in Japanese giants Mitsubishi Corp (TYO:8058), Mitsui & Co (TYO:8031), Itochu Corp (TYO:8001), Marubeni Corp (TYO:8002), and Sumitomo (TYO:8316) has risen to 7.4% in recent months.

In the meantime, here is the link for those of you who would like to subscribe to InvestingPro and start analyzing stocks yourself.

Disclosure: The author does not own any of the securities mentioned.