Samuel Benner, a 19th-century farmer and businessman, is known for his intriguing theories on financial market cycles. In 1875, Benner published his work titled "Benner's Prophecies," in which he outlined a series of investment predictions based on his observations of agricultural, industrial, and financial cycles.

Despite their age, Benner's cycles continue to capture the interest of investors and market enthusiasts, especially those looking for a historical approach to understanding long-term market movements.

The Essence of Benner's Investment Cycles

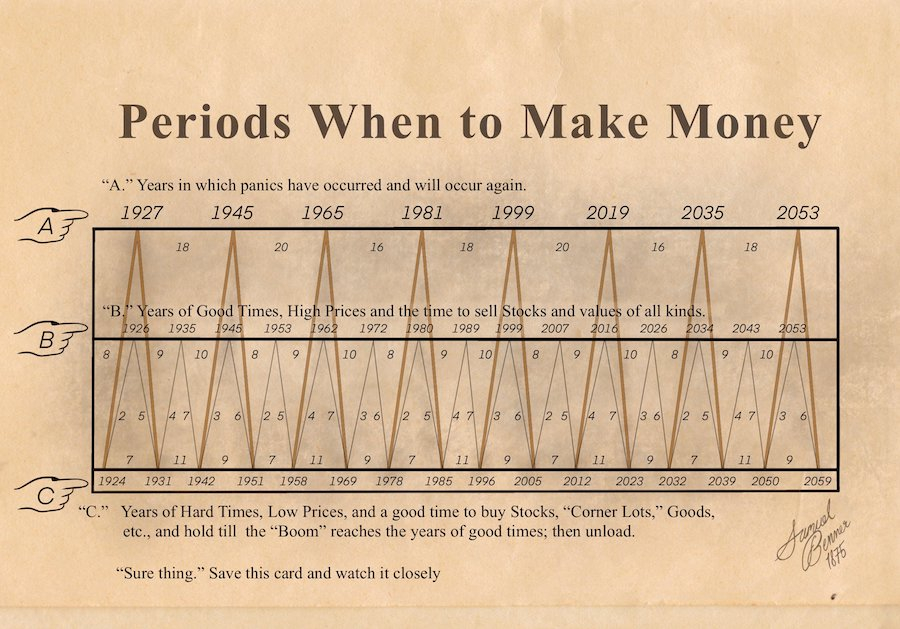

Benner's investment cycles are based on a series of patterns that attempt to predict peaks and troughs in economic activities and stock markets. His approach draws from the belief that cycles are a natural part of economic behaviour, influenced by psychological and economic factors that tend to repeat over time. Benner identified specific time intervals for predicting both prosperous and depressive periods for investments, including periods to buy and sell industrials, as well as periods to expect financial panics.

Benner's theory identifies alternating bullish and bearish phases, categorised by years of boom, depression, and recovery. Specifically, he believed that agricultural and industrial production cycles played a crucial role in the broader economy and thus impacted stock market trends. His model proposed a rhythmic nature of market highs and lows, predicting market peaks roughly every 8-9 years and troughs occurring at intervals of 16-20 years.

Benner's Cycles and Modern Markets

While Samuel Benner's predictions were grounded in a different era, the concept of cyclical investing has remained relevant. Many technical analysts and market observers still look for repeating patterns within financial data to identify market cycles, albeit using more advanced statistical and computational tools compared to Benner's era.

Some investors find Benner's cycles intriguing due to their perceived alignment with modern market events.

For example, the dot-com bubble of the early 2000s and the global financial crisis of 2008 both occurred roughly within the 8-9 year market peak intervals Benner suggested. This lends some credence to the idea that markets have a natural rhythm, often driven by the human emotions of greed and fear, which echo through time.

To illustrate Benner's concepts with modern examples, consider the following stocks:

- Caterpillar Inc. (NYSE:CAT): Caterpillar is influenced by industrial cycles, often reflecting the broader economic expansion and contraction. Its stock price tends to peak during economic booms and decline during slowdowns, aligning well with Benner's predicted market peaks and troughs.

- Bank of America (NYSE:BAC): Bank of America's performance reflects the financial cycle, with significant movements during financial crises and expansions. The 2008 financial crisis, for example, aligns with Benner's prediction of financial panics occurring periodically.

- Ford Motor Company (NYSE:F): The automotive industry is inherently cyclical, closely tied to economic conditions and consumer spending. Ford's performance often follows these economic cycles, demonstrating peaks during optimism and troughs during recessions.

- Goldman Sachs Group Inc. (NYSE:GS): Investment banking firms like Goldman Sachs see revenue and stock performance rise during strong economic growth and suffer setbacks during downturns. This behaviour is consistent with Benner's theories on the financial cycle and alternating periods of boom and bust.

- Procter & Gamble Co. (NYSE:PG): While less cyclical than industrial stocks, Procter & Gamble still exhibits fluctuations based on economic conditions. It often performs better during recovery phases and shows resilience during downturns, reflecting Benner's concept of alternating bullish and bearish sentiment.

Benner's Prediction for 2025

According to Benner's original cycles, 2025 is expected to be a year of significant economic activity, potentially marking the start of a bullish phase following periods of consolidation and recovery. If Benner's patterns hold, 2025 could represent a year of renewed optimism in the markets, suggesting that investors may see rising stock prices and economic growth.

However, as always, it is important to consider these predictions as part of a broader analysis, especially given the complexities of the modern global economy.

Application in Technical Analysis

Benner's investment cycles are often referenced by those who employ technical analysis, especially traders who appreciate the historical perspective of market rhythms. His work serves as an early precursor to the more sophisticated cycle theories developed in the 20th century, such as Kondratiev waves and Elliott Wave Theory. Traders who incorporate Benner's concepts often use them to understand the broader market environment, viewing his cycles as a potential context for identifying long-term trends.

In particular, Benner's emphasis on alternating periods of bullish and bearish sentiment aligns well with the sentiment-based analysis used by many traders today. The cyclic patterns can be used as a broad framework to help identify periods where caution or optimism might be warranted, complementing other technical indicators like moving averages, oscillators, and Fibonacci retracements.

Limitations and Considerations

While Benner's cycles are historically interesting, relying on them exclusively for investment decisions would be risky. Market dynamics have evolved considerably since Benner's time. The influence of central banks, the rise of algorithmic trading, and the increasing integration of global economies have introduced complexities that Benner could not have accounted for.

Furthermore, while certain market events might appear to align with his predicted cycles, these occurrences can be attributed to coincidence rather than a predictable rhythm.

For investors and analysts, Benner's work is best viewed as a conceptual framework rather than a forecasting tool. It offers an opportunity to reflect on the repetitive nature of human psychology in markets, especially the cycles of greed and fear that continue to drive price action.