Beazley PLC (LON:BEZ), a prominent name in the insurance industry, has had a dynamic year in 2024, marked by a mix of challenges and growth opportunities. As a leader in specialty insurance, Beazley has continued to adapt to the evolving market landscape, positioning itself strategically for future success.

Performance Overview

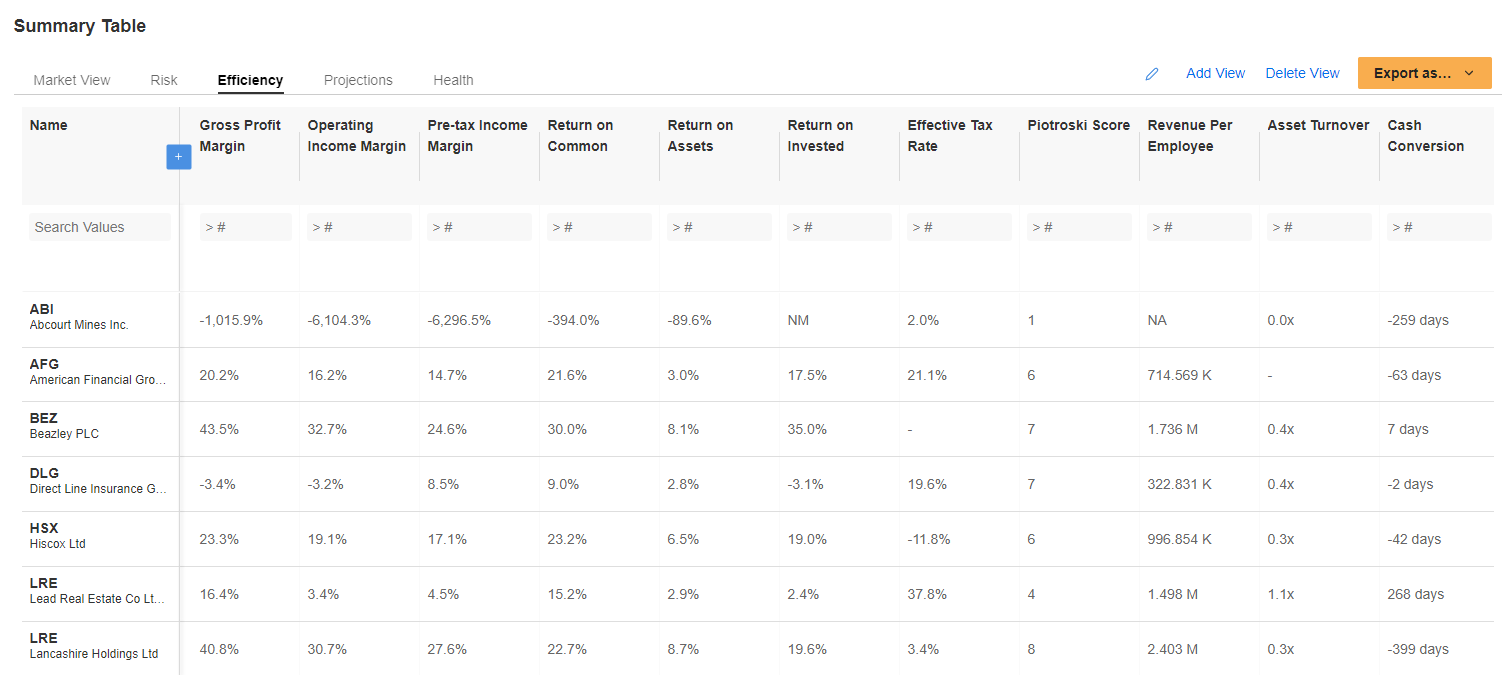

In the first half of 2024, Beazley’s stock (BEZ) has shown resilience despite facing macroeconomic pressures. The company has managed to maintain steady growth, supported by its diversified portfolio and strong underwriting performance.

According to the company's half-year report released in July 2024, Beazley reported a 10% increase in gross written premiums compared to the same period in 2023. This growth is attributed to the firm’s robust performance in its cyber and specialty risk divisions, which continue to be key drivers of revenue.

Strategic Developments

Beazley’s strategic focus in 2024 has been on expanding its digital capabilities and enhancing its data analytics to improve underwriting accuracy and customer service. The company has also been actively pursuing growth in new markets, particularly in the US and Asia, where demand for specialty insurance products is rising.

In a recent statement, CEO Adrian Cox mentioned, "Our investment in digital transformation is paying off, allowing us to offer more tailored solutions to our clients and improve operational efficiency. We are confident that these initiatives will position us well for sustained growth in the coming years."

Market Conditions and Challenges

The broader insurance market has faced significant headwinds in 2024, including rising inflation and increased claims costs. However, Beazley has managed to navigate these challenges through prudent risk management and pricing adjustments.

The company's focus on high-margin products, such as cyber insurance, has also helped mitigate the impact of these macroeconomic factors.

According to a report by Barclays (LON:BARC), "Beazley’s emphasis on specialty lines and its strong market position in cyber insurance provide a buffer against broader industry challenges. The company’s ability to adapt to changing market conditions is a key strength."

Stock Performance and Future Outlook

As of August 2024, Beazley’s stock has experienced moderate volatility, reflecting broader market trends. However, analysts remain optimistic about the company's long-term prospects. The stock has seen a gradual upward trend, supported by positive earnings reports and the company’s ongoing expansion efforts.

Looking ahead, Beazley is expected to continue capitalising on its strong market position and strategic initiatives. The company's focus on innovation, combined with its expansion into new markets, should drive sustained growth. Investors are likely to see continued value in Beazley’s shares, particularly as the company further strengthens its digital and data capabilities.

In conclusion, Beazley PLC has demonstrated resilience and strategic foresight in 2024, positioning itself well for future growth. With a strong focus on innovation and market expansion, the company is poised to navigate the challenges ahead and deliver long-term value to its shareholders.

_____________________________________

Find out more in our AI supported Investing Pro