As what was widely expected and what has been highlighted in my most recent analyses, BOC raised today the target of its overnight interest rate by 0.25% to 0.75% to be the first major central bank to follow the Fed in tightening its monetary policy, after the credit crisis.

CAD could resume its rally versus its rival currencies, while USD has been under pressure because of Yellen's reference to the monetary policy in her semiannual testimony released report by saying that it has become close to normal.

The market participants interpreted her comments into lower interest rate outlook driving the yields of US treasuries notes down.

As anticipated, Yellen assured on the current evolving economy broadly which can support the Fed's step to unwind assets from its $4.5 trillion balance sheet later this year, as what has been mentioned in the FOMC recent meeting minutes on last of last June 15 when The Fed decided to raise the fund rate by another 0.25% to be between 1% and 1.25% as widely expected expecting another tightening by 0.25% by the end of this year.

BOC has said in its statement that this decision has been taken following rising of the inflation outlook made the monetary policy lagged behind.

But it has underscored in the same time the current inflation pressure easing down which can be "temporarily" as it said expecting the inflation to rise 2% yearly before the middle of 2018.

BOC expected the Canadian economic expansion to be 2.8% in 2017, before decelerating to 2% in 2018 and 1.6% in 2019 supported by the household spending which supports demand for services and goods, while the US economy is gathering momentum currently, after tepid growth in the first quarter.

Bank of Canada Governor Stephen Poloz has paved the way for this action by his recent indication to CNBC that "the interest rate cuts have done their job and the current rates levels are now looking extraordinarily low".

He said that the Fed is now two years ahead of Canada because of the recent oil price shock that forced the Bank to cut rates to that levels driving USDCAD down to be traded well below 1.30

BOC’s quarterly Business Outlook Survey of summer 2017 has shown also previously evolving economic activities in Canada broadly with improving of the inflation outlook and rising of the Canadian business leaders trust in hiring.

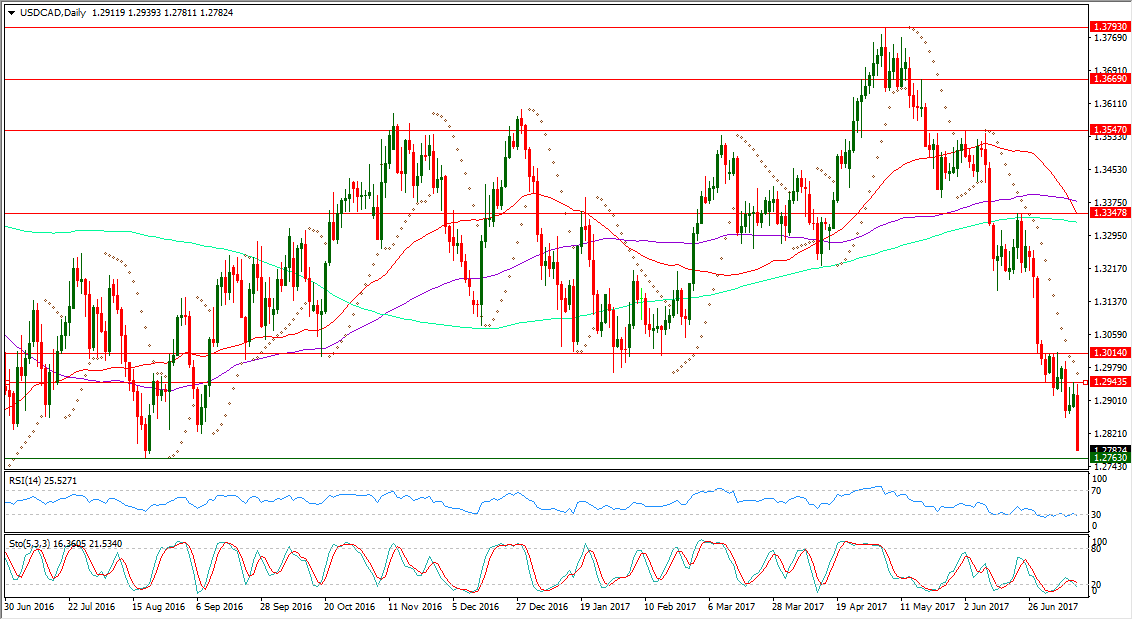

After forming another lower high at 1.2943 yesterday, USDCAD dived today below 1.2859 which supported it by the end of last week.

USDCAD gathered downside momentum to break its formed bottom at 1.2822 which could prop up the pair on last Sep. 7 to be now in a deeper place below its daily SMA200, its daily SMA100 and its daily SMA100.

After it had topped a lower high at 1.3347 below its previous peak which has been formed at 1.3547 on last Jun. 2.

USDCAD is now in its day number 24 of consecutive being below its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading 1.2966 today.

USDCAD daily RSI-14 is referring to existence inside its oversold territory below 30 reading 25.527.

USDCAD daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having also its main line inside its oversold region below 20 at 16.360 leading to the downside its signal line which is still in its neutral region between 80 and 20 at 21.534

Important levels: Daily SMA50 @ 1.3376, Daily SMA100 @ 1.3346 and Daily SMA200 @ 1.3327

S&R:

S1: 1.2763

S2: 1.2654

S3: 1.2460

R1: 1.2943

R2: 1.3014

R3: 1.3347