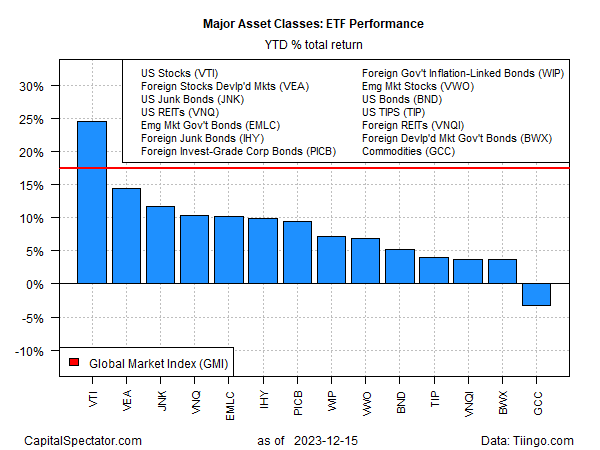

It’s been a profitable year for the major asset classes, with a glaring exception: commodities. The general slide in prices of raw materials stands out in an otherwise rising tide for global markets, based on a set of ETFs through Friday’s close (Dec. 15).

WisdomTree Enhanced Commodity Strategy Fund (NYSE:GCC) has lost 3.3% year to date. That’s a mild decline, but it marks a stark contrast against across-the-board gains in 2023 for the major asset classes, led by US stocks (VTI) with an outsized 24.5% surge.

Commodities are, of course, highly volatile and cycle and so the obvious question: Is the asset class set to become everyone’s favorite contrarian play for 2024?

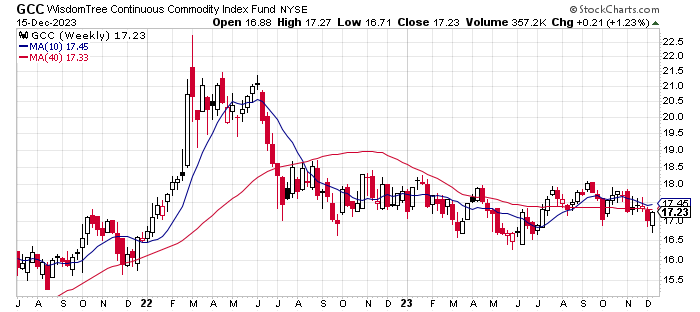

No one knows, of course, but let’s look at trending behavior in the commodities space for some perspective. Note that the charts below are based on weekly data.

Using GCC as a proxy suggests that a tight trading range prevails. Until pricing action offers a reason to think otherwise, it’s reasonable to assume that the broad trend for commodities will remain stuck in neutral, at least by GCC standards, which reflects a quasi-equal-weighting strategy for raw materials. After sharp losses in mid-2022, the fund has yet to show convincing signs of an upward bias.

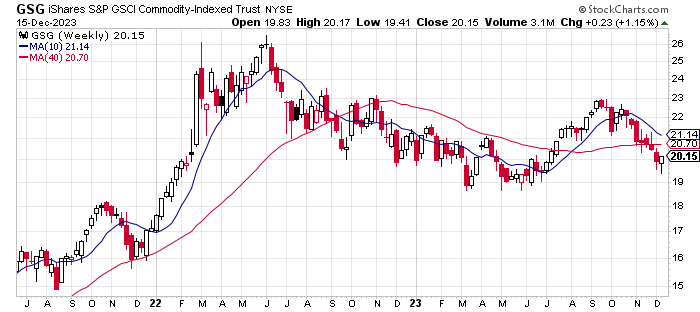

Critics of equal-weighting commodities say that a better measure of the asset class reflects a higher weight in energy and so iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG) is arguably a better proxy. But here, too, the near-term outlook remains uninviting. GSG’s slide over the past two months suggests the fund will soon test its summer lows.

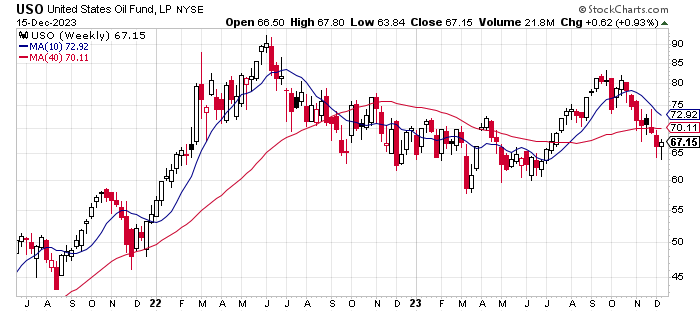

A fair amount of the bearish bias for commodities is driven by the sharp decline in crude oil prices recently, as shown by United States Oil Fund, LP (NYSE:USO).

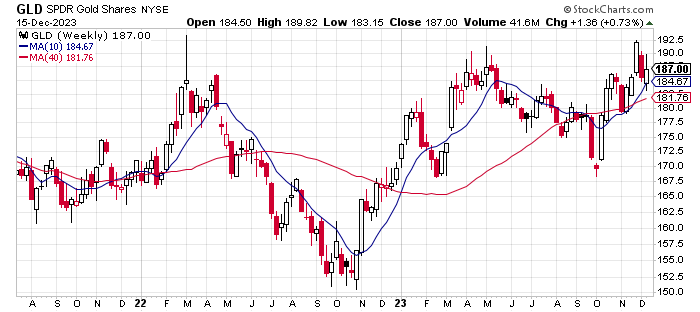

Gold is an upside outlier within the commodities space. GLD has recently taken out its spring highs, and so traders are looking for more confirmation in the weeks ahead that everyone’s precious metal will extend its recent rally into 2024.

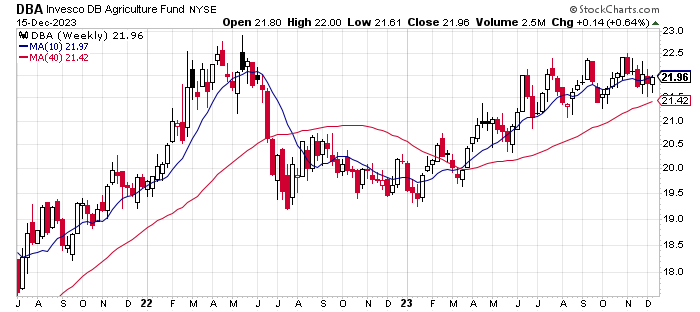

Are trends favorable elsewhere in commodities? Keep your eye on agricultural products for a possible upside breakout trade in the new year. Invesco DB Agriculture Fund (NYSE:DBA) has been slowly but consistently trending higher in 2023 and looks set to test its 2022 high in the near term.

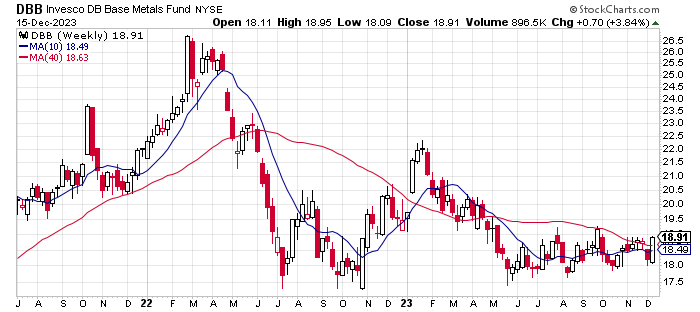

By contrast, base metals (DBB) are still having a rough time breaking out of a slump.