This article was written exclusively for Investing.com.

- Latest WASDE report send agricultural prices higher

- Fed may say inflation is “transitory,” but food commodities continue accelerating

- ADM: A of the ABCD group of companies that feed people worldwide

- Bullish trend in the stock and a juicy dividend

- ADM should continue to beat earnings expectations

The bull market in commodities began with the March through May 2020 lows sparked by the worldwide pandemic. In 2008, the global financial crisis pushed raw material prices to multi-year lows. Meanwhile, central bank liquidity and government stimulus planted inflationary seeds that pushed commodity prices to multi-year, and in some cases, all-time highs by 2011-2012.

While the 2020 pandemic is a far different event than the 2008 crisis, central banks and governments used the same monetary and fiscal policy tools to stabilize the economy. The only difference: in 2020, the amounts of liquidity and stimulus were far higher than in 2008. Over the past year, prices have been explosive. The consumer price index has been rising at the highest rate in decades. Grain and oilseed prices have risen to the highest level in over eight years in 2021, and the futures market trends remain bullish.

The Archer-Daniels-Midland Company (NYSE:ADM) is a leading agricultural company that procures, transports, processes, and merchandises agricultural commodities, products, and ingredients in the US and internationally. A bull market in agricultural commodities means more profits for the company that feeds the world.

Latest WASDE report sent agricultural prices higher

The monthly USDA World Agricultural Supply and Demand Estimates (WASDE) report is the gold standard for the commodities that grow from the fertile soil in the US and worldwide. Corn, soybean, wheat, and cotton prices rallied after the latest Apr. 12 report. Over the past year, agricultural commodity prices have moved appreciably higher.

- Nearby corn futures rose from $3.53 to $5.6825 per bushel or 61.0%.

- Soybeans rallied from $9.67 to $13.73 per bushel or 42.0%.

- CBOT wheat increased from $5.5175 to $7.6225 per bushel or 38.2%.

- Live cattle appreciated from $1.08225 to $1.28125 per pound or 18.4%.

- Lean hogs are up from 56.70 cents to 86.525 per pound or 52.6% over the period.

- Cotton futures moved from 65.79 cents to 94.32 cents per pound or 43.4% higher.

Higher agricultural product prices tend to increase profit margins for companies in the sector. The prospects for even higher levels are rising as trends are bullish. Inflation continues to take a bite out of consumer’s pockets.

Fed may say inflation is “transitory,” but the food commodities continue accelerating

The consumer price index data from May, June, and July showed the highest rise in inflation in years. The economists at the Fed focus on core CPI when considering monetary policy, which excludes food and energy as those prices can be volatile because of weather and other exogenous events and factors. Core CPI rose by a lower than expected 0.3% in July.

Meanwhile, food and energy prices have escalated steadily since 2020. Bottlenecks in supply chains, booming demand as vaccines eased social distancing guidelines, central bank, and government stimulus have combined to push commodity prices to multi-year, and in some cases, all-time highs over the past months.

The Federal Reserve continues to call inflationary pressures “transitory,” but the across-the-board price appreciation in essential raw materials is taking a considerable bite out of consumer’s budgets. When it comes to food, prices continue to rise.

ADM: A of the ABCD group of companies that feed people worldwide

Archer Daniels Midland is the “A” of the ABCD group of companies that feed the world. ADM, Bunge (NYSE:BG), Cargill, and Louis Dreyfus are the other leading companies. Cargill and Dreyfus are privately held.

ADM’s website highlights the many products and services the company offers to feed people around the globe. The company has been in business since 1902, with headquarters in the heart of the United States, in Chicago, Illinois.

Bullish trend in the stock and a juicy dividend

At the $62.40 level, ADM’s market cap was just below the $35 billion level. The shares trade an average of over 2.44 million each day. The $1.48 annual dividend equates to a 2.37% yield.

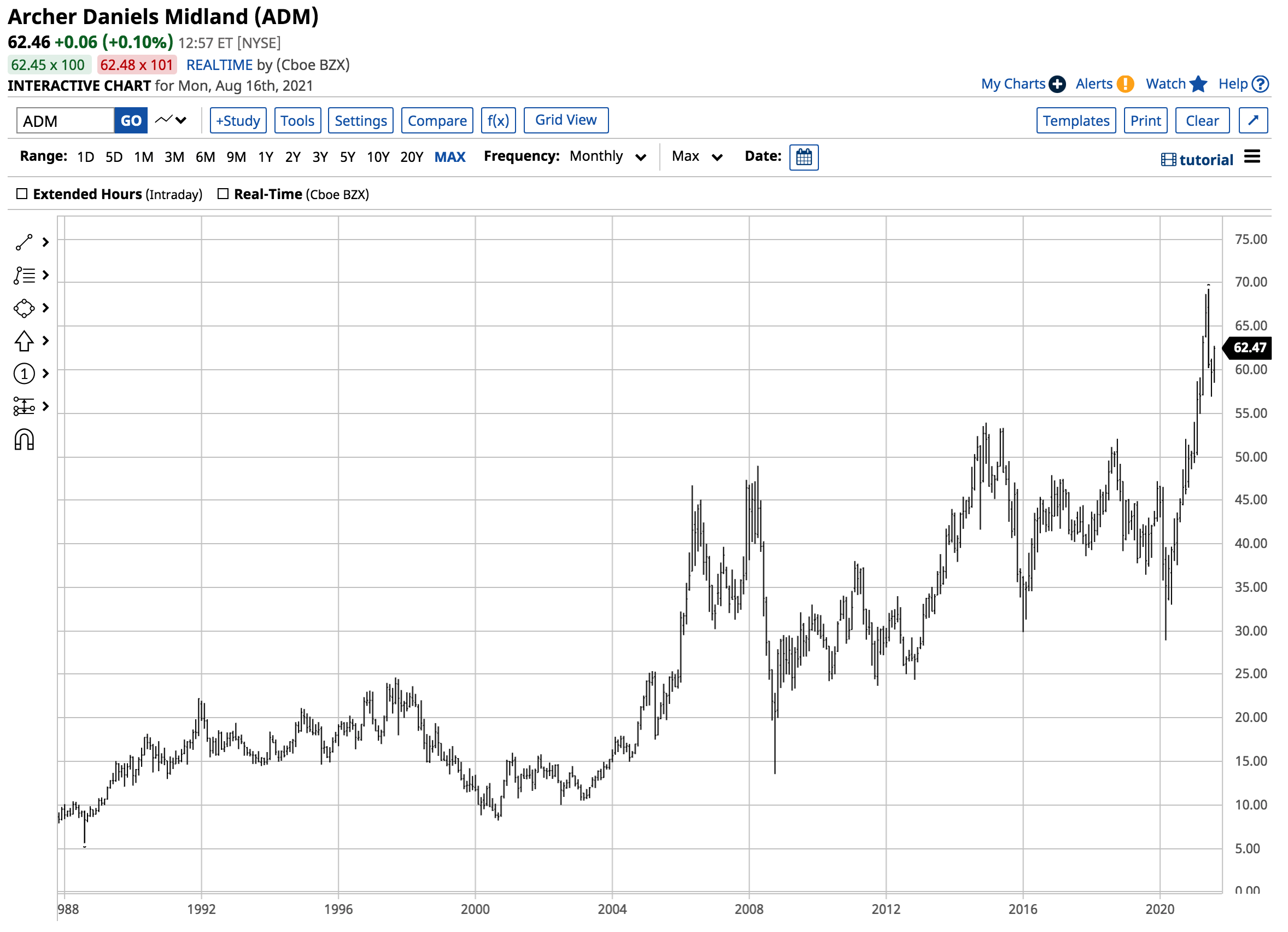

ADM shares have increased with agricultural commodity prices in 2021, hitting a new all-time high in June.

Source: Barchart

As the chart above highlights, ADM shares rose to a high of $69.30 in June before correcting to the $62.46 level on Aug. 16. ADM has mainly made higher lows and higher highs over the past three decades.

The demand side of food’s fundamental equation is a function of the rising global population. According to the US Census Bureau, the global population has grown from around six billion at the turn of this century to over 7.783 billion as of Aug. 16, increasing nearly 30%.

Each year, there are more mouths to feed; the world's population is higher in 2021 than it was in 2020 and will be higher again in 2022. The addressable market for ADM and the other ABCD companies continues to grow. Higher agricultural prices tend to increase profit margins for the companies.

ADM should continue to beat earnings expectations

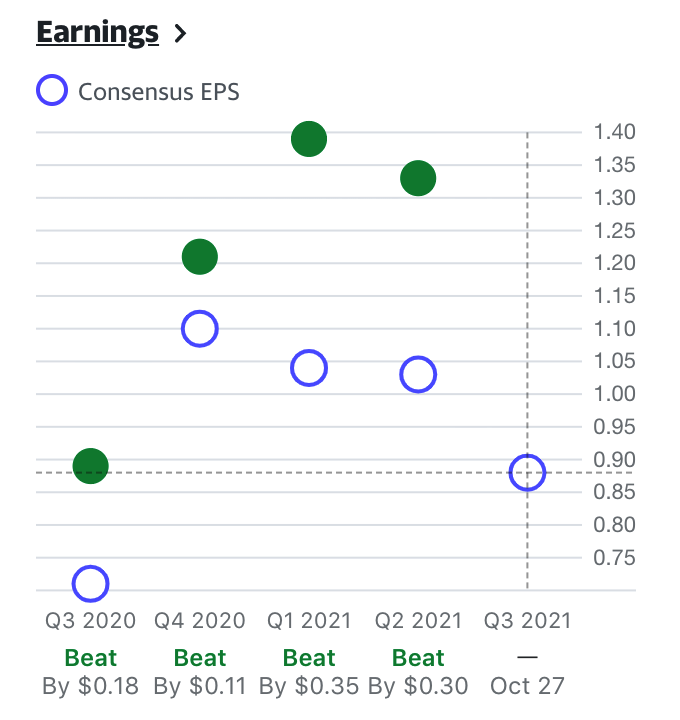

The company's latest earnings report validates ADM’s share appreciation. Archer Daniels Midland has had an excellent earning record over the past four quarters.

Source: Yahoo Finance

As the chart illustrates, in Q2, ADM reported $1.33 per share earnings compared to consensus forecasts of $1.03. The second quarter of 2021 was the fourth consecutive quarter where the company beat the consensus earnings estimates.

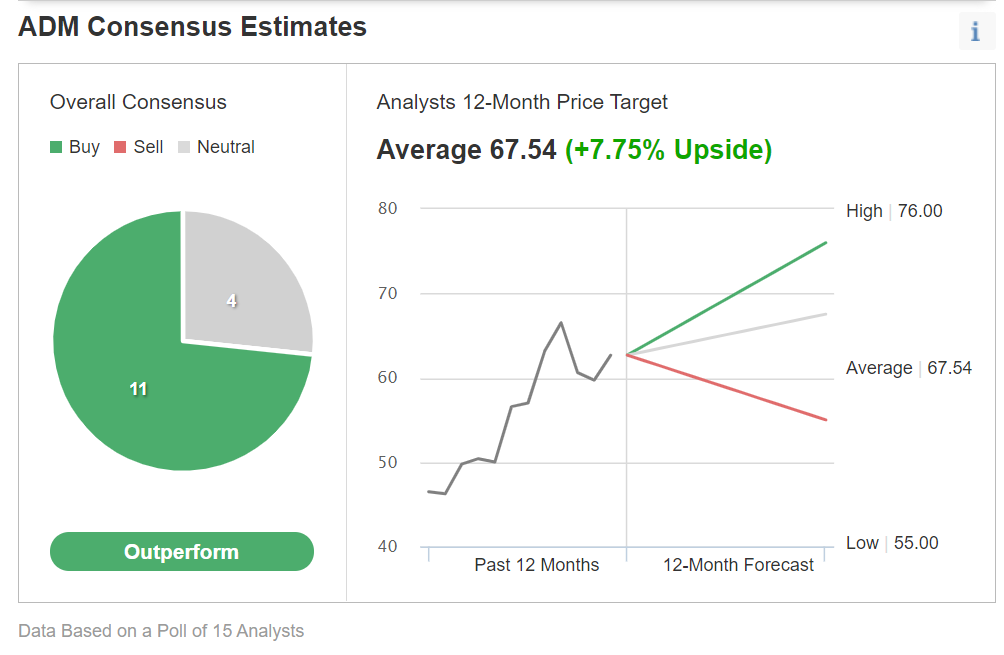

Chart: Investing.com

A survey of 15 analysts on Investing.com has an average price target of $67.54, with forecasts ranging from $55 to $76 per share.

The Fed may continue to call inflationary pressures “transitory.” Nevertheless, the trend in agricultural commodity prices remains higher as we head towards the 2021 harvest in the US and the northern hemisphere.

Rising agricultural product prices support higher levels for ADM shares over the coming months and years. Meanwhile, the stock offers shareholders an attractive dividend while they wait for capital growth.