- Apple will publish earnings after the closing bell today.

- Expectations are low, and the stock is close to a 1-year low.

- Could upside surprise spark a rally?

- Identify top stocks and build outperforming portfolios with InvestingPro, for less than $9 a month thanks to our limited 1-year subscription offer!

All eyes turn to Apple (NASDAQ:AAPL) today as the tech giant releases its highly anticipated quarterly results after the markets close. Apple, the world's second-largest company by market capitalization, holds immense sway over the broader market, making its performance a crucial indicator for investors.

Analysts are cautiously optimistic about the results, but a positive surprise is needed to reverse Apple's recent stock price decline. Since December 2023, the share price has trended downward, hitting a one-year low of $164.07 in April. While it has stabilized somewhat, closing yesterday at $169.30, a strong performance tonight is essential to break the downward momentum.

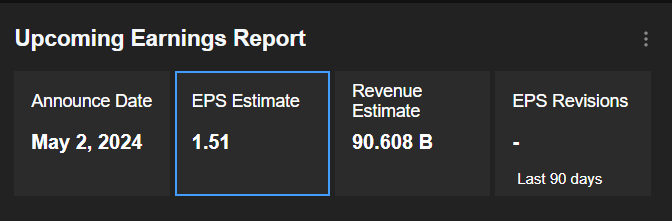

Revenues are forecast to reach $90.608 billion, a 4.5% decrease compared to the same quarter last year. Can Apple defy expectations and deliver a positive surprise that reignites investor confidence? Tonight's results are set to be a pivotal moment for the tech giant.

Source: InvestingPro

Low Expectations Could Lead to Upside Surprise

Analysts predict Apple's EPS to reach $1.51, slightly lower than the $1.52 reported a year ago. This suggests the stock is trading at relatively low levels ahead of the earnings release, and analyst expectations are modest. Interestingly, another Magnificent 7 stock, Tesla (NASDAQ:TSLA), found itself in a similar situation before its earnings.

Despite below-consensus figures, Tesla's stock surged following promises from Elon Musk. While this doesn't guarantee a similar outcome for Apple, it hints that expectations for a positive earnings surprise might not be overly high.

Source: InvestingPro

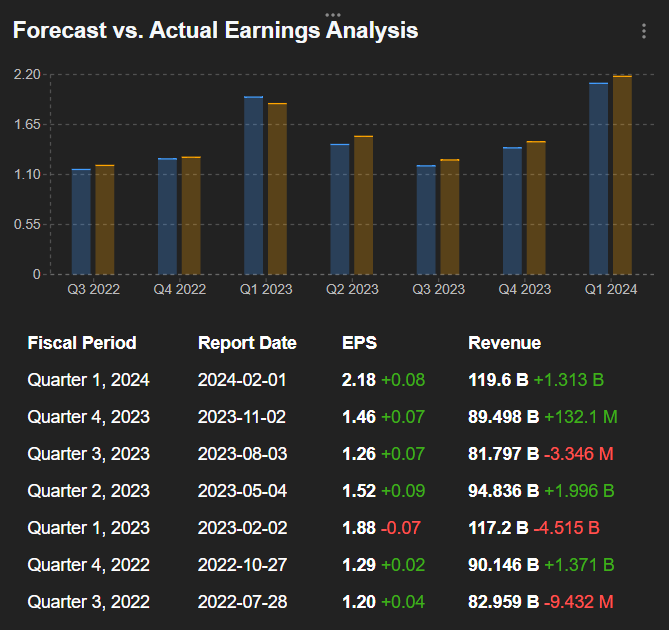

Furthermore, Apple has consistently surpassed EPS estimates in 6 out of the last 7 quarters and exceeded sales forecasts 4 times.

InvestingPro data also reveals a positive market reaction following 9 out of the last 10 quarterly results.

Source: InvestingPro

China Woes in Focus Too

Beyond these headline figures, specific details like performance in key divisions and regions will influence the stock's reaction. iPhone sales in China, Apple's second-largest market, will be closely scrutinized due to competition from Huawei.

Additionally, performance in the services division, including the App Store and Apple TV, will be of significant interest as it represents the company's most profitable segment.

Ultimately, the market's reaction might hinge most heavily on Apple's forecasts for the coming quarters and its commentary on AI integration within its devices, a potential driver of future growth.

Analyst Targets and Valuations

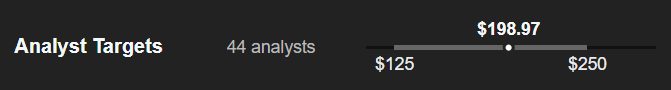

In terms of potential medium-term targets for Apple shares, we note that the 44 professional analysts who follow the stock display an average target of $198.97, which translates into a potential upside of 17.7%.

Source: InvestingPro

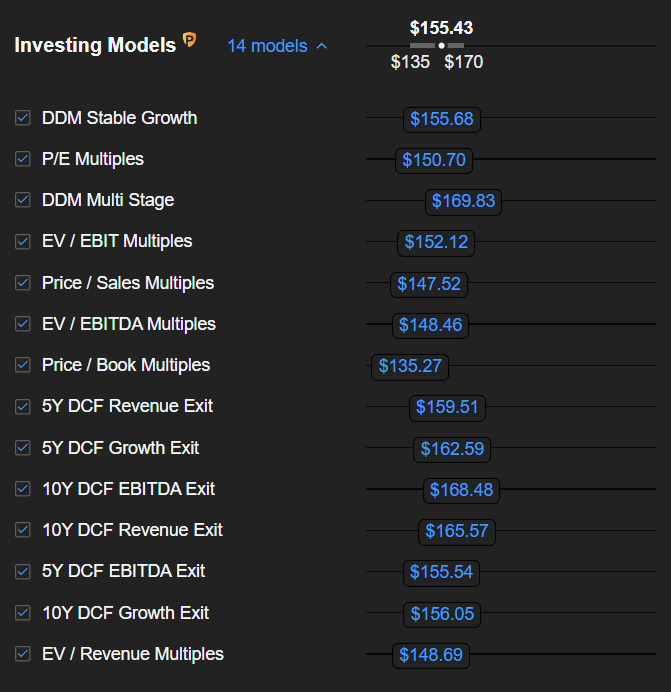

By contrast, the InvstingPro Fair Value, which synthesizes 14 recognized financial models in the case of Apple, is much more conservative, at $155.43, or 9.3% below Wednesday's closing price.

Source: InvestingPro

It's also worth noting that Apple's Fair Value is all the more credible because valuations differ little between the different models applied, with a range extending from $135 to $170.

Conclusion

Therefore, expectations for Apple's results this evening are low, as is the share price, given its historical trend, which might suggest that it won't take much to get the stock off the ground, as was the case with Tesla.

However, it should be remembered that Tesla benefited from a Fair Value potential of over 20% before its results were published, which is not the case for Apple, whose InvestingPro Fair Value is below the current share price.

While this detail alone is not enough to justify shunning the stock, it does at least justify extra caution.

***

Identify the next hot stocks with Fair Value, or rely on the stock picks of our investment AI ProPicks (and enjoy many other benefits) with InvestingPro!

You can also use the promo code ACTUPRO (to be entered on the payment page, after selecting the subscription of your choice via this page) to obtain a 10% discount on the 2-year Pro and 1 and 2-year Pro+ subscriptions.

Disclaimer: This content is prepared purely for educational purposes, and cannot be considered as investment advice.