- Reports Q4 2021 results on Tuesday, Feb. 1, after the market close

- Revenue Expectation: $72.23 billion

- EPS Expectation: $27.80

Investors in Google parent company Alphabet (NASDAQ:GOOGL) have little to complain about. The pandemic-driven shift to online shopping turbocharged the company’s earnings and made its stock the best-performing among the trillion-dollar market-cap group.

That strength will likely be on display again today when the search engine behemoth reports its latest quarterly numbers after the market close. Analysts, on average, are forecasting year-over-year growth of 20% to 25% in both earnings and revenue.

The revival in the ad business in 2021 was so powerful that Alphabet produced its most significant sales growth in more than a decade in the third quarter. Those figures helped propel the global ad spending to a 26% rise in 2021, up from earlier projections of 15%, according to GroupM, a media-buying firm.

Furthermore, unlike Meta Platforms (NASDAQ:FB) and Snap (NYSE:SNAP), Google’s ad sales were little affected by the most recent privacy changes to Apple's (NASDAQ:AAPL) iOS, mainly because the company relies on its Android operating system.

This clear lead in the digital ad market is also helping the California-based company’s shares withstand the current bearish spell in markets much better than other tech stocks. Google stock closed on Monday at $2,706.07, down about 6.4% this year. During that period, the NASDAQ 100 has fallen about 9%.

Google was the best-performing stock in 2021 among the five mega tech stocks that include Apple and Amazon (NASDAQ:AMZN), as it surged 65%.

Buy Rating

This growth momentum will likely see some deceleration this year after producing a projected 40% revenue jump in 2021, its most significant expansion since 2007. But any post-earnings weakness, in our view, should be taken as a buying opportunity for long-term investors.

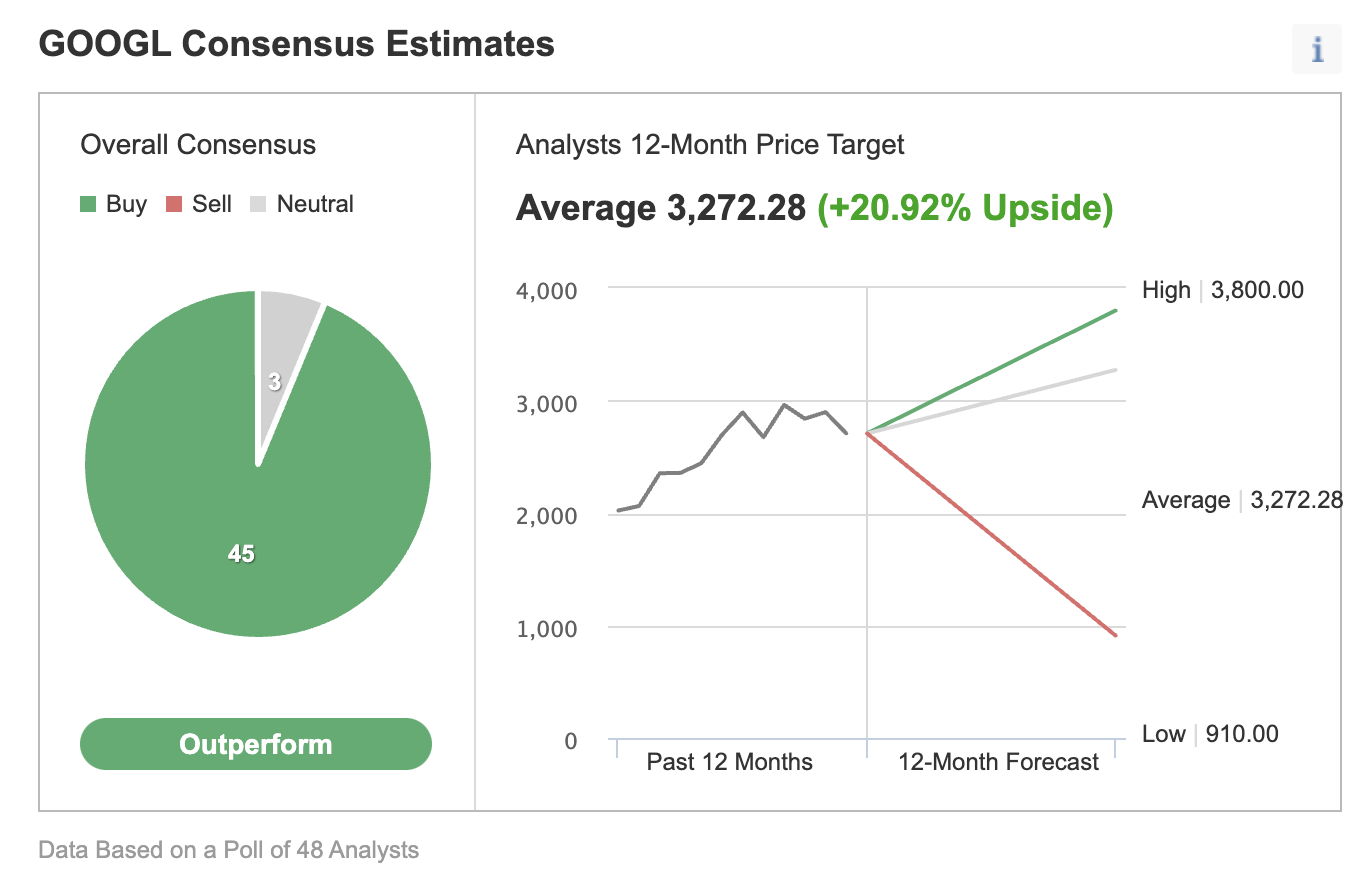

First, Google stock has a cheaper valuation and higher growth rate than most mega-cap peers. Alphabet trades around 24 times forward earnings, making it cheaper than Amazon and Microsoft (NASDAQ:MSFT). That is perhaps why Google stock had a buy rating from 45 out of 48 analysts surveyed by Investing.com. The average 12-month price target for the stock is $3,272.28, which suggests a 20.9% return from its current share price.

Source: investing.com

RBC Capital Markets analyst Brad Erickson said in a Bloomberg report that arguments can be made around whether the stock’s multiple is already baking in enough optimism. Still, there are solid reasons to remain positive.

Erickson added:

“Given the especially attractive COVID rebound exposure, ever-rising YouTube engagement and monetization, and Google Cloud Platform’s march toward profitability, we see solid reasons to own the name.”

In a recent note, Credit Suisse also reiterated Alphabet as outperform, given its stock’s upside potential, driven by its ad business, YouTube, and advances in its cloud computing unit.

The note said:

“We maintain our outperform rating based on the following: 1) ongoing monetization improvements in search advertising through product/AI driven updates, 2) greater-than-expected revenue contribution from non-search businesses.”

Bottom Line

Even after producing remarkable returns in 2021, Alphabet continues to remain in a high-growth mode, helped by strong momentum in its ad and non-ad businesses. Today’s earnings report will likely reflect that optimism.