- Airbnb gave a robust sales forecast for the current quarter

- The booking app predicts “substantial demand” ahead of the busy summer season

- Despite travel rebound, macroeconomic headwinds have limited stock's gains

- If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

Airbnb's (NASDAQ:ABNB) latest earnings report gave its investors several reasons to remain bullish on the stock. The tech platform for vacation home rentals exceeded analysts’ EPS expectations for the three-month period that ended on Mar. 31 and delivered a robust sales forecast for the current quarter. Airbnb closed Wednesday at $156.18.

After more than two years of COVID-19 restrictions, the San Francisco-based company now sees pent-up worldwide demand for leisure traveling heading into the busy summer season.

Those expectations contradict projections that soaring gas prices, air tickets, and other essential commodities would force people to curb spending on non-discretionary items.

Chief Executive Officer Brian Chesky wrote in a letter to shareholders:

“As we lap the beginning of the travel rebound that started last year, we are particularly encouraged by the compounding growth in North America. This year, US domestic demand has outpaced our internal expectations, and we are encouraged by US international bookings exceeding 2019 levels.”

According to Airbnb’s latest guidance, the second-quarter revenue will be $2.03 billion to $2.13 billion. According to data compiled by Bloomberg, that topped the average analyst’s estimate of $1.97 billion.

In the first three months of the year, revenue was also better than expected, helping to narrow the net loss to $19 million from $1.2 billion in the same quarter a year ago. Airbnb reported 102.1 million nights and experiences booked for the first quarter, surpassing pre-pandemic levels.

Airbnb Stock Is Up 120% Since IPO

Airbnb stock has weakened about 9% this year, losing about half of its close rivals. Expedia (NASDAQ:EXPE) and Booking Holdings (NASDAQ:BKNG) suffered during the same period.

Despite this year’s losses, mainly caused by investors’ exit from growth companies when the Federal Reserve is hiking interest rates, ABNB shares have provided more than 120% gains since its IPO in 2020. This strength reflects the company’s success in managing the challenges posed by the pandemic.

The app quickly took advantage of the flexibility offered by new remote work policies that resulted in people spreading out to thousands of towns and cities, staying for weeks, months, or even entire seasons.

Citi analysts reiterated ABNB as a buy in a note released today, saying they see the stock will continue to benefit from the travel demand surge.

“Following 1Q22 results whereby Bookings, Revenue, and EBITDA came in 4%, 3%, and 205% above consensus, respectively, we emerge incrementally confident that Airbnb is taking a share of the global lodging travel market and shares remain our top pick within the online travel vertical.”

These successes, in our view, are unlikely to help trigger another powerful rally in its stock this year as long as the macroeconomic risks linger. Expedia’s stock tumbled more than 17% on Monday even after its earnings report showed an 80% jump in revenue in the first quarter, on concerns about inflation, which is running at its hottest in nearly four decades.

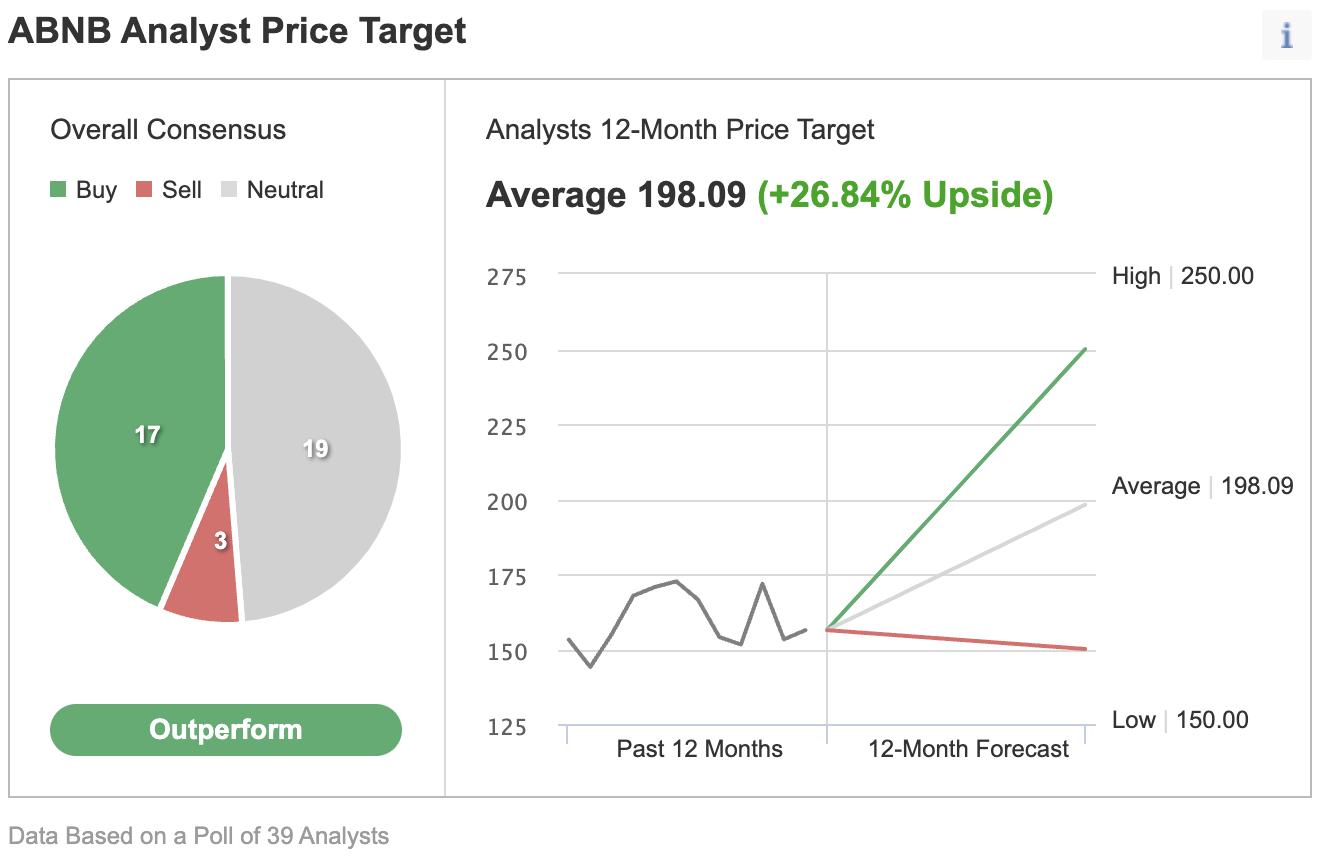

Airbnb stock isn’t cheap when compared with the industry peers. Airbnb sells for about 14 times its sales for the trailing 12-month period. That’s well above the industry average of 5.99. That’s perhaps why more than half of 39 analysts surveyed by Investing.com are not recommending buying the Airbnb stock at this time.

Bottom Line

Airbnb’s latest earnings showed that the company remains in a solid position to benefit from the post-pandemic travel rebound. Despite this positive outlook, its shares may not have much more upside room after substantial gains during the past two years. Given higher inflation and rising interest rates, investors remain cautious about growth stocks.

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI