Investor enthusiasm for electric car-makers received resounding approval this week when the S&P Dow Jones Indices said Tesla (NASDAQ:TSLA) would join the index on Dec. 21.

The move had been widely anticipated after the company posted a profit in four consecutive quarters—a key eligibility requirement in the world’s most tracked index. These positive developments have helped fuel Tesla shares’ incredible run this year, soaring 481%.

After seeing Tesla’s success, now investors are turning their attention to smaller electric-vehicle stocks, hoping that they could provide similar returns as the market of electric cars gets support from governments globally.

China, for example, could be a big growth driver for the electric vehicle (EV) market in the next decade, with its government incentivizing electric-car developers. Beijing wants new-energy vehicles to account for 15% or more of the market in 2025.

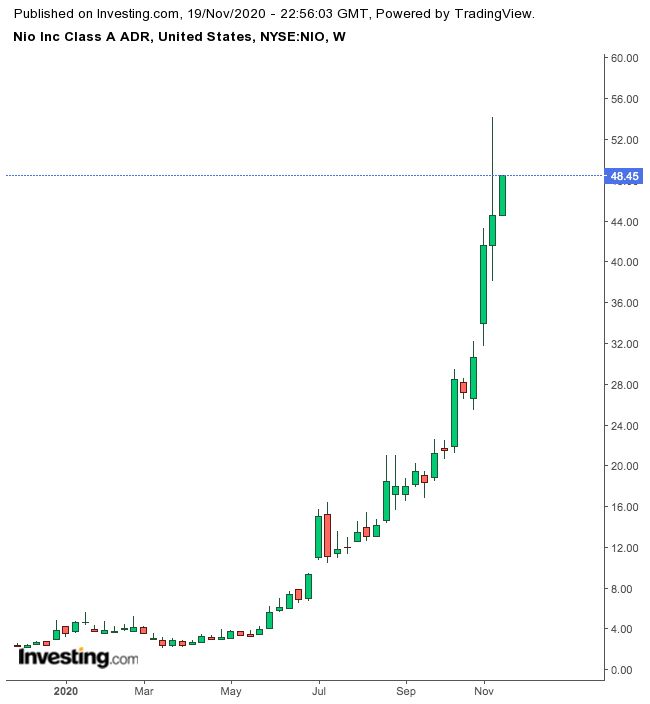

One such stock that is getting overwhelming support from Wall Street analysts these days is Chinese electric-SUV maker NIO (NYSE:NIO). NIO’s New York-listed shares have risen more than 1,000% this year, valuing the company more than $60 billion—and making it worth more than General Motors Company (NYSE:GM).

The starting price for a NIO ES6 SUV is about $54,000, more than a third higher than that of Tesla’s popular Model 3 sedan. But what makes NIO standout is its services, including leasing and its battery-swap stations. The company is also working on self-driving technology and plans to launch its robotaxi fleet by 2022. NIO sold 20,565 cars last year, marking an 81% year-over-year increase.

On The Brink of Collapse

Just like Tesla, however, NIO has had a troubled past. Last year, it faced a severe cash crunch that made investors’ uncertain about its future. Since April, that situation has changed. That is when state-backed investors provided liquidity, bailing out the company from near collapse.

Along the way, Tesla’s strong rebound also changed sentiments for EV makers, helping NIO to raise $1.7 billion in September from a stock offering. In addition, the Chinese EV market came back strongly from the coronavirus slump.

NIO’s revenue for the quarter ended in September, surged 146% from a year earlier. The company delivered 12,206 cars last quarter, a 154% year-over-year rise. These impressive earnings prompted many analysts to raise their price targets for NIO this week.

Bank of America more than doubled its price target on the stock to $54.70, while Deutsche Bank and JPMorgan also raised their targets, with each firm boosting its forecast to $50. These analysts were encouraged by NIO’s ambitious expansion plans that could challenge Tesla’s Model 3 sedan in China.

On Wednesday, according to a Bloomberg report, chief executive officer William Li said the following in a conference call:

“We are going to launch a sedan soon, and are currently developing another one. So the next two products in line will both be sedans.”

NIO also plans to enter the European market as soon as the second half of 2021, focusing on its premium makes.

Bottom Line

NIO is turning out to be a great growth story in 2020, helped by the swift shift in consumer and investor perception about electric cars. That said, it’s no guarantee that this smaller player will be able to succeed in a market that is getting crowded as the conventional auto giants make their entry. Investors, therefore, are advised to tread with caution.