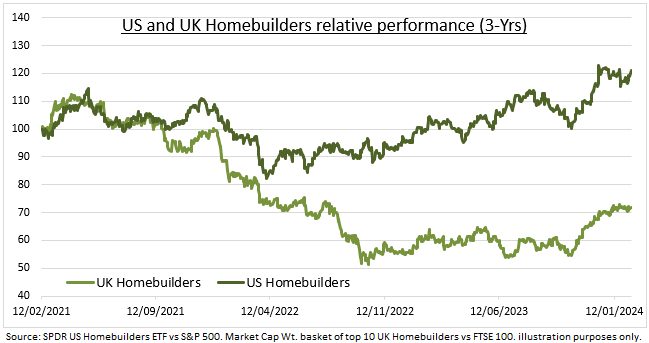

HOMEBUILDERS: US homebuilders have outperformed even the NASDAQ in the past year, as limited inventory drove new home sales despite high interest rates. Whilst UK homebuilders have made a recent comeback, with mortgage rates peaked and valuations discounted, after hugely underperforming. US homebuilders counter-intuitively benefit from higher mortgage rates, whilst UK builders need them to keep falling. This transatlantic divergence (see chart) is despite the two’s similarities. Both have high home ownership (65.7% in US and 65.2% in UK), and house prices (US avg. $387,000 vs UK equiv. $357,000). And chronic deficits (only 0.43 US dwellings/person vs 0.45 in the UK), with house prices rising again (5.4% in US vs 2.5% in UK). Housing is the largest expenditure and debt for consumers, and their biggest source of wealth.

US: The SPDR US homebuilders ETF (XHB) has soared 46% the past year. With big builders, like Pulte (PHM) and Lennar (LEN), one of the year’s big surprises. As soaring mortgage rates stopped existing home sales in their tracks. These are 85% the market and at decade lows. Whilst driving up demand for new build. In this light the recent US mortgage rate fall is a mixed blessing. The standard 30-year fixed mortgage peaked at 7.8% in Nov. and has fallen to 6.7%. Whilst underlying valuations are now at a 40% price/book premium of 1.7x versus UK builders.

UK: Our 10-stock UK homebuilders basket, from Taylor Wimpey (LON:TW) and Berkeley (BKGH (LON:BKGH)) down, has lagged the FTSE 100 by 30% the past three years. Though a comeback started late last year. As bond yields fell sharply as interest rate cuts came on horizon, and housing prices quickly firmed. Five year fixed mortgage rates, the most common in the UK market, peaked in November at 5.03% having soared from under 1.5% at the end of 2021. Whilst M&A made a comeback with Barratt (LON:BDEV)’recent all-share 27% premium offer for peer Redrow (LON:RDW).

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Tale of Two Housing Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.