Despite 13 central banks meeting this week and most expected to hike rates aggressively, the FOMC meeting is the week's marquee event. With so many variables that could move markets, we look at the core factors traders should be aware of when assessing risk around the FOMC meeting.

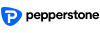

Rates Review – we display the implied rate hike priced by the market for the upcoming central bank meeting and the step up (in basis points) to the following meeting(s).

1. 75bp Hike Incoming

Arguably the debate everyone wants answering straight away; will the Federal Reserve hike the fed funds rate by 50bp, 75bp, or 100bp – the consensus view (from economists) is they hike by 75bp, with the market pricing in 80bp – this equates to an 80% chance of 75bp and 20% of 100bp.

Given the recent (Aug) US CPI print (core CPI at 6.3%), I think we can rule out a 50bp hike. 100bp would be a surprise and make a defiant statement, but again this seems unlikely. So, 75bp is the play, and given the elevated expectations in rates pricing, a 75bp hike in isolation offers modest downside risks in the USD.

2. The ‘Dot plot’ Projections

The Fed offers forecasts for where they see the Fed funds rate in the years ahead. The current median projection for 2022 and 2023 is 3.38% and 3.8%, respectively – One suspects these will lift to 3.9% (2022) and 4.1% (2023), just under current market pricing.

3. Powell's Press Conference

US financial conditions are the tightest since April 2020, with 30-year mortgage rates at 6.33%. The Fed’s Quantitative Tightening (QT) program is about to beef up to $95b a month; Fed chair Jay Powell will be grilled (in his press conference) on how long policy is expected to be restrictive and the signals they are watching for slowing the pace of policy tightening.

4. FOMC Statement

Reading the statement, how concerned will the Fed be given likely persistently high core and ‘sticky’ inflation – notably, around core goods, shelter, and rental inflation?

5. Inflation Forecast

It wouldn’t shock at all to see its core PCE inflation forecasts lift for 2022 from 4.3% to 4.5%, but will there be any change to the call of 2.7% for 2023?

6. GDP Forecast

In June, the Fed forecasted GDP at 1.7% for both 2022 and 2023 – we should see the 2022 GDP forecast cut in half, but will we see forecasts of 1.7% GDP for 2023 revised lower?

7. Unemployment Forecasts

Again, looking at the economic projections, the Fed is expected to forecast a slightly higher unemployment rate for 2022 and 2023. The current forecast is 3.7% (2022) and 3.9% (2023) respectively.

Conclusion

With the market pricing a 20% chance of a 100bp hike and the ‘dots’ likely to undershoot market pricing modestly, it feels there could be a downside bias in the USD into and around the meeting.

Any selling in the USD will provide relief to equities, but I suspect this offers levels for the shorts to re-enter. The market will watch the ‘terminal’ rate in fed funds pricing (currently 4.4%), and risky assets should be sensitive to moves in this pricing.

United States 2-Year Treasuries will be closely watched, and a move in the yield above 3.9% would be positive for the USD. Conversely, any move below 3.80% would weigh on the USD and boost risky assets.

CFTC data shows traders long in USDs, and broad positioning is the most stretched since July 2020. Clients are sensing a turn and are largely positioned short USD, notably vs. the GBP and JPY. We see traders net short NASDAQ and positioned for a near-term bounce in gold.

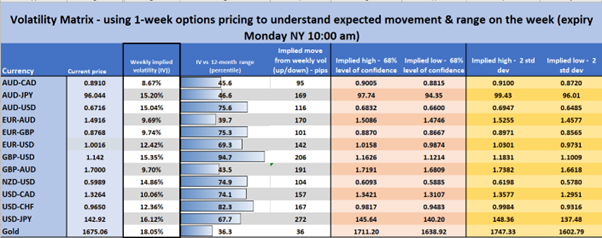

Unsurprisingly 1-week FX volatility has risen, notably GBP/USD, which is close to the 100th percentile of the 12-month range. We can see the expected move (up or down) over the week and the implied range (with a 68% confidence level). The market is expecting greater movement, so consider this in position sizing.