The week of Dec. 19 will be anything but slow and quiet. There will be a ton of economic data, and the highlights won’t come until Friday when we get PCE, the University of Michigan, durable goods, and new home sales. On top of that, there will be a 20-year auction on Dec. 21 and a 5-year TIPS auction on Dec. 22. So, if you thought this week would be calm, that is not the case.

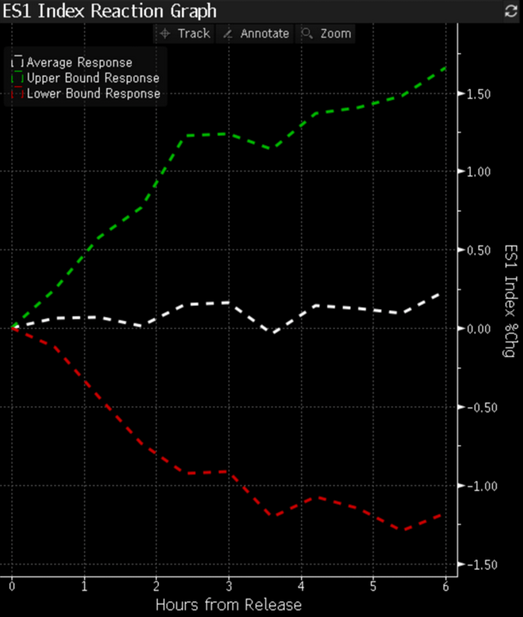

The PCE report is the Fed’s preferred inflation measure. However, truthfully, this is not a market-moving event.

The most significant drop came in the S&P 500 Futures on Aug. 26, the same day as Jackson Hole. The biggest gain came on Oct. 28, when the S&P 500 futures rose 2.7%, marking a short-term top. Otherwise, the market tends to do nothing. I’m not sure why the PCE doesn’t get the same respect as the CPI, but it doesn’t.

1. S&P 500 (SPY (NYSE:SPY))

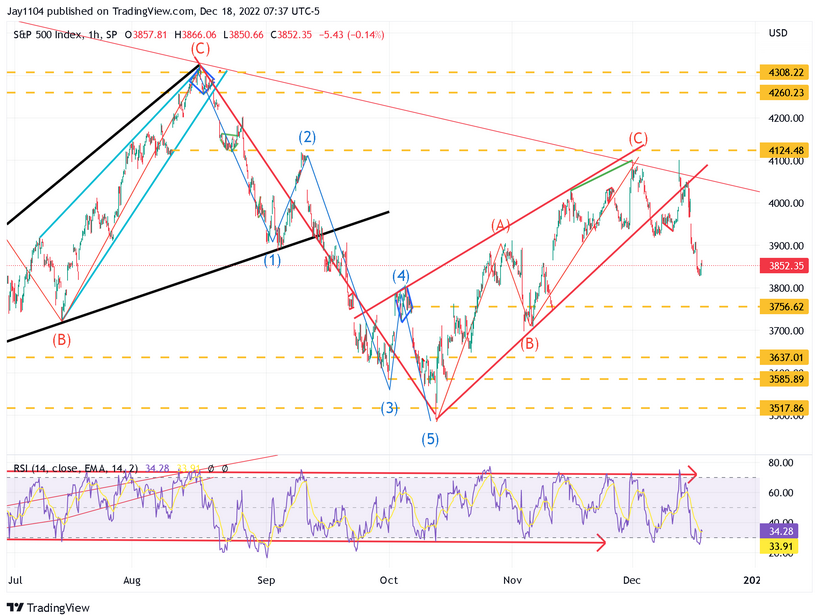

At this point, the S&P 500 is in the middle of filling the gap down to 3,750, which remains the biggest level of support for the S&P 500. Additionally, the option gamma level will reset, removing the support we recently saw in the S&P 500. This could clear a path for the index to fill that gap at 3,750.

If this is a rising wedge pattern, we should see the S&P 500 return to the lows seen in October. If this is a bear pennant, we could see the S&P 500 undercut the October lows and make new lows.

2. Dollar (DXY)

In the meantime, the dollar index appears to have formed a falling wedge, a bullish reversal pattern. It would indicate that the dollar should strengthen further and potentially rise all the back to 111.

3. Apple

Apple (NASDAQ:AAPL) appears to have formed a triangle pattern and was likely to break lower. That happened this past week after it broke below the lower bound. The $130 to $135 region has acted as support in the past, and I’m not sure that area will hold this time. The RSI still shows it could fall further before reaching oversold levels, and Apple may make a new low this time.

4. Tesla

Meanwhile, Tesla (NASDAQ:TSLA) continues to deflate after breaking support at $181 and is now working to fill the gap around $136. That will be a crucial spot for the stock to stop at. If the selling continues and shares drop below $136, Tesla is probably going below $100.

5. Oil

Oil has a falling wedge that is present, meaning that oil prices are due to rise. But it may have one more leg down to make first to around $65. Otherwise, it will be due to rebound and push higher back to approximately $85.

6. Zoom (ZM)

Finally, Zoom (NASDAQ:ZM) continues to flirt with making a new 52-week low. Again, this is another important one to watch, as it tends to be a market leader, and if it makes a new low, then the rest of the market probably isn’t too far behind. If it breaks below $69, the next level of support for Zoom doesn’t come until $66, which would be a new 52- week low.