- When it comes to investing, it is critical to know whether a company's stock is overvalued or undervalued before you decide to buy.

- The Fair Value feature, available on InvestingPro, reveals key insights about a company's intrinsic value.

- Today we will look at four stocks that have great upside potential and are trading well below their respective fair values.

- If you invest in the stock market and want to get the most out of your portfolio, try InvestingPro. Sign up HERE and take advantage of up to 38% discount for a limited time on your 1-year plan!

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a large amount of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

When investing in stocks, it's crucial to analyze the intrinsic value alongside market trends.

Fair Value, representing a stock's target price, offers valuable insights into whether a company's shares are undervalued or overvalued. While not foolproof, it helps assess a stock's potential for growth or decline.

Today, we'll examine several US stocks that, based on Fair Value, are currently trading below their target price, indicating potential upside.

To conduct this analysis, we'll utilize InvestingPro, which provides this ratio along with other essential metrics for each company.

1. Delta Air Lines

Delta Air Lines Inc (NYSE:DAL) is an American commercial airline founded in 1924 and based in Atlanta, Georgia.

It is a founding member, along with Aeromexico, Air France (EPA:AIRF), and Korean Air (KS:003490), of SkyTeam, a global airline alliance.

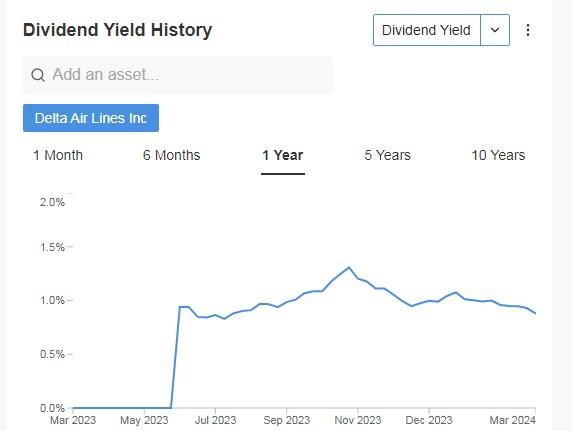

Its dividend yield is +0.88%.

Source: InvestingPro

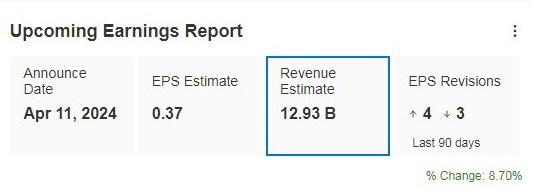

It reports its results on April 11 and revenue growth of +8.70% is expected. Looking ahead to 2024 the EPS (earnings per share) forecast is +3.6%.

Source: InvestingPro

To its credit it has upside potential for FY24 and FY25 margins driven by revenue inflection and moderating cost pressures from 2H2024 onwards (benefiting from lower maintenance expenses and a slowdown in pilot wage increases).

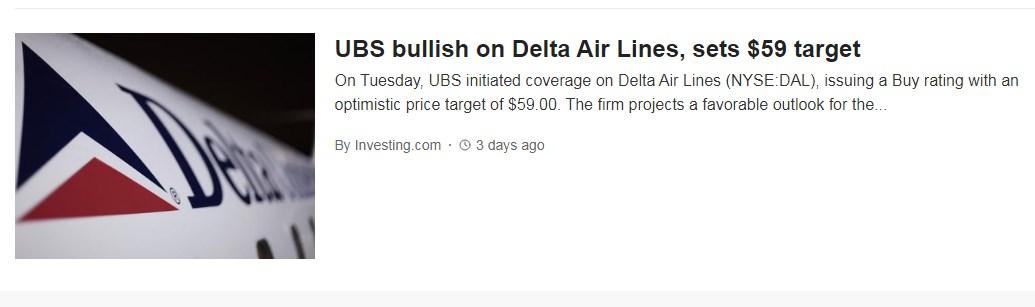

UBS initiated coverage of several airline stocks Wednesday highlighting four names it considers buys: Southwest Airlines (NYSE:LUV), American Airlines (NASDAQ:AAL) , Alaska Air (NYSE:ALK) Group and Delta Air Lines.

Source: InvestingPro

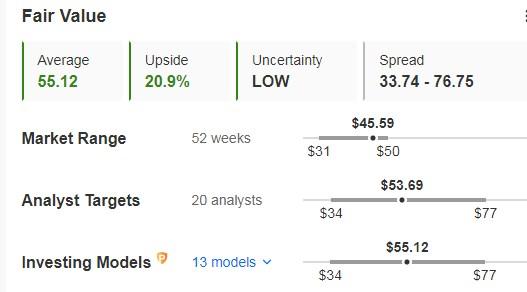

UBS gives it potential at $59, while the company's Fair Value using InvestingPro's models would stand at $55.12.

Source: InvestingPro

It has 96% Buy, 4% Hold and 0% Sell ratings.

Its shares are up +42.88% in the last 12 months.

2. Schlumberger

Schlumberger NV (NYSE:SLB) is the world's largest oilfield services company and operates in more than 85 countries. It was formerly known as Societe de Prospection Electrique. It was founded in 1926 and is headquartered in Houston, Texas.

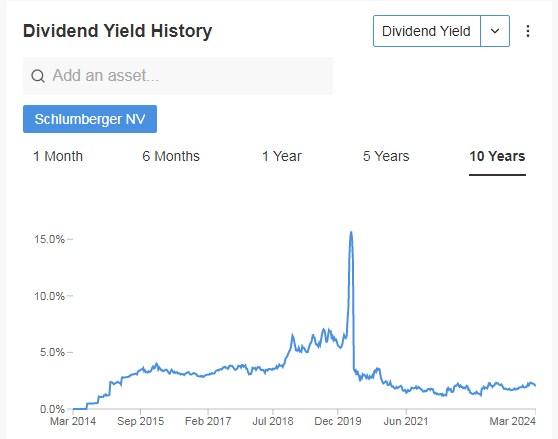

Its dividend yield is +2.04%.

Source: InvestingPro

We will know its numbers on April 19. Looking ahead to 2024, the forecast is for EPS growth of +19.3% and revenue growth of +12.8%.

Source: InvestingPro

Of note, the stock's enterprise value to earnings before interest, taxes, depreciation and amortization (EV/EBITDA) is 7.9x, the lowest since 2012-2013 and the second lowest in 26 years. In addition, the company's price/earnings (P/E) ratio stands at a competitive 16.75.

The international positioning, which accounts for 80% of the company's total operations, together with its artificial intelligence solutions, differentiates the company from its competitors.

This differentiation is a key factor in SLB's favor, underscoring the company's positive outlook on the stock's future performance.

Benchmark maintained its Buy rating while maintaining a $68 price target. It believes it is currently undervalued.

Source: InvestingPro

It has 94% Buy, 6% Hold and 0% Sell ratings.

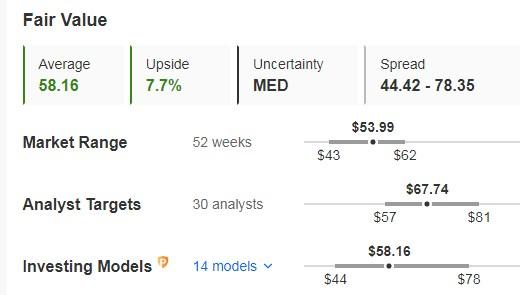

The company's Fair Value using InvestingPro's models would stand at $58.16.

Source: InvestingPro

Its shares are up +21.12% in the last 12 months.

3. Lamb Weston (LW)

Lamb Weston Holdings (NYSE:LW) is a U.S. company, one of the largest producers and processors of frozen French fries. It is headquartered in Eagle, Idaho, and was founded in 1950 in Weston, Oregon.

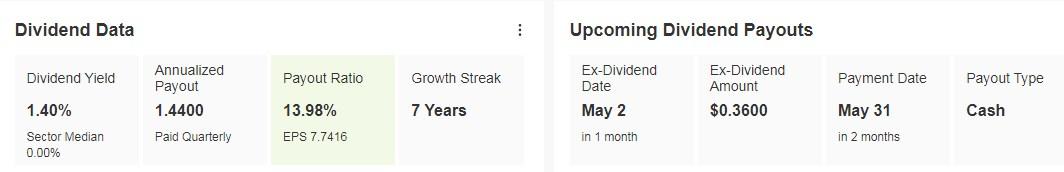

On May 31, it pays a dividend of $0.36 per share. To receive it you must own shares by May 2.

Source: InvestingPro

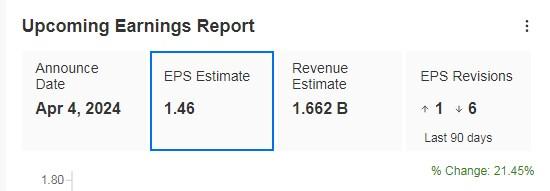

On April 4 it will release its numbers and is expected to increase EPS by +21.45%. Looking ahead to 2024 the increase would be +28.4% and revenue +28.8%.

Source: InvestingPro

Of note is its continued gross margin expansion.

Citi revealed that BellRing Brands (NYSE:BRBR), Kraft Heinz (NASDAQ:KHC), Lamb Weston and Mondelez (NASDAQ:MDLZ) are its top names to buy.

It features 93% buy ratings, 7% hold and 0% sell.

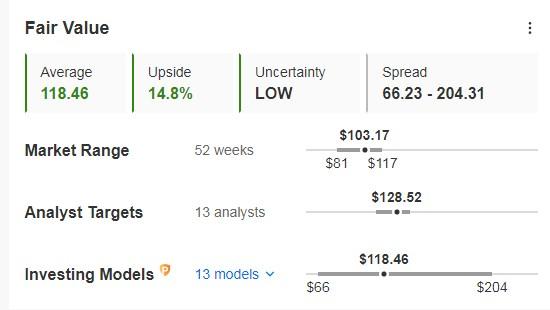

The company's Fair Value using InvestingPro's models would stand at $118.46.

Source: InvestingPro

Its shares are up +5.70% in the last 12 months.

4. Aptiv

Aptiv PLC (NYSE:APTV) is an Irish-American automotive technology supplier based in Dublin, Ireland. The company was formerly known as Delphi Automotive and changed its name to Aptiv in December 2017. It was founded in 2011.

It will report its accounts on May 2 and is expected to increase its revenue by +11.80%. For 2024 the forecast is for an EPS increase of +16.8%.

Source: InvestingPro

To re4salt that it announced a share buyback program of approximately $750 million that is expected to be implemented during the remainder of 2024.

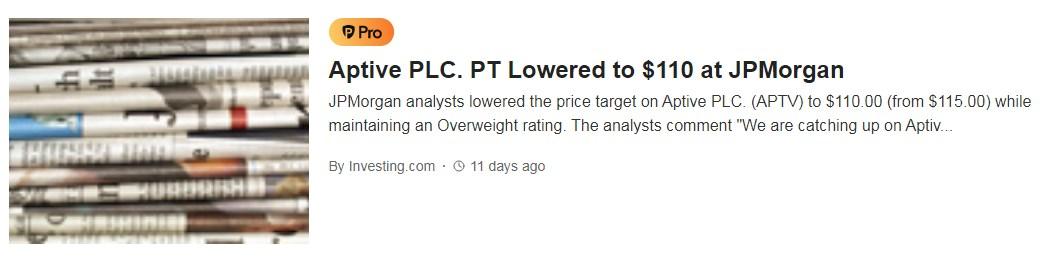

JP Morgan (NYSE:JPM) puts its price target at $110.

Source: InvestingPro

It has 80% buy, 17% hold and 3% sell ratings.

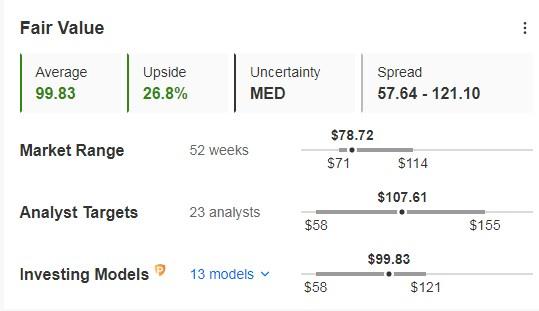

The company's Fair Value using InvestingPro's models would stand at $99.83.

Source: InvestingPro

Its shares are down -26.90% in the last year.

***

When and how to enter or exit the stock market, try InvestingPro, and take advantage of it HERE & NOW!

Click HERE, choose the plan you want for 1 or 2 years, and take advantage of your DISCOUNTS. Get from 10% to 50% by applying the code INVESTINGPRO1. Don't wait any longer!

With it, you will get:

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.