- Many companies resumed dividend payouts for the first time since the pandemic

- Some of them pay a high dividend and have good upside potential

- Let's take a look at these companies using InvestingPro

- InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

After a challenging period due to the broad market route and lower earnings growth last year, many companies have now begun to resume their dividend payouts, presenting a great opportunity for investors seeking income and growth.

And that's not all. Some of these companies not only offer high dividend yields but also boast significant upside potential.

With that in mind, let's dive into the world of dividend investing and explore four stocks that fit this description, using the powerful insights provided by InvestingPro.

By the way, InvestingPro is currently hosting its Summer Sale, offering massive discounts on subscription plans. This is your chance to access cutting-edge tools, real-time market analysis, and expert opinions at a fraction of the price.

1. Coca-Cola

As the world's most widely purchased beverage brand and the flagship product of the Coca-Cola Company (NYSE:KO), Coca-Cola has an intriguing history. Originally formulated by pharmacist John Pemberton as a patented medicinal drink, it was later acquired by entrepreneur Asa Griggs Candler, who successfully transformed it into the most consumed beverage worldwide.

Coca-Cola has consistently increased its dividend for an impressive 61 consecutive years. In 2022, the company paid out $1.76 per share in dividends, and indications suggest that this figure is likely to rise in 2023. Notably, in March, the quarterly dividend was raised from $0.44 to $0.46 per share. Currently, the dividend yield stands at over 3%.

Source: InvestingPro

On April 24, the latest earnings were unveiled, surpassing market expectations.

Source: InvestingPro

The next earnings are due on July 25.

Source: InvestingPro

Coca-Cola receives strong support from analysts, with 17 buy ratings and 8 hold ratings, while no sell ratings have been assigned. HSBC (LON:HSBA) projects a potential target price of $74 for the stock, whereas the market's outlook downgrades it to around $70.

Source: InvestingPro

The InvestingPro news section provides valuable insights into the valuations and target prices assigned to Coca-Cola shares by Wall Street analysts.

Source: InvestingPro

Technical View:

After reaching a resistance point in April (which was formed in December), Coca-Cola's stock started to decline. What's interesting is that there is a support level of $59.51-$59.66, which coincides with a Fibonacci level. This support level could act as a trigger for a potential upward rebound.

2. Kraft Heinz

Kraft Heinz (NASDAQ:KHC) has solidified its position as the fifth-largest food and beverage company globally and the third-largest in the United States.

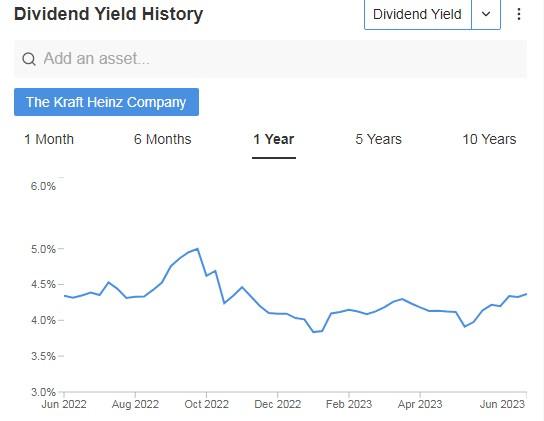

In the previous year, Kraft Heinz distributed dividends amounting to $1.60 per share to its shareholders. With a dividend yield of approximately 3.94%, the company has maintained a consistent quarterly dividend payout of $0.40 per share since March 2019.

Source: InvestingPro

In Q1, Kraft Heinz reported sales of $6.489 billion, reflecting a notable increase of 7.3% compared to Q1 2022. Looking ahead to the entirety of 2023, the company anticipates a net sales growth range of 4-6%.

On May 3, Kraft Heinz unveiled its latest results, which exceeded market expectations, demonstrating strong performance.

Source: InvestingPro

It presents results on August 3.

Source: InvestingPro

InvestingPro models indicate a potential value of $45.67 for Kraft Heinz.

Source: InvestingPro

Technical View:

It is immersed within a wide rectangular range. A drop to $32.88 would be an interesting buying opportunity. Although it is a distant level, as it is about 10% away.

3. British American Tobacco (LON:BATS)

British American Tobacco (NYSE:BTI) is a prominent tobacco company that holds ownership of several renowned cigarette brands, including Dunhill, Lucky Strike, and Pall Mall.

While the company continues to thrive, it is worth noting that it will distribute a dividend on February 8. Looking ahead, the expected dividend yield for 2024 stands impressively at +9.90%.

Source: InvestingPro

Its dividend history over the last 10 years is very interesting.

Source: InvestingPro

British American Tobacco has reaffirmed its annual revenue and earnings forecast for 2023, citing strong demand and consistent customer numbers. The company expects organic revenue growth of 3% to 5% this year.

The upcoming financial results are scheduled to be presented on July 26, providing further insights into the company's performance.

Below are the revenue and earnings per share (EPS) forecasts for the current year and the following year:

Source: InvestingPro

The news section provides comprehensive coverage of the diverse estimates and valuations assigned to British American Tobacco shares by Wall Street analysts.

Source: InvestingPro

The market consensus gives it a potential of $48.15.

Source: InvestingPro

Technical View:

After reaching a resistance level in February and failing to break through it, British American Tobacco's stock began a downward trend. However, it has recently reached its support level and started to rebound. Notably, the stock is not only finding support but also showing signs of being oversold.

Analyzing the chart, we can observe a pattern where whenever the shares were in an overbought condition, they experienced a decline, whereas whenever they were oversold, they witnessed a rise in value. This suggests a potential reversal and upward movement in the stock's price.

4. Chevron

Chevron (NYSE:CVX) is an American oil company that was incorporated in 1911 in California following the dissolution of the Standard Oil Trust.

With a dividend yield of approximately 4%, Chevron has consistently increased its dividend payments to shareholders for over 36 years. In fact, the most recent dividend increase occurred in February, raising the quarterly dividend from $1.42 to $1.51 per share.

In 2022, Chevron reported earnings of $35.465 billion, marking an impressive 127% increase compared to the previous year. This robust performance contributed to a significant rise of 58% in its share price.

On April 28, Chevron announced its latest financial results, which exceeded market expectations, showcasing a strong performance.

Source: InvestingPro

It will present earnings on July 28.

Source: InvestingPro

InvestingPro models give it a potential of $183.75.

Source: InvestingPro

After encountering resistance in late January, Chevron's stock started a downward trend. However, in March, it found support at the $150.16 level. Notably, when the stock touched this support level again in June, it effectively halted further declines and triggered a subsequent upward bounce. Now, a return to that level is an opportunity for another upward rebound, making it an attractive entry point.

***

Get ready to boost your investment strategy with our exclusive summer discounts.

As of 06/20/2023, InvestingPro is on sale!

Enjoy incredible discounts on our subscription plans:

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and the best expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won't last forever!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest, nor is it intended to encourage the purchase of assets in any way.